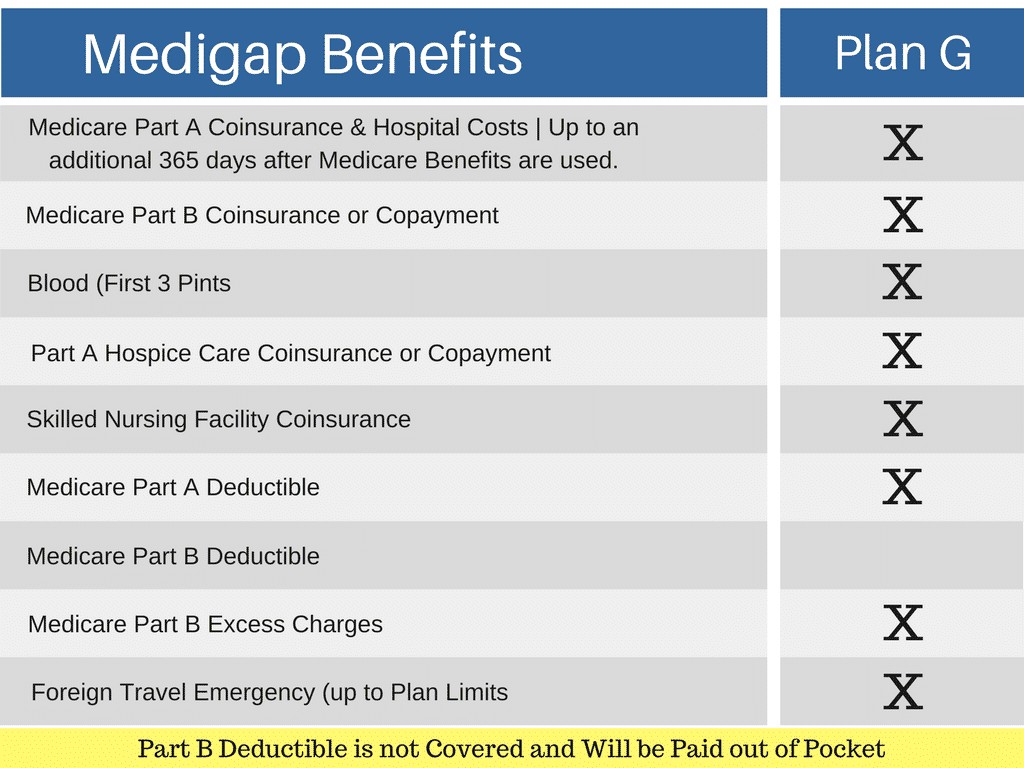

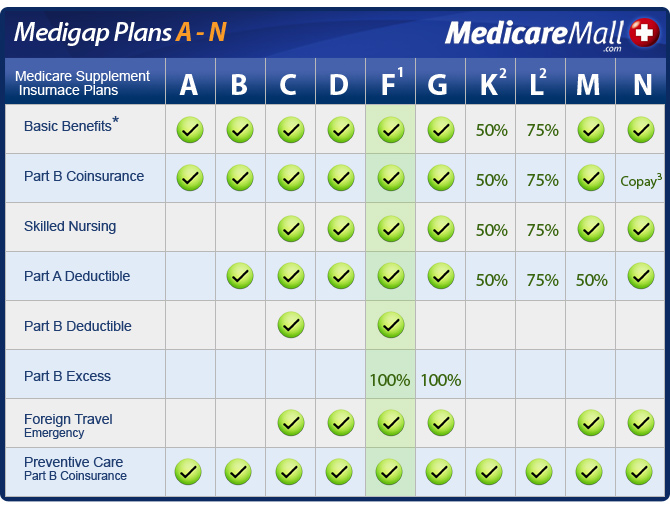

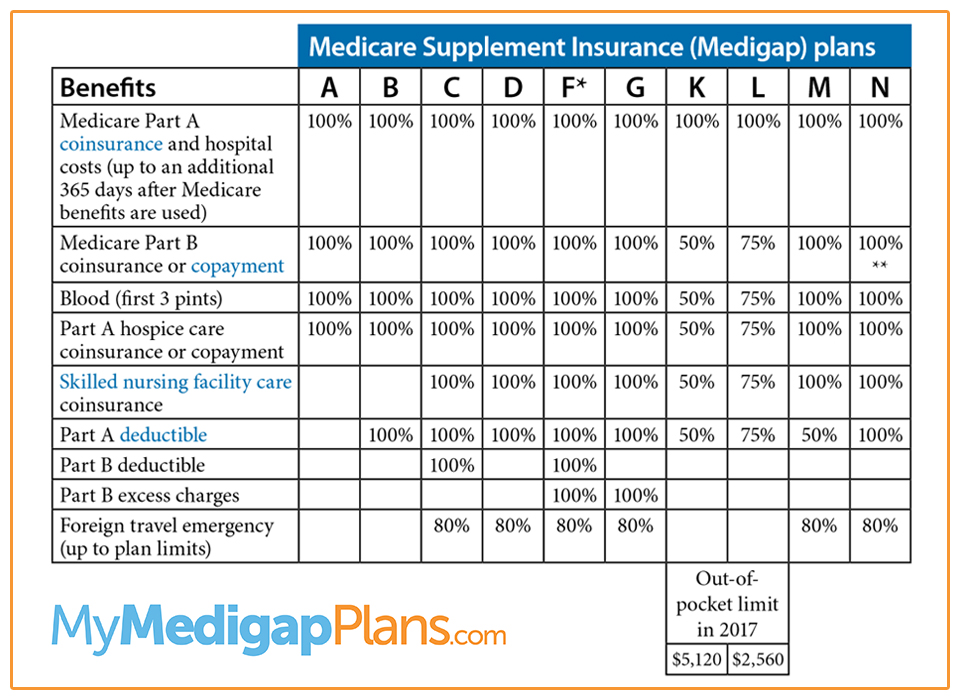

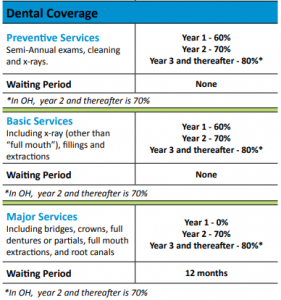

They provide coverage for most if not all of the out-of-pocket costs Original Medicare does not cover. Original Medicare is the government health care plan for those aged 65 and over.

