Since Tennessee does not impose a state income tax HSA contributions have no impact on state tax liability. 1998-2021 BlueCross BlueShield of Tennessee Inc an Independent Licensee of the Blue Cross Blue Shield Association.

A Deep Dive Into Health Insurance Coverage In Tennessee

A Deep Dive Into Health Insurance Coverage In Tennessee

After you spend that much your insurance company pays for all covered services with no copayment or coinsurance.

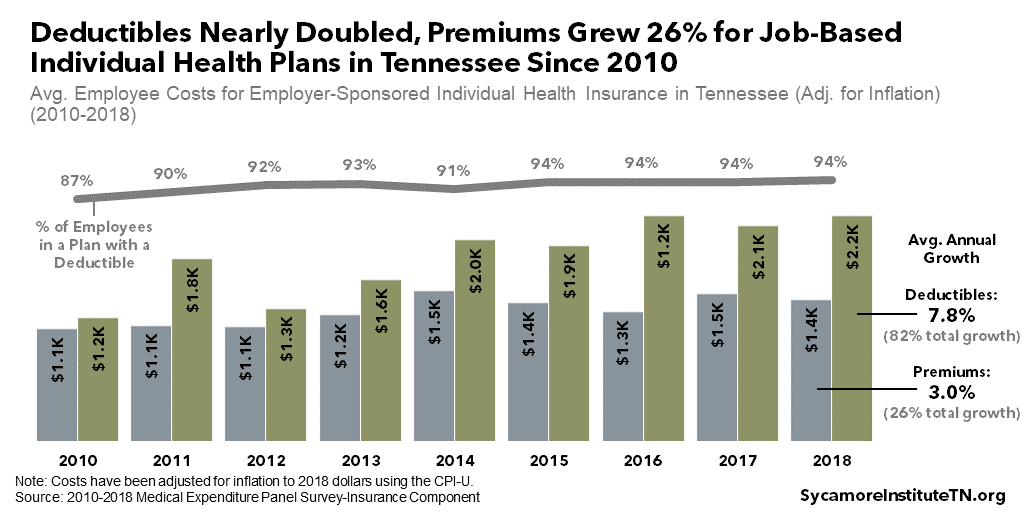

High deductible health plan tennessee. High Deductible Health Plan Perfect for individuals or families who want to open a Health Savings Account HSA. BlueCross BlueShield of Tennessee is a Qualified Health Plan issuer in the Health Insurance Marketplace. According to the IRS a high-deductible plan in 2020 is any plan with a deductible of at least 1400 for an individual or 2800 for a family.

What Catastrophic plans cover. Find Tennessee health insurance options at many price points. High-Deductible Health Plans with Health Savings Accounts HDHP wHSAs These plans give you more control over your out-of-pocket expenses by offering lower monthly premiums with higher deductibles.

High deductible plans must also limit annual out-of-pocket expenses to 7000 for individual coverage or 13800 for. For 2019 the IRS defines a high deductible health plan as any plan with a deductible of at least 1350 for an individual or 2700 for a family. An HDHPs total yearly out-of-pocket expenses including deductibles copayments and.

Consumer-driven health plan a type of medical insurance or plan that generally has a higher deductible and lower monthly premiums. For 2020 the Internal Revenue Service IRS defines an HDHP as one with a deductible of 1400 or more for an individual or 2800 or more for a family. We offer a range of High Deductible Health Plan HDHP choices for individuals or families in need of health coverage with an HSA option.

