To enter your 1095-A form and generate Form 8962. 8962 Form Fill Online By clicking the link above you can get to our page with fillable 8962 Form.

Irs Form 8962 Premium Tax Credit Community Tax

Irs Form 8962 Premium Tax Credit Community Tax

Premium Tax Credit 2015 Inst 8962.

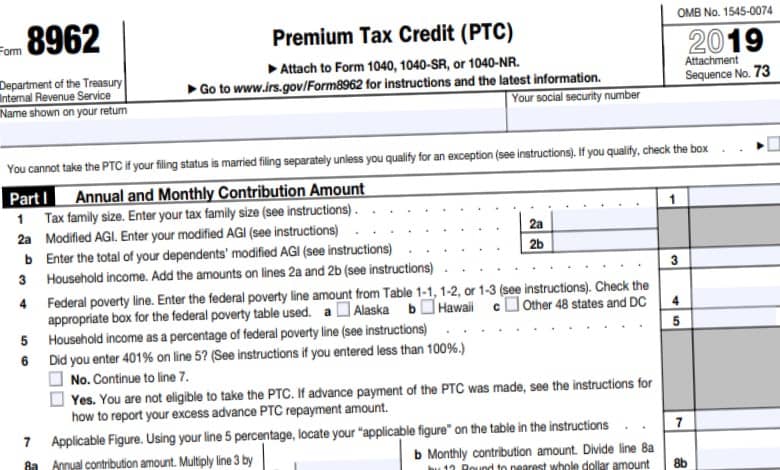

2019 tax form 8962. The Accountant can help you with your 8962. Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR. The form may be available in packages of print forms.

Instructions for Form 8962 Premium Tax Credit PTC 2015 Form 8962. Go to wwwirsgovForm8962 for instructions and the latest information. Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit.

Your social security number. The question arises How can I e-sign the printable tax form 8962 I received right from my Gmail without. Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR.

73 Your social security number You cannot take the PTC if your filing status is married filing separately unless. Name shown on your return. If youre mailing in a paper tax return and you received advance payments of your health insurance premium tax credit youll need to file a completed Form 8962 with your regular tax return forms.

Filling out 8962 form for 2019. On the Thats all we need on your 2019 coverage screen 10. You may take the PTC and APTC may be paid only for health insurance coverage in a qualified health plan defined later purchased through a Health Insurance Marketplace Marketplace also known as an Exchange.

Premium Tax Credit PTC 2020 11172020 Inst 8962. How to make an e-signature for signing the 2019 Form 8962 Premium Tax Credit Ptc in Gmail irs printable form 8962es have already gone paperless the majority of are sent through email. Form 8962 OMB No.

2019 Instructions for Form 8962 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. What is a 8962 Form Form 8962 is used to calculate the amount of premium tax credit youre eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace. Click Done with Health.

Is there anything else youd like to add before I connect you. Premium Tax Credit 2017 Inst 8962. Click on View or Print Forms to print the forms you need.

When saving or printing a file be sure to use the functionality of Adobe Reader rather than your web browser. Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC. For more help I can be reach via my facebook page.

Instructions for Form 8962 Premium Tax Credit PTC 2020 12142020. Print save or preview this years return and click in the box to select federal returns. That goes for agreements and contracts tax forms and almost any other document that requires a signature.

Name shown on your return. Go to wwwirsgovForm8962 for instructions and the latest information. Premium Tax Credit 2016 Inst 8962.

Your social security number. 1545-0074 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Name shown on your return 2020 Attach to Form 1040 1040-SR or 1040-NR. The 1095 a is someone who filling out 8962 form for 2019 JA.

2019 Federal Tax Forms And Instructions for Form 8962 We recommend using the most recent version of Adobe Reader -- available free from Adobes website. Instructions for Form 8962 Premium Tax Credit PTC 2018 Form 8962. About Form 8962 Premium Tax Credit Internal Revenue Service.

Instructions for Form 8962 Premium Tax Credit PTC 2016 Form 8962. Go to wwwirsgovForm8962 for instructions and the latest information. Instructions for Form 8962 Premium Tax Credit PTC 2017 Form 8962.

Select Tax Tools on the left menu. Premium Tax Credit 2018 Inst 8962. Purpose of Form Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC.