State and Federal Privacy laws prohibit unauthorized access to Members private information. The state Senate Thursday unanimously passed an overhaul of Blue Cross Blue Shield of Michigan.

Blue Cross Bills Nearing Gov Snyder S Signature This Time Without Abortion Language Mlive Com

Blue Cross Bills Nearing Gov Snyder S Signature This Time Without Abortion Language Mlive Com

Blue Cross Blue Shield of Michigan the states dominant insurer sells plans that cover abortion and plans that dont said spokeswoman Stephanie Beres.

Does blue cross blue shield cover abortions michigan. Blue Precision HMO BlueCare Direct and Blue FocusCare members Elective abortions were not a covered benefit. Abortion care in-clinic procedure and abortion pill cancer screening. Benefits are payable after you have met a policy year deductible equal to one month of the subscribers base pay excluding overtime hazard pay night shift premium on call pay etc.

Blue Cross Blue Shield of Michigan Conference CoordinationUnit PO. Financial obstacles can also push women to try to self-induce an abortion potentially putting. For state of Michigan assistance contact the Civil Service Commission Employee Benefits Division PO.

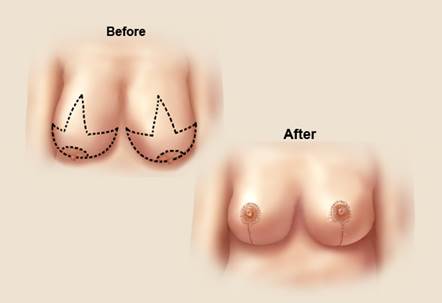

Coverage for voluntary abortion not medically necessary is provided to members under select Medicare Plus Blue Group PPO plans regardless of the circumstances that led to the pregnancy or the conditions related to the abortion. Conditions for payment The table below specifies payment conditions for voluntary abortion. Testing and treatment for sexually transmitted infections STIs.

The measure was unexpectedly vetoed by Governor Rick Snyder last month because it included some controversial abortion language. Blue Cross Blue Shield of Michigan Employee Benefits. Box 2 456 Detroit MI 48231-2459.

State and Federal Privacy laws prohibit unauthorized access to Members private information. By 20 weeks that rises to around 1500. See above reference regarding coverage change.

Lawmakers recently reintroduced the legislation without the abortion measure. All the listed benefits are extracted from job descriptions reviews and QA posted on Indeed. Infertility services Not covered Not covered Injectable contraceptives 1 You pay nothing Not covered Insertion andor removal of intrauterine device IUD 1 You pay nothing Not covered.

