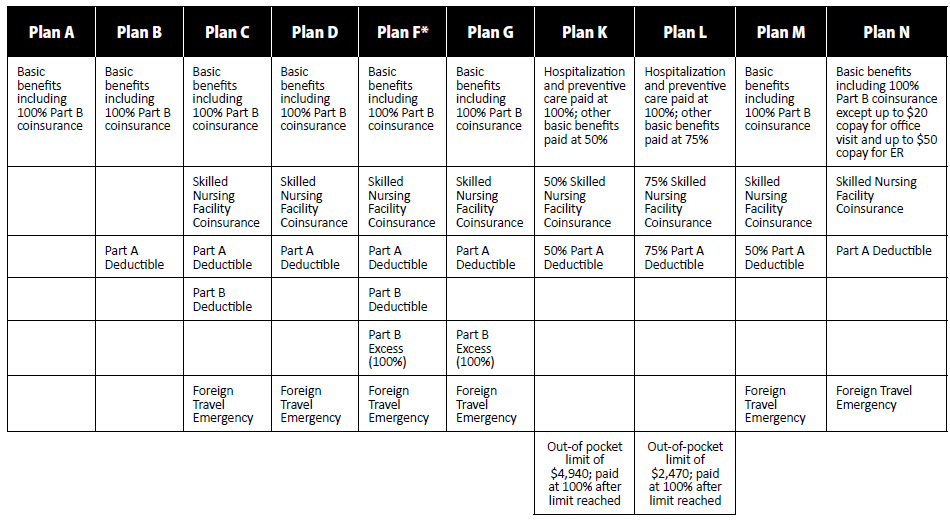

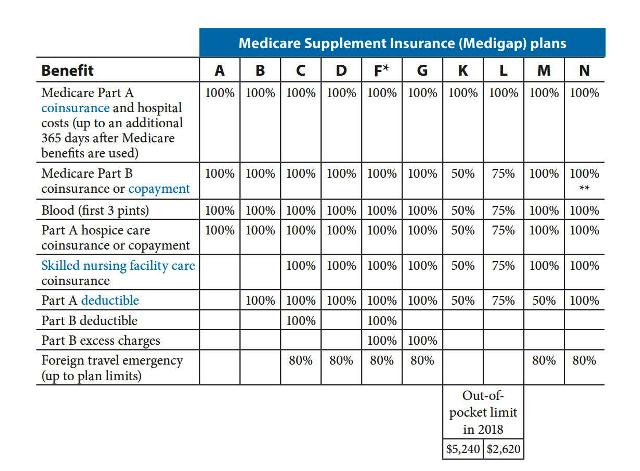

With this plan 100 of Medicare Part Bs coinsurance costs are covered other than an office visit copayment of up to 20 and a copayment of up to 50 for emergency room visits. Blue Cross Blue Shield is just one of many options.

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Thats where Medigap plans come in.

Blue cross blue shield medigap plans. Keep in mind that this is a separate plan from your Original Medicare benefits. They offer all 10 available Medigap plans and support millions of seniors across the country. Other costs with this plan that you would need to pay for out-of-pocket include.

Vermont Medigap Blue is our lowest-cost plan At Blue Cross and Blue Shield of Vermont we believe your best years are ahead of you. Private insurance companies such as BlueCross BlueShield offer Medigap policies to new enrollees. Contact PlanMedigap for a quote today.

Blue Cross Blue Shield Medicare Supplement plans also known as Medigap help cover medical costs not covered by Medicare Part A and Part B Original Medicare. These include such out-of-pocket expenses as deductibles copays and coinsurance. Our plans provide the complete Medicare coverage you deserve so you can live your best life.

Blue Cross Blue Shield of Michigan offers Blue Cross Medicare Supplement options for Plans A C D F High-Deductible F G. BlueCross Blue Shield known as Anthem in some states as well as BCBS is one of the biggest names in insurance. The government mandates that all.

Two or more existing Blue Cross Medicare Supplement or Legacy Medigap. Its one more way were helping Keep Vermont Well. Anthem Insurance Companies Inc Blue Cross and Blue Shield of Massachusetts Inc Blue Cross Blue Shield of Rhode Island and Blue Cross and Blue Shield of Vermont are the legal entities that have.

These costs can include 20 coinsurance and your Medicare Parts A and B deductibles. These policies come from private health insurance companies. It also pays for Part B coinsurance which is usually 20 of Medicare expenses or copayments for hospital outpatient services.

Blue Cross and Blue Shield of Texas Medicare Supplement Plan N. With Medicare Supplement Plan N you will be covered for the basic core Medigap benefits as well as for the Medicare Part A deductible. Medigap plans are sold by private insurance companies and are designed to assist you with out-of-pocket costs eg deductibles copays and coinsurance not covered by Parts A.

Blue Cross Blue Shield Medigap plan extra benefits On top of the standard coverage that comes with all Medigap plans some of Blue Crosss plans offers. The Medicare Supplement Plan N benefits include. Blue Cross Blue Shield Medicare Supplement Plan provides affordable healthcare coverage in all 50 states.

However the only charge not covered by Plan. Your coverage works together with your Original Medicare Parts A and B benefits and does not include prescription drug benefits. Medicare Part B deductible of 203 in 2021.

Medicare Supplement plans Medigap cover the costs Original Medicare leaves you to pay. It pays Part A coinsurance plus the coverage for 365 additional days after your Medicare benefits run out. Blue Cross Blue Shield Plan G gives the beneficiary a fully comprehensive coverage option for a lower premium.

Blue Cross Blue Shield Medigap Plan A Medicare Part A coinsurance and coverage for hospital benefits Medicare Part B coinsurance or copayments Coinsurance or copayments for hospice care The first three pints of blood in a medical procedure. They have a separate monthly premium that you will have to pay directly to the insurance company you choose. Contact PlanMedigap for a quote today.

Another Blue Cross Blue Shield Medigap plan that provides a wide range of benefits is Plan N. Information-filled but confusing layout. Plan B is not part of Blue Cross Blue Shield but is something you should be familiar with.

These policies help with Medicare out-of. Enrollment in Blue Cross Blue Shield of Massachusetts depends on contract renewal. They have a website specifically dedicated to Medicare Supplement Plans so you dont have to worry about sorting through health insurance information that doesnt apply to you.

Plan N - Covers hospital copayments Part B co-insurance except 20 for office visits 50 for emergency visits first 3 pints of blood hospital deductible SNF foreign care all of Part B co-insurance for preventive care and hospice care. Medigap Medicare Supplement If you are enrolled in Medicare Part A and B Original Medicare Medigap plans can help fill the coverage gaps in Medicare Part A and Part B. They fill the gap between what Original Medicare Part A and Part B covers and what you owe.

Youll often see Medigap plans called Medicare Supplement Insurance Policies. If youre in the market for a Medigap plan Blue Cross Blue Shield BCBS might be exactly what youre looking for. Blue Cross Blue Shield Medigap Plan G Plan G has quickly gained notoriety as the most popular plan available to beneficiaries.

If youre an Existing member You and any other household members who are currently enrolled in a Blue Cross Medicare Supplement or Legacy Medigap plan can apply. Blue Cross Blue Shield of Massachusetts is an HMO and PPO Plan with a Medicare contract.