Field notes that many deductibles are in the range of 5000 to 6000. A high deductible plan HDHP can be combined with a health savings account HSA allowing you to pay for certain medical expenses with money free from federal taxes.

51 Of U S Workforce Enrolled In High Deductible Health Plans Which May Leave Some Underinsured Valuepenguin

What Is an HDHP.

Ultra high deductible health insurance. Learn the attributes of an HDHP and its potential advantages and disadvantages compared with other health insurance options. An HDHP is a type of health insurance plan that offers lower monthly premiums than more traditional plans like PPOs or HMOs in exchange for a higher deductible hence the name high deductible health plan. It is primarily designed to provide comprehensive cover against emergencies and deadly diseases.

When you choose a health insurance plan its important to understand what your insurance company covers without requiring you to pay your deductible. To qualify as a high deductible health plan the minimum deductible for single coverage must be 1350 or higher for 2019 or 2700 or higher for family coverage. An HDHPs total yearly out-of-pocket expenses including.

The opposite is true as well. This type of plan has a higher deductible than a traditional insurance policy. If your deductible is higher it means you are required to pay for your medical care out-of-pocket up to that amount before your health plan begins to help pay for covered costs.

I read in an old thread that the assumption is that those looking for this type of insurance are wealthy with a. Catastrophic health insurance is a type of medical coverage under the Affordable Care Act. Currently thats a 7150 deductible for an individual and.

For example if you get into a medical emergency and your medical. They are usually paired with a health savings account HSA that allows you andor your employer to make tax deductible contributions to. As you can probably guess from its name a high-deductible health plan has a higher deductible than other plans.

For 2020 the IRS defines a high-deductible health plan as any plan with a deductible of at least 1400 for an individual or 2700 for a family. The exception is for preventive care which is covered at 100 under most health plans when you stay in-network. With your insurance premium and high.

Hello - we are a family of 7 investigating the option of an ultra-high deductible insurance plan. If you only have a 1000 deductible the odds are pretty good that the insurance company will have to pay something. For many the answer is to accept the possibility of higher out-of-pocket costs while reaping the benefit of lower premiums.

Everything involved in insurance and medical care is to make some people extremely wealthy. LOW DEDUCTIBLE HEALTH PLANS. For 2019 the IRS defines a high deductible health plan as any plan with a deductible of at least 1350 for an individual or 2700 for a family.

Some employers of fast food workers are only offering plans with the maximum out-of-pocket exposure Obamacare regulations will allow. That means that they are willing to offer you a lower premium per month. The IRS currently defines a high-deductible health plan as one with a deductible of at least 1350 for an individual or 2700 for a family according to healthcaregov.

But theres a significant payofflower monthly premiums. For example if you have a really high deductible the insurance company has a much smaller chance of having to pay out for your medical bills. The deductibles are high because the insurance companies know you wont use their plans because you cant afford to after paying your high premiums.

The insured has to bear a pre-fixed amount of deductible before the insurers cover starts. High-deductible plans are part of a move to whats called consumer-directed healthcare. The idea is that if youre more on the hook financially for the medical choices you make youll take.

Ultra High Deductible - Catastrophic - Health Insurance. The upfront premium to be paid is lower. Offline kurtjenvb New Member.

HIGH DEDUCTIBLE HEALTH PLANS. Its called a high-deductible health plan HDHP. Monthly Insurance premiums are now as much as some peoples mortgage payments but with a mortgage payment you at least get something to live in and shelter you.

The upfront premium amount to be paid is higher. Then you can decide whether you want a plan with lower monthly premiums and a higher deductible or one with a higher monthly premium and a lower deductible. Over 70 of Marketplace plans have deductibles under 3000.

For 2020 the Internal Revenue Service IRS defines an HDHP as one with a deductible of 1400 or more for an individual or 2800 or more for a family. This is a type of high-deductible health plan for people under 30 or those who qualify for a hardship exemption Catastrophic plans are designed to protect you in a worst-case scenario. Even if you choose a high deductible catastrophic plan your out-of-pocket costs should not exceed this limit.

Is It Better To Have A High Or Low Deductible For Health Insurance

Is It Better To Have A High Or Low Deductible For Health Insurance

High Deductible Health Plan Hdhp Pros And Cons

High Deductible Health Plan Hdhp Pros And Cons

As High Deductible Health Plans Grow In Popularity Some State Officials Want To Rein Them In Hartford Business Journal

As High Deductible Health Plans Grow In Popularity Some State Officials Want To Rein Them In Hartford Business Journal

