Get a Free Quote. High Deductible Plan F includes the comprehensive benefits of regular Plan F but you manage your health care costs until youve reached the calendar year deductible amount.

Https Www Bcbsm Com Content Dam Microsites Som State Health Plan Hdhp Booklet Pdf

IndividualFamily Plan Type.

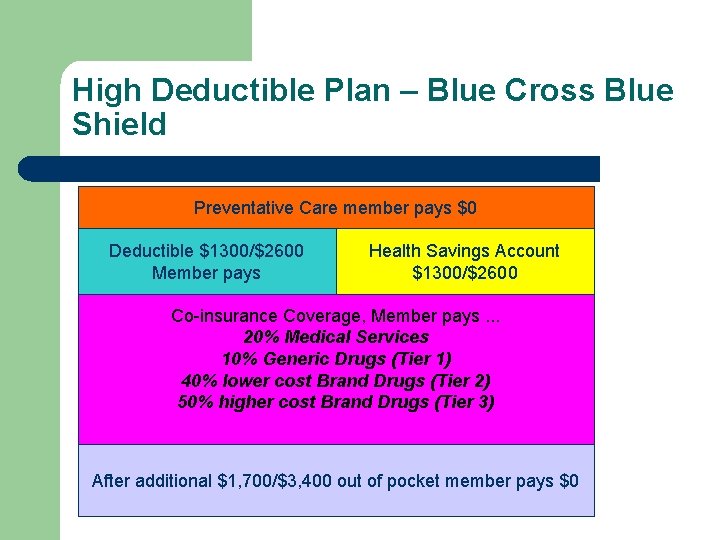

Blue cross blue shield high deductible. In most cases the higher your deductible the lower your monthly premium and the lower the deductible. We are committed to providing outstanding services to our applicants and members. After you meet your deductible you may only be responsible for a small percentage of the costs called a co-insurance.

Beginning on or after 07012020 Medical Prescription Plan Summary of Benefits and Coverage. Else with the current example you would be paying 5000 towards the deductible plus 6000 coinsurance for a total of 11000 out-of-pocket instead of the maximum of 6000. Your health insurance plan has a.

Benefits from high-deductible Plan F will not begin until out-of-pocket expenses are 2370. Weve selected physicians hospitals and specialists in each market based on our local expertise deep data and strong provider relationships. With an HDHP you pay the full cost for services until your annual deductible is met for services other than in-network preventive care services which are covered 100.

Plans F and J also have an option called a high deductible plan F and a high deductible plan J. After that you share the cost with your plan by paying coinsurance. Blue High Performance Network is built to do more.

Does not include charges in excess of allowed amount services not pre-certified or non-covered services. Out-of-pocket maximum of 5000. Advertentie Compare 50 Global Health Insurance Plans for Expats living abroad.

The lower a plans deductible the higher the premium. If your plans deductible is 1500 youll pay 100 percent of eligible health care expenses until the bills total 1500. You must pay 4000 toward your covered medical costs before your health plan begins to cover costs.

Blue Cross Blue Shield HSA-Advantage High Deductible Health Plan HDHP Medical Prescription Plan Coverage Period. If youre willing to pay more when you need care you can choose a higher deductible to reduce the amount you pay each month. After you pay the 4000 deductible your health plan covers 70 of the costs and you pay the other 30.

Blue Cross Blue Shield and the Cross and Shield Symbols are registered service marks of the Blue Cross and Blue Shield Association. An independent company that provides and hosts an online community platform for blogging and access to social media for Blue Cross and Blue Shield of Texas. These high deductible plans pay the same benefits as plans F and J after one has paid a calendar year 1860 deductible.

This high-deductible plan pays the same or offers the same benefits as Plan F after one has paid a calendar year 2370 deductible. IndividualFamily Plan Type. This high-deductible plan pays the same or offers the same benefits as Plan F after one has paid a calendar year 2370 deductible.

The money in the account helps pay the deductible as well as any other eligible medical expensesincluding coinsurancethat may not be covered by the plan once the deductible. With a high deductible health plan you have two levels of coverage. After that the plan functions like regular Plan F.

What this Plan Covers What You Pay For Covered Services Coverage for. Blue Cross Blue Shield HSA-Advantage High Deductible Health Plan HDHP Coverage Period. Benefits from high deductible plans F and J will not begin until out-of-pocket expenses exceed 1860.

Highmark Blue Shield also provides services in conjunction with Independence Blue Cross in southeastern Pennsylvania. Out-of-pocket expenses for this deductible are expenses that would. Get a Free Quote.

What this Plan Covers What You Pay for Covered Services Coverage for. Having a high deductible can reduce your monthly premiums. A deductible is the amount you pay for health care services before your health insurance begins to pay.

The deductible does not apply to. Advertentie Compare 50 Global Health Insurance Plans for Expats living abroad. HDHPs offer a lower premium with a higher annual deductible.

In most cases the higher a plans deductible the lower the monthly premium. Were collaborating with providers who deliver quality affordable care today and who are committed to helping us set and meet higher healthcare standards for the future. If you require special assistance including accommodations for disabilities or limited English proficiency please call us at 1-800-876-7639 or TTY at 711 to receive assistance free of charge.

Since the 5000 deductible applies towards the 6000 out-of-pocket maximum you are responsible for at most 1000 of coinsurance then. Plan F also has an option called a high-deductible Plan F. An HSA a tax-favored savings account that is used in combination with a high deductible health insurance plan.

Deductible is the amount you must pay each calendar year before the Plan pays a benefit. When you use preferred providers in-network doctors and hospitals your coverage is higher more of the cost is covered than when you use non-preferred providers out-of-network doctors and hospitals. PPO Group Number 007000285-0014 0015 6 of 8.

Not 6000 as the third bullet point says. Beginning on or after 07012021 Summary of Benefits and Coverage. PPO Group Number 007000285-0014 0015 1 of 8.

High Deductible Plan F overview.

Https Www Cmich Edu Fas Hr Documents 2020 202021 20hsa Advantage 20hdhp 20sbc Pdf

Hdhp With Rx Bluecross Blueshield Of Western New York

Hdhp With Rx Bluecross Blueshield Of Western New York

Pharmacy Benefit Guide Producer Premera Blue Cross Blue Shield Of Alaska

Pharmacy Benefit Guide Producer Premera Blue Cross Blue Shield Of Alaska

Dismissing High Deductible Hsa Plans Is A Costly Mistake Resource Planning Group

Think Carefully Before Signing Up For A High Deductible Health Plan

Think Carefully Before Signing Up For A High Deductible Health Plan

What You Need To Know About Hsas Hras And Fsas

What You Need To Know About Hsas Hras And Fsas

Hmo Pos Ppo And Hdhp Making Sense Of Different Types Of Health Plans

Hmo Pos Ppo And Hdhp Making Sense Of Different Types Of Health Plans

Health Savings Accounts Blue Cross Blue Shield Seneca

Health Savings Accounts Blue Cross Blue Shield Seneca

High Deductible F Plan For Medicare Coverage

High Deductible F Plan For Medicare Coverage

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Insurance Reviews

Blue Cross Blue Shield Medicare Supplement Insurance Reviews

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.