Medicare Supplement Plans Arkansas Medicare In Arkansas

Medicare Supplement Plans Arkansas Medicare In Arkansas

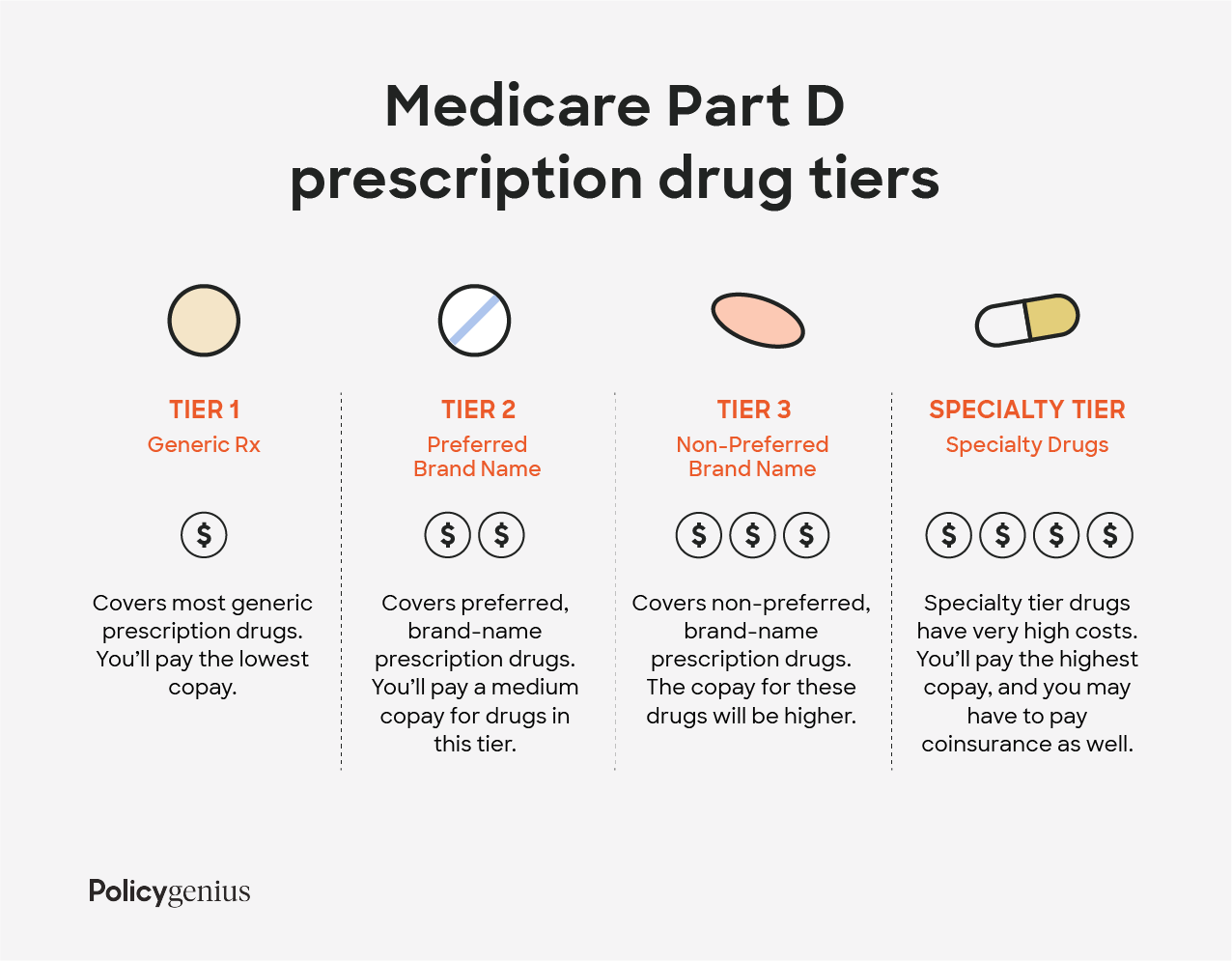

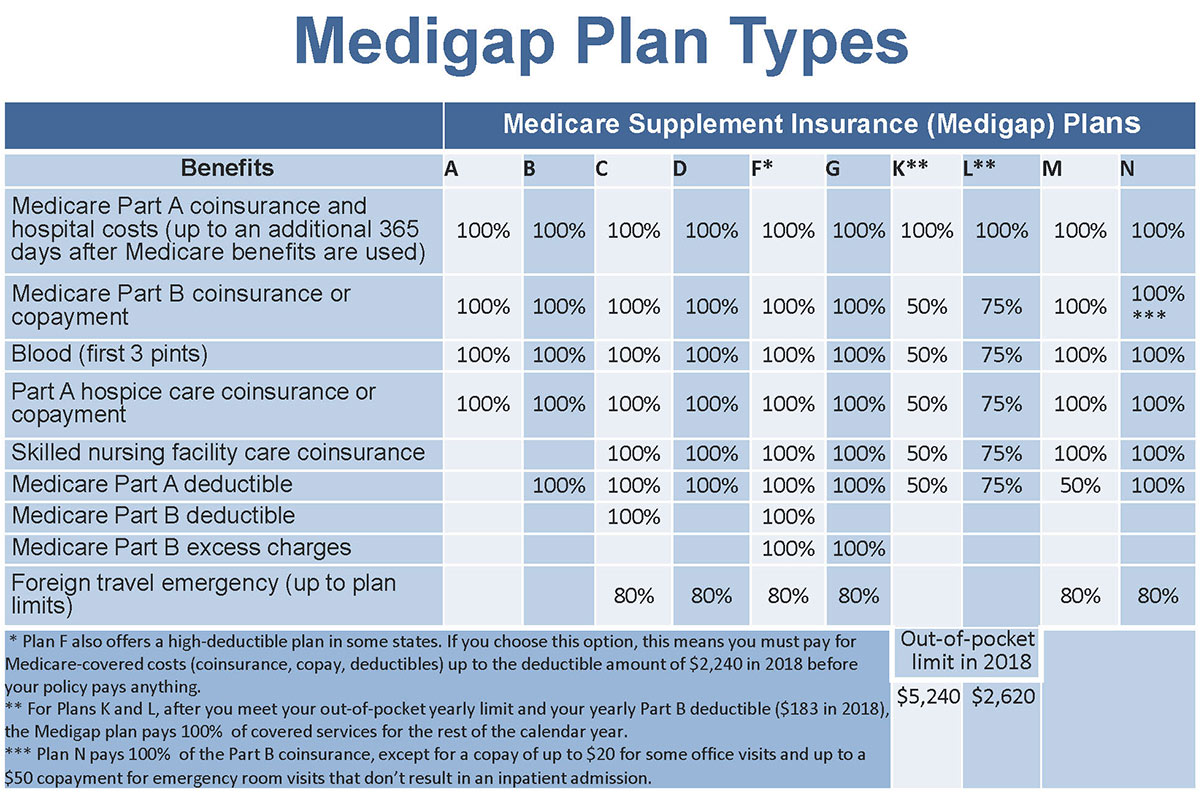

You can choose from 5 prescription drug plans offering additional gap coverage.

