Under Your Existing Applications select your 2019 application not your 2020 application. If a Form 1095-A was sent for a policy that shouldnt be reported on a Form 1095-A such as a stand-alone dental plan or a catastrophic health plan send a duplicate of that Form 1095-A and check the void box at the top of the form.

When the pop-up appears select Open With and then OK.

Where do i get form 1095 a. Part A coverage including coverage through a Medicare Advantage plan is considered qualifying health coverage. Click Save at the bottom and then Open. Internet Explorer users.

How to find your 1095-A online Log in to your HealthCaregov account. You can get all your MA Form 1095-As going back all years. Theres only one place where you can get a copy of your 1095 tax form.

Under Your Existing Applications select your 2020 application not your 2021 application. Youll get forms from anyone who provided you coverage by early February. If you have Part A you may get IRS Form 1095-B from Medicare in the early part of the year.

The downloaded PDF will appear at the bottom of the screen. Download all 1095-As shown on the screen. If you get healthcare from your employer contact your companys benefits department.

It also lists anyone covered on the insurance policy such as you your spouse and any children. If you were due a 1095-A and didnt get it contact the state or federal marketplace in charge of your coverage. Contact them directly ONLY your insurer will have access to it and can provide you with a copy.

Does Medicare provide Form 1095 B. Line-By-Line Instructions for 1095-A Form. IF YOU ARE TRYING TO DO THIS.