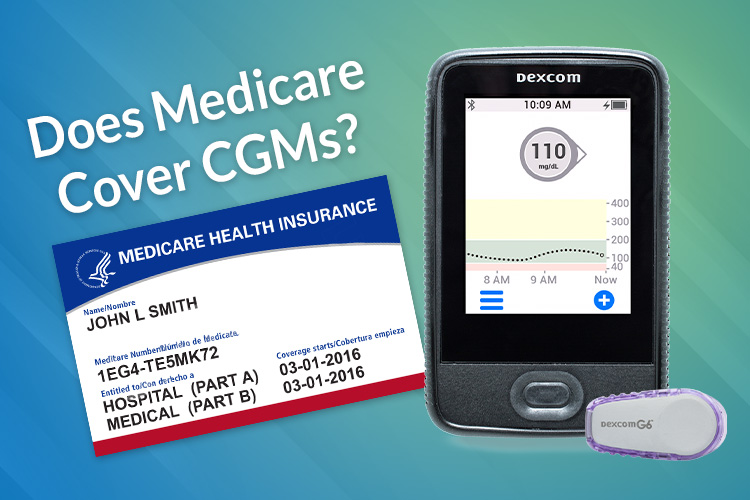

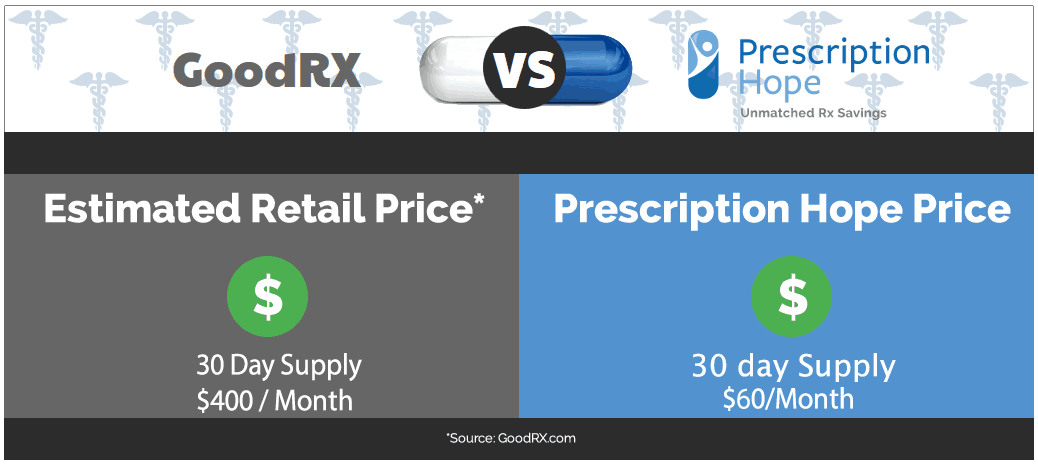

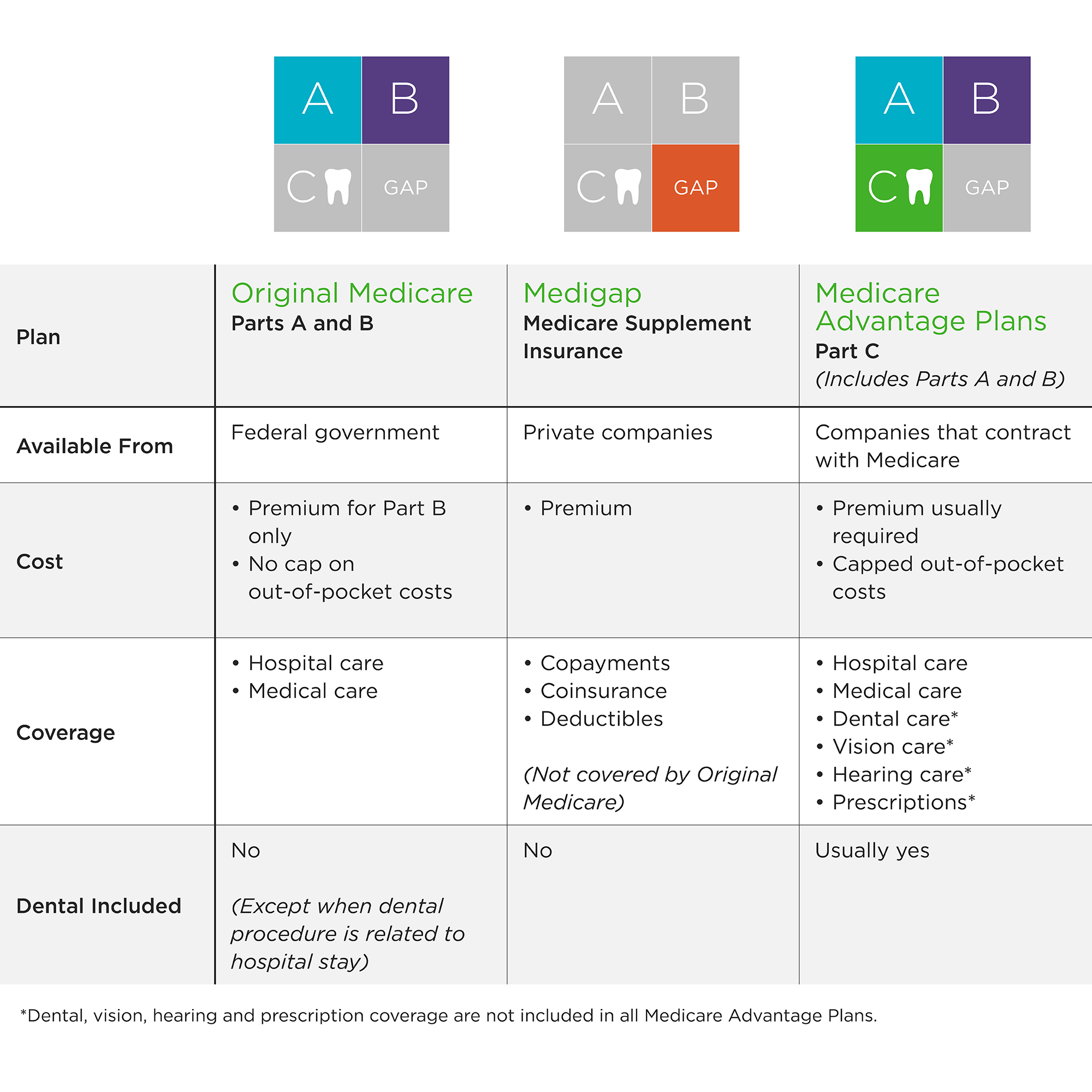

Box 30002 Lansing MI 48909 or the Department of Insurance and Financial Services Office of. Blue Cross Blue Shield BCBS of Michigan is a Medicare-contracted private insurance company that offers you an alternative way to get your Original Medicare benefits through its wide selection of Medicare Advantage plans. Blue Cross Blue Shield of Michigan and Blue Care Network on March 1 will stop paying for the brand name drug EpiPen and will only.

The average cost of an abortion at 10 weeks is around 500. We provide health insurance in Michigan. Beyond that these plans have the flexibility to offer extra benefits that Original Medicare doesnt cover.

Or STDs sexually transmitted diseases HPV vaccination for people ages 19 to 45. Blue Cross Blue Shield of Michigan a nonprofit mutual insurance company is an independent licensee of the Blue Cross and Blue Shield Association. The brand name EpiPen costs more than 650 at most pharmacies.

Individuals attempting unauthorized access will be. Please contact the employer to understand the benefits connected to a relevant job. Effective July 1 2017 elective and Therapeutic abortions are not in benefit for members of the Archdiocese of.

Breast cervical Pap tests. By law these plans must offer all the coverage of Original Medicare except for hospice care which remains covered under Part A. An abortion was only covered in cases of rape incest or endangerment to mother.