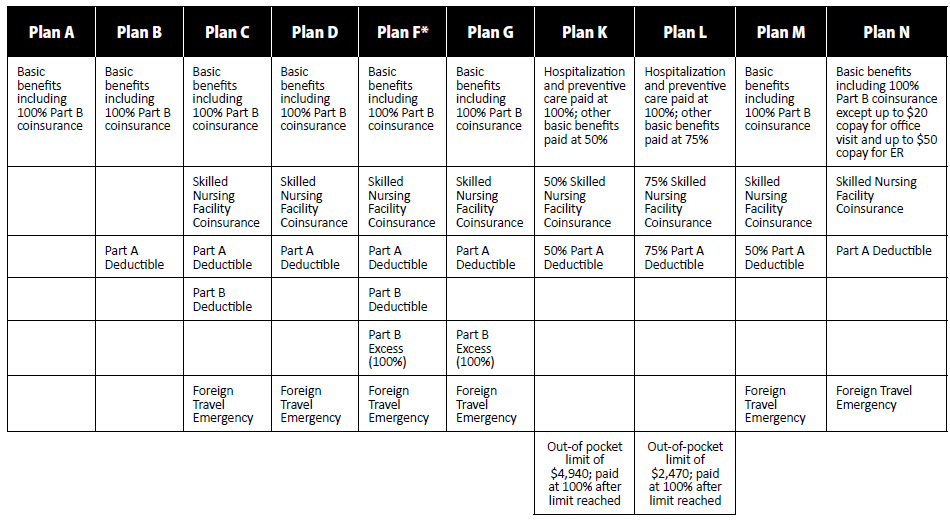

Typically you take responsibility for covering your health care expenses until your deductible is met. IRS high deductible health plan definition 2021. The Plan G deductible is standardized by the federal government and will be consistent no.

1998-2021 BlueCross BlueShield of Tennessee Inc an Independent Licensee of the Blue Cross Blue. What this Plan Covers What You Pay For Covered Services Coverage for. Our HDHPs meet all federal requirements necessary to open a Health Savings Account.

A high deductible plan HDHP can be combined with a health savings account HSA allowing you to pay for certain medical expenses with money free from federal taxes. For 2010 the minimum deductible for HDHPs increases to 1200 for self-only coverage and 2400 for family coverage Tennessee Income Tax Treatment on HSA Contributions. Once you meet your deductible coinsurance applies up to the out-of-pocket maximum.

For 2019 the deductible for all Catastrophic plans is 7900. Some qualified high-deductible health plans may be paired with a Health. Beginning on or after 07012020 Medical Prescription Plan Summary of Benefits and Coverage.

For 2020 the deductible for all Catastrophic plans is 8150. HDHPs have higher deductibles and lower premiums than standard health plans. For 2021 the IRS defines high deductible as any plan with a deductible of 1400 or higher for an individual.

PPO Group Number 007000285-0014 0015 1 of 8. Get an online quote today. The Cigna Connect 4750 Silver plan for instance has a monthly premium of 429 with a 4750 deductible for a 40-year-old in Shelby County.

For family coverage the deductible limit is set at 2800. The Cigna Connect 1000 Gold plan has a much lower deductible of 1000 but it has a higher monthly rate of 641. IndividualFamily Plan Type.

Explore health plans for you and your family including short-term gap coverage and more. A high deductible health plan HDHP has lower monthly premiums and a higher deductible than other health insurance plans. An HDHPs total yearly out of pocket-expenses cant be more than 6900 for an individual or 13800 for a family.

HDHPs offer a lower premium with a higher annual deductible. Minimum Deductible Amounts for HSA-Compatible HDHPs. If you anticipate only needing preventive care which is covered at 100 under most plans when you stay in-network then the lower premiums that often come with an HDHP may help you save money in the long run Tax-free spending account.

Blue Cross Blue Shield HSA-Advantage High Deductible Health Plan HDHP Coverage Period. Catastrophic plans cover the same essential health benefits as other Marketplace plans. They are typically combined with HSAs that allow you to set aside interest-earning pretax funds through your employers payroll deduction or tax-deductible funds you deposit in a.

With an HDHP you pay the full cost for services until your annual deductible is met for services other than in-network preventive care services which are covered 100. What is an High Deductible Health Plan. 1 Cameron Hill Circle Chattanooga TN 37402-0001.

The 2020 deductible amount for high deductible Plan G is 2340. Most high deductible health plans come with lower monthly premiums.