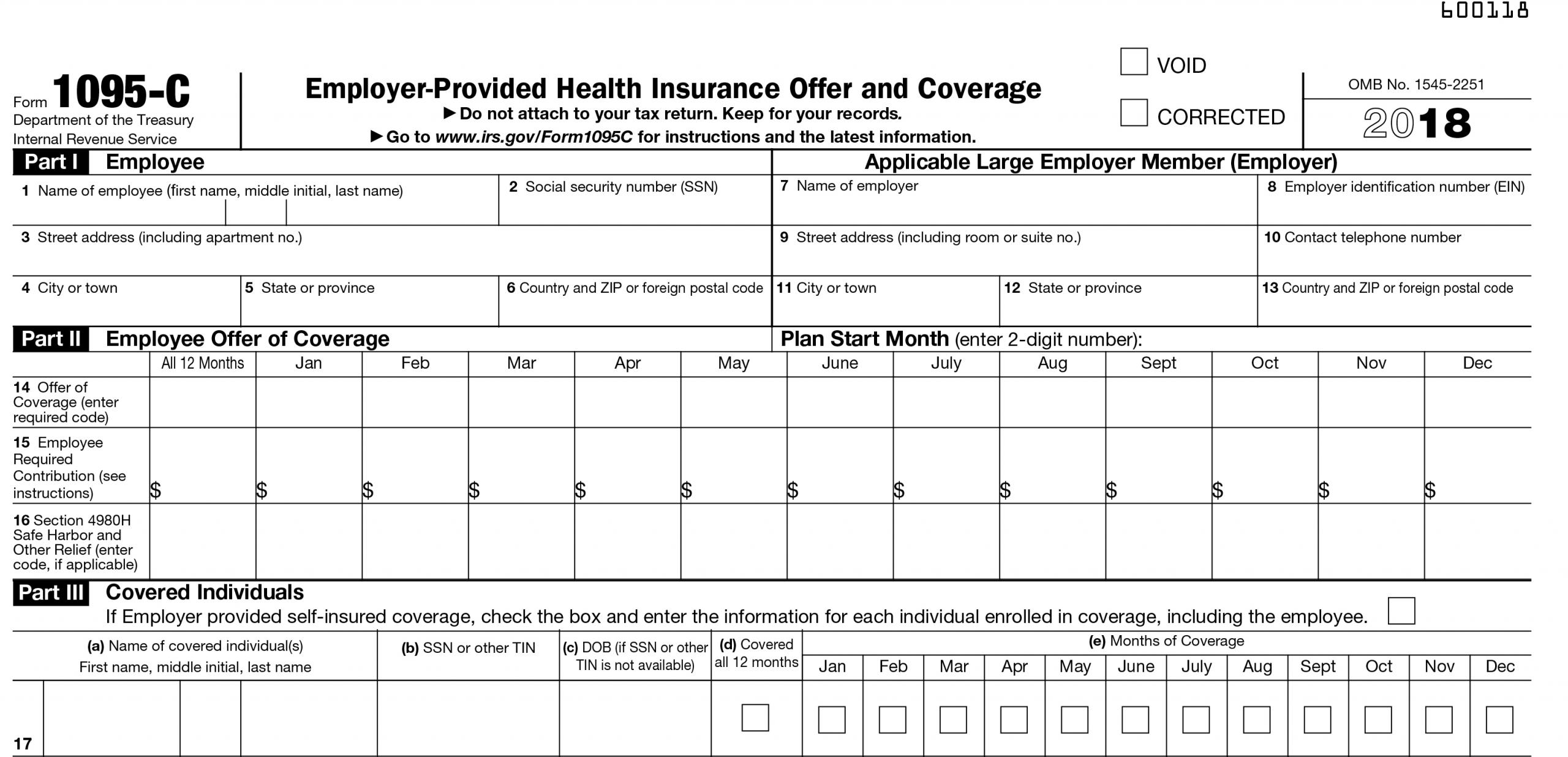

Form 1095-B is the catchall form that is issued for any type of coverage not on a Form 1095-A or C. Note you may have received IRS letter 12C where the IRS is looking for Form 1095-A. Not everyone will get this form from Medicare and you dont need to have it to file your taxes.

This includes coverage from insurance. Youll get 1095-A forms from every provider who you had a Health Insurance Marketplace plan with. If you receive health coverage for yourself or your family through the Health Insurance Marketplace you will receive a Form 1095-A from your insurer after the year ends.

Do you get a 1095 form if you are on Medicare. The form includes basic personal information such as your name address and insurance provider. Just keep it for your records.

Log into your Marketplace account at httpswwwhealthcaregov. Select Tax Forms from the menu on the left. How to find your 1095-A online Log into your HealthCaregov account.

During tax season Covered California sends two forms to members. Click the green Start a new application or update an existing one button. The federal IRS Form 1095-A Health Insurance Marketplace Statement.

If you had more than one type of health insurance throughout the year then follow this rule of thumb. In short the 1095-A form is the document provided to people who purchase their health insurance through the government-run healthcare Marketplace. The Form 1095-A only reports medical coverage not catastrophic coverage or stand-alone dental and vision plans.

Other states that use healthcaregov will find their 1095-A at wwwhealthcaregov. For those in doubt the best thing one can do is contact their state Marketplace or HealthCareGov. Click here if you purchased your plan via healthcaregov.

What Is The 1095-A Form. If you had insurance through healthcaregov or a state exchange you may need this form to help you fill out your taxes. If you have not yet received your 1095-A you can obtain the form the Marketplace online or by phone.

The California Form FTB 3895 California Health Insurance Marketplace Statement. Use the California Franchise Tax Board forms finder to view this form. But you dont need to send the form to the IRS.

The buck starts with HealthCaregov filing the 1095-A form and ends with the IRS receiving it around the same time the consumer should receive their. If you had another type of health insurance you dont need the form to file your taxes. Select Tax Forms from the menu on the left.

Download all 1095-As shown on the screen. Under Your Forms 1095-A for Tax Filing click Down-load PDF and follow these steps based on your browser. Form 1095-A should be mailed to you but you can also usually find it in your online marketplace account.

How to find your 1095-A online. Provide this information to the IRS and to the recipient of the statement as soon as possible after discovering that the statement was sent in error.

/what-to-expect-during-an-iud-insertion-906772_color2-5b6c76e146e0fb0050c334ab.png)