Applicable deductibles are deducted from the approved amount. The maximum policy year deductible. BCBSM provides and administers health benefits to more than 46 million members residing in Michigan in addition to employees of Michigan-headquartered companies who reside outside the state.

If you have health insurance coverage with Blue Shield or youre looking for BlueShield Acupuncturists in Michigan or Michigan Acupuncturists who accept BlueShield please contact these Acupuncturists and confirm that they are either in-network with Blue Shield are or can help you with your Blue Cross coverage. About Blue Cross Blue Shield of Michigan. 1996-2020 Blue Cross Blue Shield of Michigan and Blue Care Network are nonprofit corporations and independent licensees of the Blue Cross and Blue Shield Association.

In 2018 Blue Cross Blue Shield of Michigan. 1996-Blue Cross Blue Shield of Michigan and Blue Care Network are nonprofit corporations and independent licensees of the Blue Cross and Blue Shield Association. Its really a case-by-case basis on what.

Individuals attempting unauthorized access will be prosecuted. The Michigan Legislature inserted and approved elective abortion health insurance restrictions into a package of bills Thursday that allows Blue Cross Blue Shield of Michigan to. Blue Cross Blue Shield of Michigan determines the approved amount.

Aetna expires February 28 2021 Blue Cross Blue Shield of Michigan Blue Care Network expires March 31 2021 HAP Alliance Health expires March 31 2021.

/GettyImages-1169330585-db025a8e65514916b79d001e80fe4567.jpg)