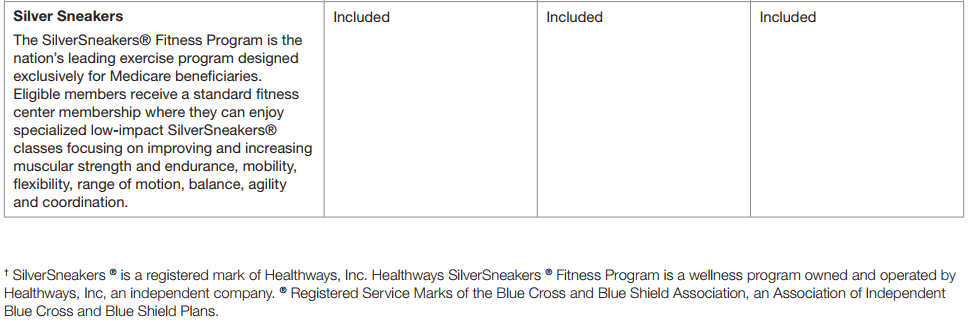

Arkansas medicare plans. Welcome to your 2021 Blue Medicare Plan Get the most out of your Arkansas Blue Medicare Plan. Lets be healthy together. The Medicare Advantage plans available in Arkansas can include minor medical benefits but are not required to.

