For the 2021 plan year. When this maximum is met any dollar over that amount will be 100 covered by your insurance provider.

Deductibles Co Pay And Out Of Pocket Maximums

Deductibles Co Pay And Out Of Pocket Maximums

What is an Out-of-Pocket Maximum.

What is out of pocket maximum. The out-of-pocket limit for a Marketplace plan cant be more than 8150 for an individual and 16300 for a family. Once you meet your deductible your health plan kicks in to share costs. These numbers have been revised up for 2021 they were slightly lower 8150 and 16300 respectively in 2020.

This is the maximum amount that the policy holder will be expected to pay out-of-pocket each year. For 2021 your maximum deductible is the same as the out-of-pocket maximum. An out-of-pocket maximum is a predetermined limited amount of money that an individual must pay before an insurance company or self-insured employer will pay 100 of an individuals covered health care expenses for the remainder of the year.

For 2021 your out-of-pocket maximum can be no more than 8550 for an individual plan and 17100 for a family plan before marketplace subsidies. The following are health care expenses that are often applied to an out-of-pocket maximum. Starting in 2016 individual.

Costs that dont count towards your out-of-pocket maximum include. If you are a current BCBSTX member you can see what your plans OOPM is within Blue Access for Members. 13700 for a family plan.

4 Zeilen Your out-of-pocket maximum is the absolute most you will have to pay towards your medical costs. Its called an out-of-pocket max or maximum. Your plans out-of-pocket maximum is the most you will need to spend on health care expenses in a given year.

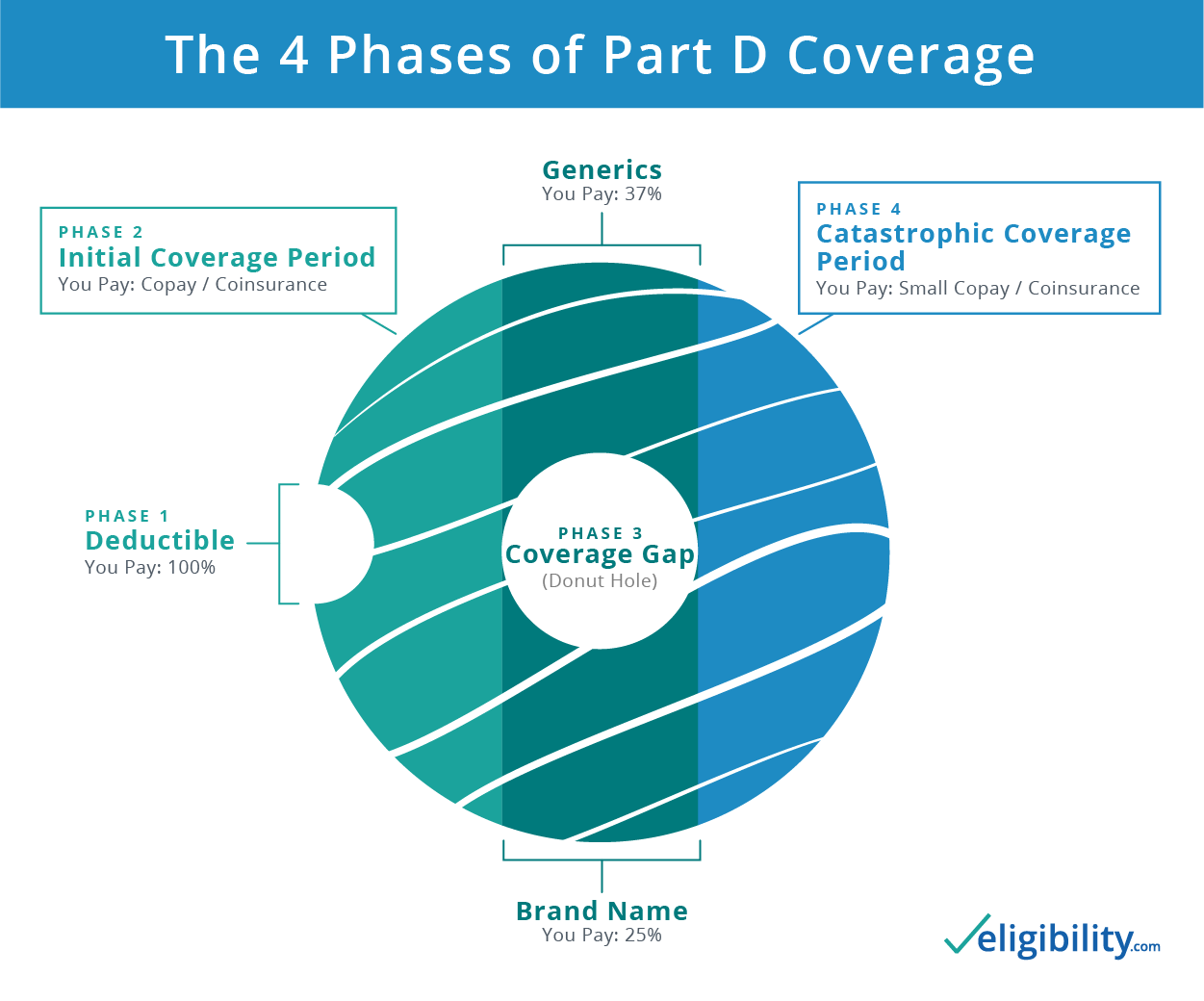

6850 for an individual plan. The out-of-pocket maximum also called OOPM is the most you will have to pay out of your own pocket for expenses under your health insurance plan during the year. Monthly plan premiums dont go towards your maximum out-of-pocket costs.

Sometimes its called a MOOP for maximum out-of-pocket. This limit includes the deductible copays and coinsurance you will continue to pay after you reach the deductible. The highest out-of-pocket maximum for a health insurance plan in 2021 plans is 8550 for individual plans and 17100 for family.

Even after youve met your. In terms of health insurance out-of-pocket expenses are your share of covered healthcare costs including the money you pay for deductibles copays and coinsurance. The out-of-pocket maximum is also known as the out-of-pocket limit.

All health insurance plans sold in the United States are required to set a maximum limit on the amount of money you have to spend on your own or out-of-pocket in a given year. What is an out-of-pocket maximum. Your out-of-pocket maximum or limit is the most you will ever have to pay out of your own pocket for annual health care.

It typically includes your deductible coinsurance and copays but this can vary by plan. This fixed-dollar amount is called an out-of-pocket maximum. The out-of-pocket maximum does not include your monthly premiums.

These are costs you pay out of your own pocket that go toward your deductible. How to estimate your total costs for health care. Medical services that arent covered wont count towards your out-of-pocket maximum.

The OOPM is different for every type of plan. The out-of-pocket limit for a Marketplace plan cant be more than 8550 for an individual and 17100 for a family. Once a person meets their maximum your Medicare Advantage provider is responsible for paying 100 percent of the total medical expenses.

Once you spend enough to reach the maximum your insurer will cover all of your medical bills. The out-of-pocket maximum is the most you could pay for covered medical services andor prescriptions each year. Its the most youll have to pay during a policy period usually a year for health care services.

For the 2020 plan year. Since most plans cover all. Health insurance plans have an.

In 2016 your out-of-pocket maximum can be no more than.