To remove a household member you need to open your Covered California account and select Report a Change from the Actions menu on the right side. Since you are collecting monthly premium assistance in the form of tax credits based on an estimated annual income of 35000 your excess tax credits for actual 2019 income of 45000 will have to be repaid when you file your taxes for 2019.

California S Health Benefit Exchange Payments

California S Health Benefit Exchange Payments

Detailed information related to pregnancy coverage can be found here.

How to withdraw covered california application. Allow 2-5 business days for Covered CA to process your newly submitted application. Get coverage within 60 days of a major life change. Send your completed and signed application to.

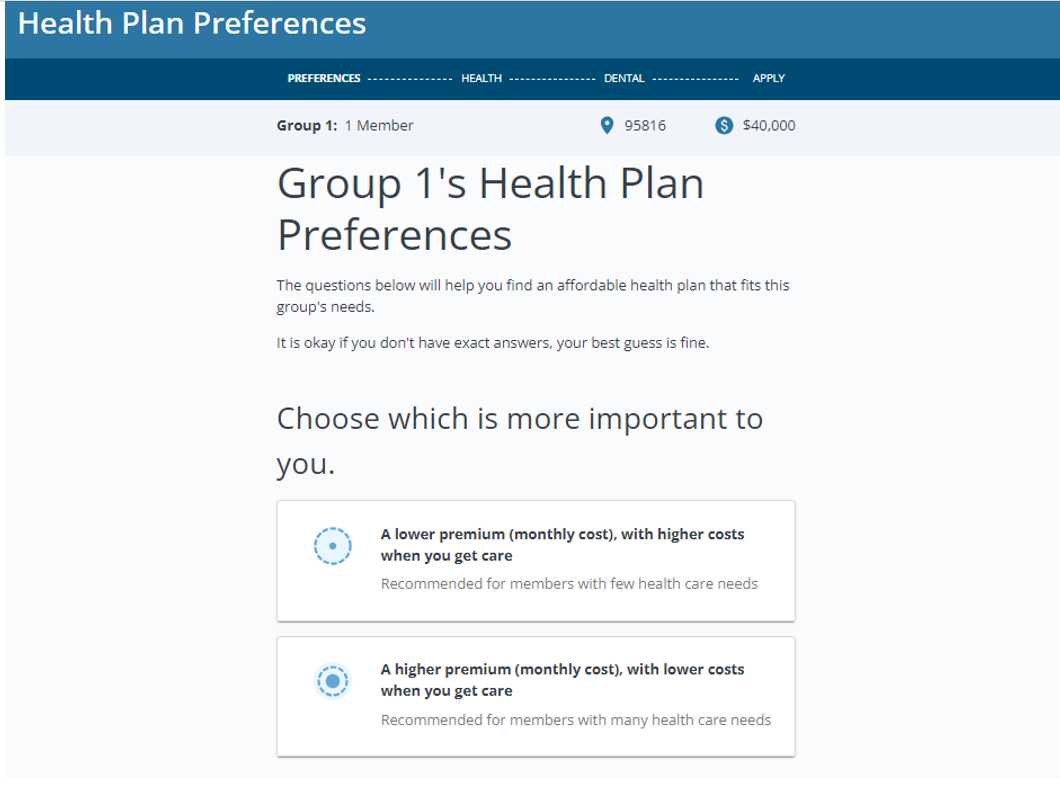

You can apply for coverage through Covered California at any time if you experience a qualifying life event. Section on the lower right hand section of the page. Click the Application Year drop-down and select 2019.

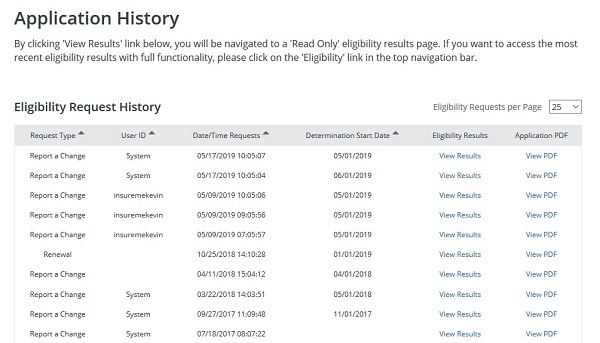

Laid off fired raise or new job. Click My Eligibility History above the My Enrollments link. When you click on the Terminate Participation link you are brought to a page showing your current participation.

Since you do not plan to make an IRA withdrawal in 2020 I suggest you do not change your stated. You lose Medi-Cal coverage. The page should list all the members of the household that are part of the health plan.

Withdraw application from their Covered California account Notify the county directly and ask to have the application withdrawn Why does Covered California show eligibility for both tax credits and Medi-Cal. This application asks for a lot of personal information. Select a reason for termination.

If you do not want financial assistance for a Covered California health insurance plan or coverage through Medi-Cal you can indicate that you are not interested in premium assistance when asked. Generally they give you 90 days from when you complete your Covered California application to submit this information. Letter of Withdrawal Template.

Close with your name and contact information. However adjusting the income will not change the flag that the. Page 2 of 2.

You can login to your Covered California account withdraw your application and select another carriers plan. Log out and log back in. Do not send your health insurance plan enrollment payment with this application.

Providing a current pay stub to show proof of income would be a good example of this. Report a Change a step to changing health plans through Covered California. The subject line should include your name and Withdraw Application Begin the letter with your salutation followed by a paragraph or two stating your intention to withdraw your application from consideration and thanking them for their time.

This will bring up the different areas of the application you can access for making a change. Medi-Cal enrollment is year-round and you dont need a life event to apply. If you do not hear from us please call us at 800 300-1506 TTY.

Pay your insurance carrier to activate your new plan and get confirmation from them that you are enrolled on your new plan before cancelling your old one. Then scroll to the. From that point you will complete the application.

Actually it is highly recommended that you report any income changes of 10 or more to Covered California within 30 days of the event that caused your income to change ie. We can call you to help you finish your application. The income adjustment tool it can found at the bottom of the income section edit page allows people to increase their income which decreases the amount of monthly tax credit subsidy they will receive.

You lose your employer-sponsored coverage. Call Covered CA at 1-800-300-1506 to see if they show you enrolled on more than one plan. The good news is that you can change the estimated income listed on your Covered California application anytime throughout the year.

We will send you a letter within 45 days to tell you which program you and your family members qualify for. You can also find a Licensed Insurance Agent Certified Enrollment Counselor or county eligibility worker who can provide free assistance in your area. Covered California includes an income adjustment tool to increase or decrease the projected income.

Navigate to the My Enrollment Dashboard page or click either View Enrollment or Choose Health and Dental Plan for 2019. Yes button on the Withdraw Application Confirmation popup to finalize the withdrawal. To report changes call Covered California at 800 300-1506 or log in to your online account.

Will Covered California share my personal and financial information. Sometimes Covered California is unable to verify information on an application through electronic sources so they may ask you to provide a document for proof. Box 989725 West Sacramento CA 95798-9725 If you dont have all the information we ask for sign and send in your application anyway.

Scroll down until you find the section that says Household Member Tom Smith.