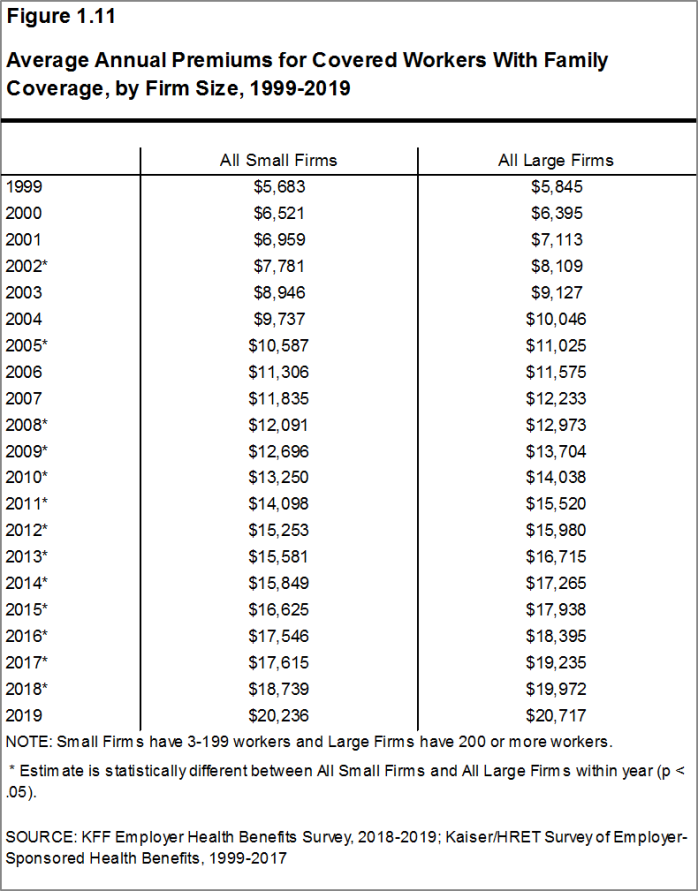

The plan with the lowest monthly premium is 730 and the highest monthly premium is 14010. The average Medicare Advantage monthly premium decreased in Arkansas compared to last year from 1506 in 2020 to 1449 in 2021. Medicare supplement plans or Medigap can complement your Original Medicare coverage but you must be enrolled in Part A and Part B to be eligible.

Contacting Arkansas Medicare Plans will put you into contact with a licensed sales agent that will provide you with Medicare quotes for your area. These plans supplement Original Medicare. There are 84 Medicare Advantage plans available in Arkansas for.

In most cases once you turn 65. If youre looking for more robust coverage numerous private health insurance companies in the state have plans that work alongside Original Medicare or provide an all-inclusive alternative through Arkansass Medicare Advantage program. For a complete listing please contact 1-800-MEDICARE or consult wwwmedicaregov.

76 rows Average costs of Medicare Advantage in Arkansas. This plan isnt available if youre newly eligible for. 84 Medicare Advantage plans are available in 2021 compared to 66 plans in 2020.

It does not cover minor medical for things like vision hearing dental and it does not offer prescription drug coverage. Start browsing Medicare plans right away by entering your zip code as indicated on the page. COMPLETE PLUS COMPLETE SHORT-TERM PLUS SHORT-TERM H E A L T H A D V A N T A G E 4 H E A L T H A D V A N T A G E.

Some plans may offer monthly premiums as low as 0 but there are usually other plan costs to consider such as copayments coinsurance deductibles and out-of-pocket maximum amounts. In Arkansas in 2021. These are supplemental plans that cover the costs of prescription medication which can be excessively expensive for senior citizens.