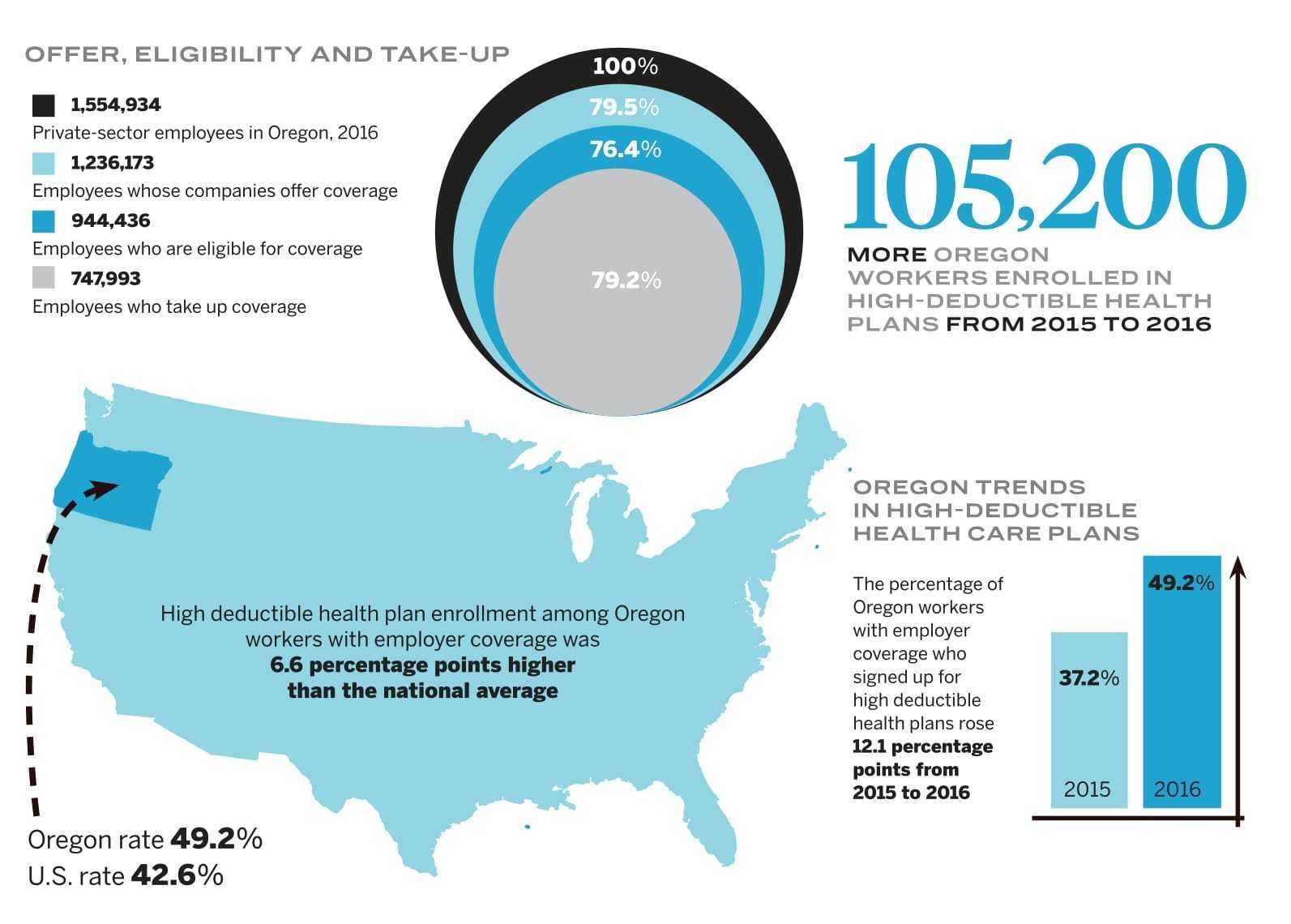

Insurance Guide 2018 Oregonians Flock To High Deductible Health Plans Oregonlive Com

Insurance Guide 2018 Oregonians Flock To High Deductible Health Plans Oregonlive Com

High Deductible Health Plan An Overview Sciencedirect Topics

High Deductible Health Plan An Overview Sciencedirect Topics

What You Need To Know About High Deductible Health Plans

What You Need To Know About High Deductible Health Plans

Study Sample Hdhp High Deductible Health Plan Plan Choice Defined Download Scientific Diagram

Study Sample Hdhp High Deductible Health Plan Plan Choice Defined Download Scientific Diagram

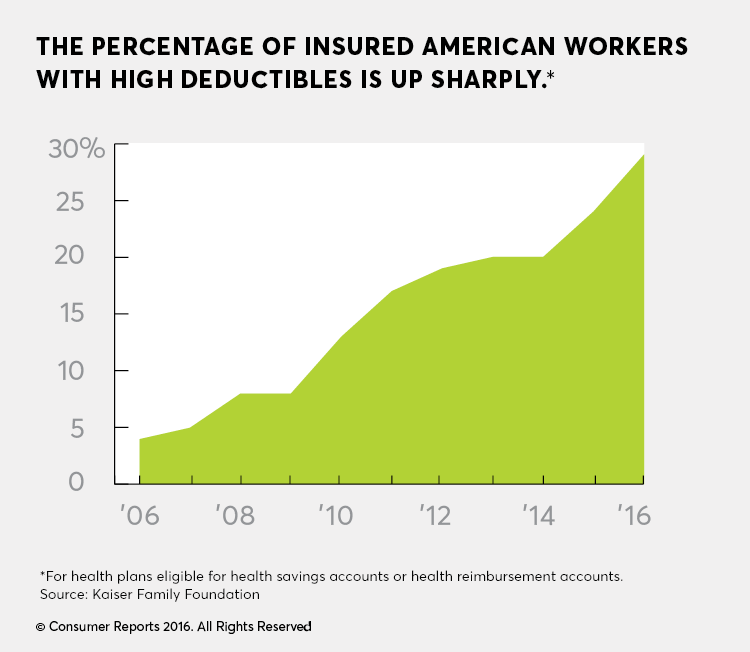

High Deductible Health Plans On The Rise Squared Away Blog

The Rise Of High Deductible Health Plans Infographic

The Rise Of High Deductible Health Plans Infographic

How To Survive A High Deductible Health Plan

How To Survive A High Deductible Health Plan

Health Insurance Top Up Plans Compare Buy Health Top Up Finserv Markets

Health Insurance Top Up Plans Compare Buy Health Top Up Finserv Markets

Https Files Nc Gov Ncshp Documents Open Enrollment Documents 2018 Hdhp Decisionguide Pdf

High Deductible Health Insurance Plans On The Rise In Massachusetts At Nearly Double National Average Masslive Com

High Deductible Health Insurance Plans On The Rise In Massachusetts At Nearly Double National Average Masslive Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.