High deductible Plan F In addition to regular Plan F some states also offer a high-deductible version. After the deductible is reached this plan works the same as a regular Medicare Supplement.

High Deductible Plan F High Deductible Medigap Plan Medicarefaq

High Deductible Plan F High Deductible Medigap Plan Medicarefaq

So how do you determine which plan is right for you.

What is the deductible for plan f. Medicare Part B first pays 80. Some doctors charge a 15 excess charge beyond what Medicare pays. HDF or high deductible plan F is different than other Medicare supplement Plans.

Here are the extensive benefits that Medicare Supplement Plan F and the high-deductible Plan F provide. Medicare Part A coinsurance and hospital costs Medicare Part B coinsurance or copayment First three pints of blood Part A hospice care coinsurance or copayment Coinsurance for skilled nursing facility Medicare Part A deductible Medicare Part B. The high deductible plan F works the same way except for one thing.

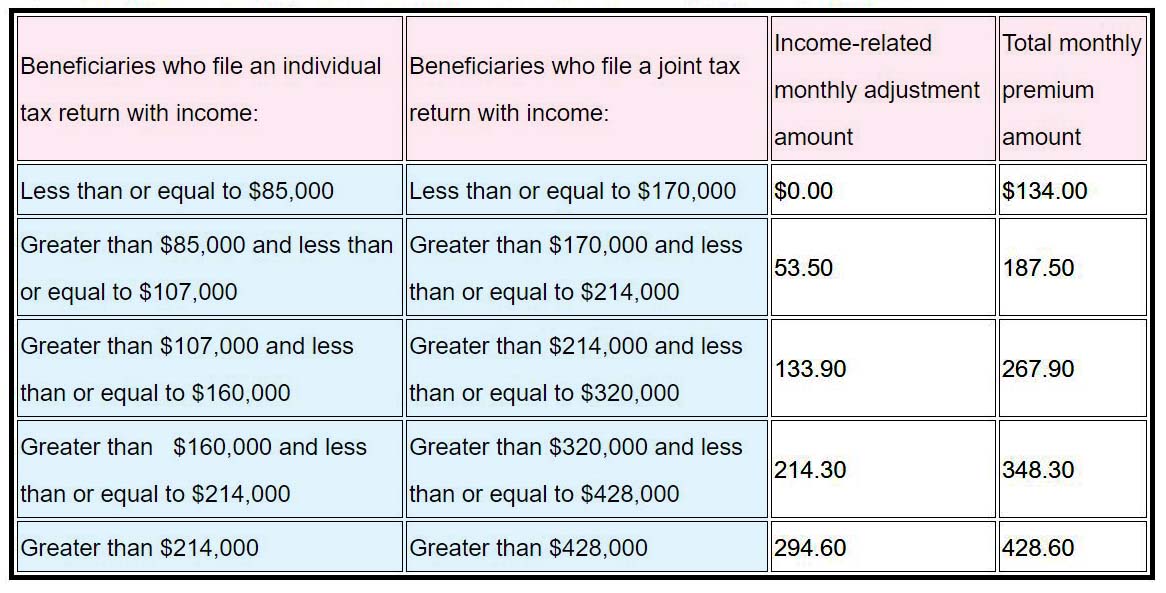

This provision prescribed a deductible of 1500 for 1998 and 1999 and directed that the amount increase each subsequent year by the percent increase in the CPI-U all items US city average. High Deductible Plan F Is a Great Value for Any Budget. Deductible for Original Medicare Part A.

While monthly premiums for this option may be lower you must pay a deductible before Plan F begins paying for benefits. 100 of Medicare Part A coinsurance and hospital costs 100 of Medicare Part B coinsurance or copayment. Beneficiaries enrolled in this plan pay the 20 of medical expenses not paid by Medicare Medicare pays 80 until they satisfy their deductible.