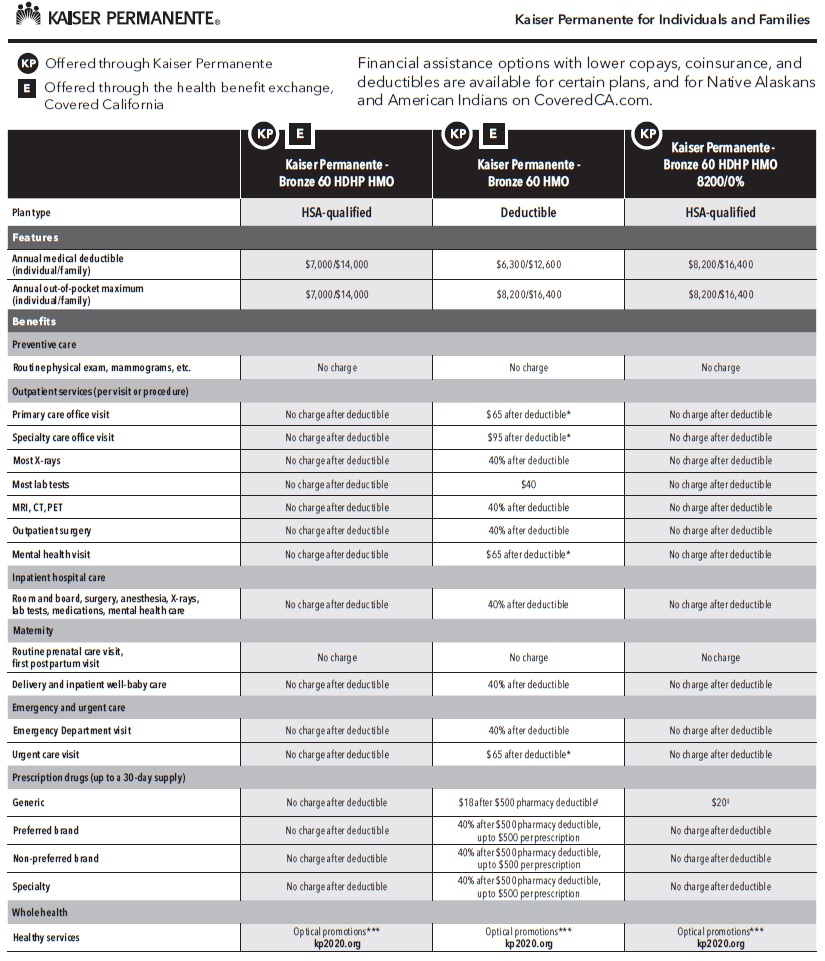

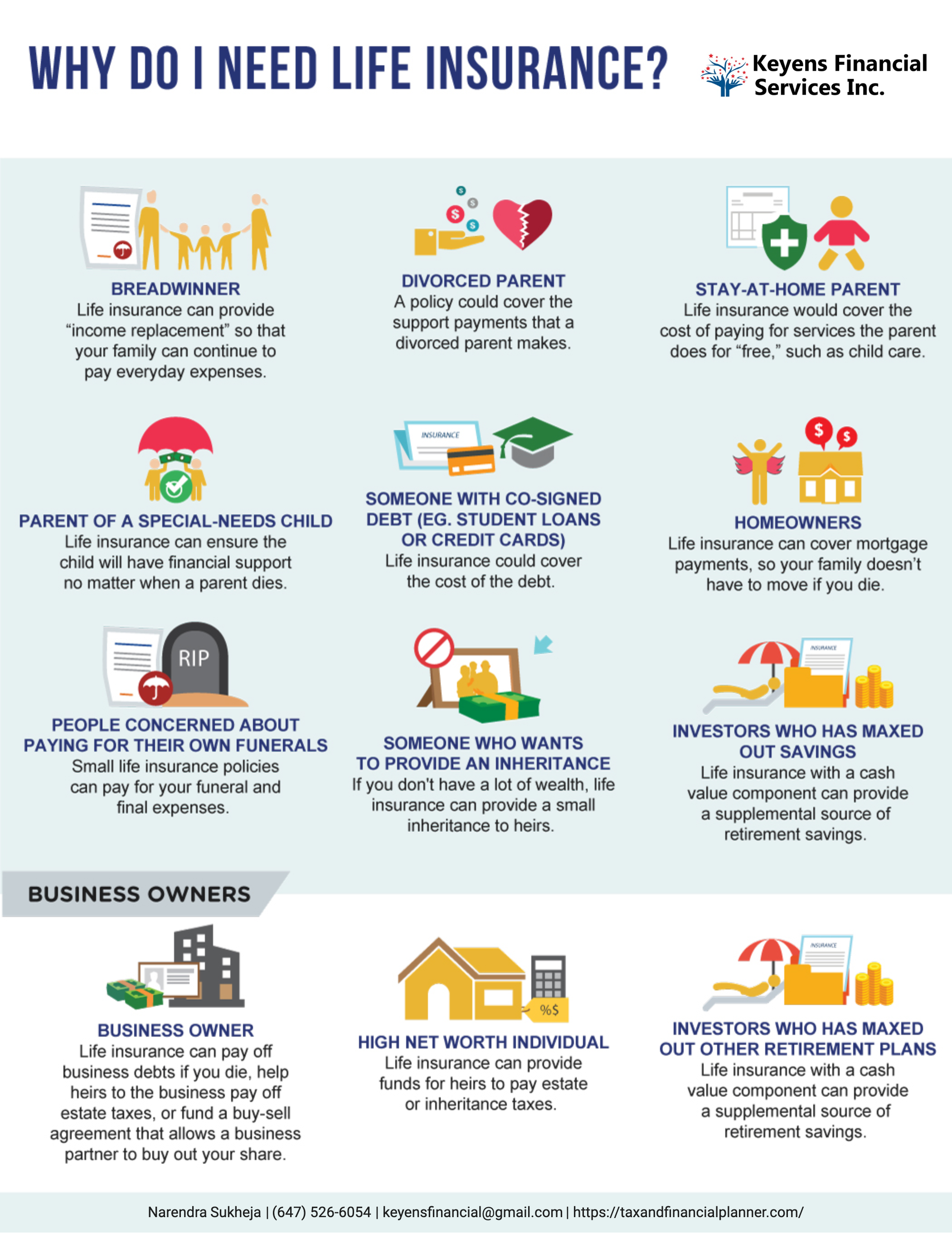

3 Popular plans include Medigap Plan F Medigap Plan G and Medigap Plan N. This represents a -382 percent change in average premium. There are 31 Medicare Part-D Plans available in Arkansas from 11 different health insurance providers.

They usually include prescription drug coverage. Types of Medicare coverage available in Arkansas. Original Medicare Part A and Part B refers to the federal Medicare coverage you might get automatically when you turn 65 or before turning 65 if you receive disability benefitsMedicare Part A hospital insurance and Part B medical insurance are available in any state.

If you choose Original Medicare you can also purchase. 42 insurers offer Medigap plans in Arkansas. The average monthly premium for a Medicare.

30 get their prescription drug coverage through a Medicare Advantage plan that includes prescription drug benefits. The state requires Medigap insurers to offer at least one plan to people under age 65 but they can be charged much higher premiums. You can receive your Medicare benefits through either Original Medicare Part A and Part B or a Medicare Advantage plan.

Shop with Arkansas Blue Cross Blue Shield to find Advantage and Supplemental plans. The most popular plan in Arkansas is Medicare Supplement Plan F with over 36000 people choosing the plan. Arkansas Medicare Advantage Plans Explained Traditional Medicare covers about 80 of all major medical costs.

The average monthly Medicare Advantage premium changed from 1506 in 2020 to 1449 in 2021. Although exact coverage will vary some policies will help pay for co-payments or deductibles while other policies will cover additional services not covered under Original Medicare. In 2018 70 of Arkansas beneficiaries enrolled in Part D have coverage through a stand-alone Medicare Prescription Drug Plan.

These plans replace Original Medicare. 1 Secondary or supplemental insurance such as Medigap or a Group Health Insurance plan GHI andor 2 Prescription drug coverage Part D or GHI. These plans can be purchased as an addition to Medicare Parts A and B to offer much more comprehensive coverage.

Looking for Medicare plans in Arkansas. There are 31 stand-alone Part D prescription plans available in Arkansas for 2021 with premiums that range from about 7 to 140 per month. The new Getting Started tool is here to help you manage your plan and access special member benefits.

Medicare Advantage plans in Arkansas can vary in terms of the coverage they offer their availability and their costs. Arkansas Medicare Part D Plans Medicare Part D plans exist as well. Not connected with or endorsed by the United States government or the federal Medicare program.

This represents a 2727 percent change in plan options. They are similar to individual and employer-sponsored plans.

/everest-reinsurance-company-e6b25f431a9643758561f2d5912f600f.png)