1 Plans F and G offer high-deductible plans that each have an annual deductible of 2370 in 2021. The only difference between a standard Plan F and the Medicare Supplement Plan F High Deductible is that with the High Deductible option you must pay for the first 2180 of covered medical expenses in any given year. Once the annual deductible is met the plan pays 100 of covered services for the rest of the year.

After that 2180 deductible is satisfied remaining expenses are covered 100 just like the standard Plan F. Medicare is going to pay what they pay and youre going to pay out-of-pocket until you reach 2200 per year. High-deductible Medigap Plan F provides coverage for.

Here is an example using the average. While the benefits in more detail can be viewed here the benefits are briefly listed below. High Deductible Plan F 2020.

Since I dont have many doctor or hospital visits high deductible Plan F seems like an even better choice for me. The only difference in plan details is that High Deductible Plan F requires you to meet a deductible before it begins covering you 2370 in 2021 whereas Plan F provides coverage immediately. If the difference between the premiums for Medigap Plans F and G is more than the 198 Part B deductible Plan G will be less expensive overall than Plan F.

This provision prescribed a deductible of 1500 for 1998 and 1999 and directed that the amount increase each subsequent year by the percent increase in the CPI-U all items US city average. Calculation of the Deductible. The Part A Deductible is 1288 in which you pay would 100 if your Medigap Plans deductible of 2180 has not already been met.

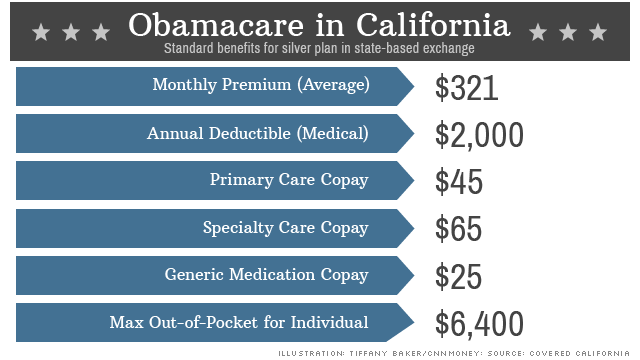

The same benefits and coverage are offered for both Medicare Supplement Plan F and High-Deductible Plan F. Then the high deductible F will kick in like a regular plan F would. With High-Deductible Plan F in 2020 youre responsible for the first 2340 in medical expenses each year before the Plan F High Deductible benefits begin.

The deductible for plans F G and J is determined in accordance with section 1882p11Ci of the Social Security Act. It looks like Plan F is the most popular probably since it covers everything with limited cost. Once your total out-of-pocket reaches 2180 your high deductible Plan F will cover all the remaining costs that Medicare doesnt pay.

The deductible for plans F G and J is determined in accordance with section 1882p11Ci of the Social Security Act. High-Deductible Plan F on the other hand offers lower monthly premiums but requires you to pay an annual deductible set at 2370 for 2021 before it will pay toward out-of-pocket costs. Then you pay nothing for the remainder of the calendar year.

You pay an annual deductible of 2200. For 2021 this deductible is set. It potentially has the lowest premiums of all the plans if I dont need much medical care for the year and has the benefit of limited.

With Plan F you have full coverage of all Medicare Part A B deductibles coinsurance copays and excess charges from day one. Part A coinsurance and hospital costs up to an additional 365 days after Medicares benefits are used up. First three pints of blood 100 of Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits have been.

The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1 2020. Plan F also has a high deductible option. 100 of the first 3 pints of blood.

This plan covers everything a regular Plan F does but in 2020 youll be responsible for paying the first 2340 up from 2300 in 2019 of costs out of your own pocket before coverage kicks in. Then your Plan F supplement pays your deductible and the other 20. Find an Available Medicare Supplement Plan F in Your State.

100 of Medicare Part B coinsurance or. The high deductible version of Plan F offers the same benefits as Plan F after you meet the deductible. Plan F coverage also includes your other doctor visits for illnesses and injuries.