Youll probably owe a late-enrollment penalty for Part B due to the years you were eligible for Medicare but not enrolled in it. In 2019 this premium is 3319.

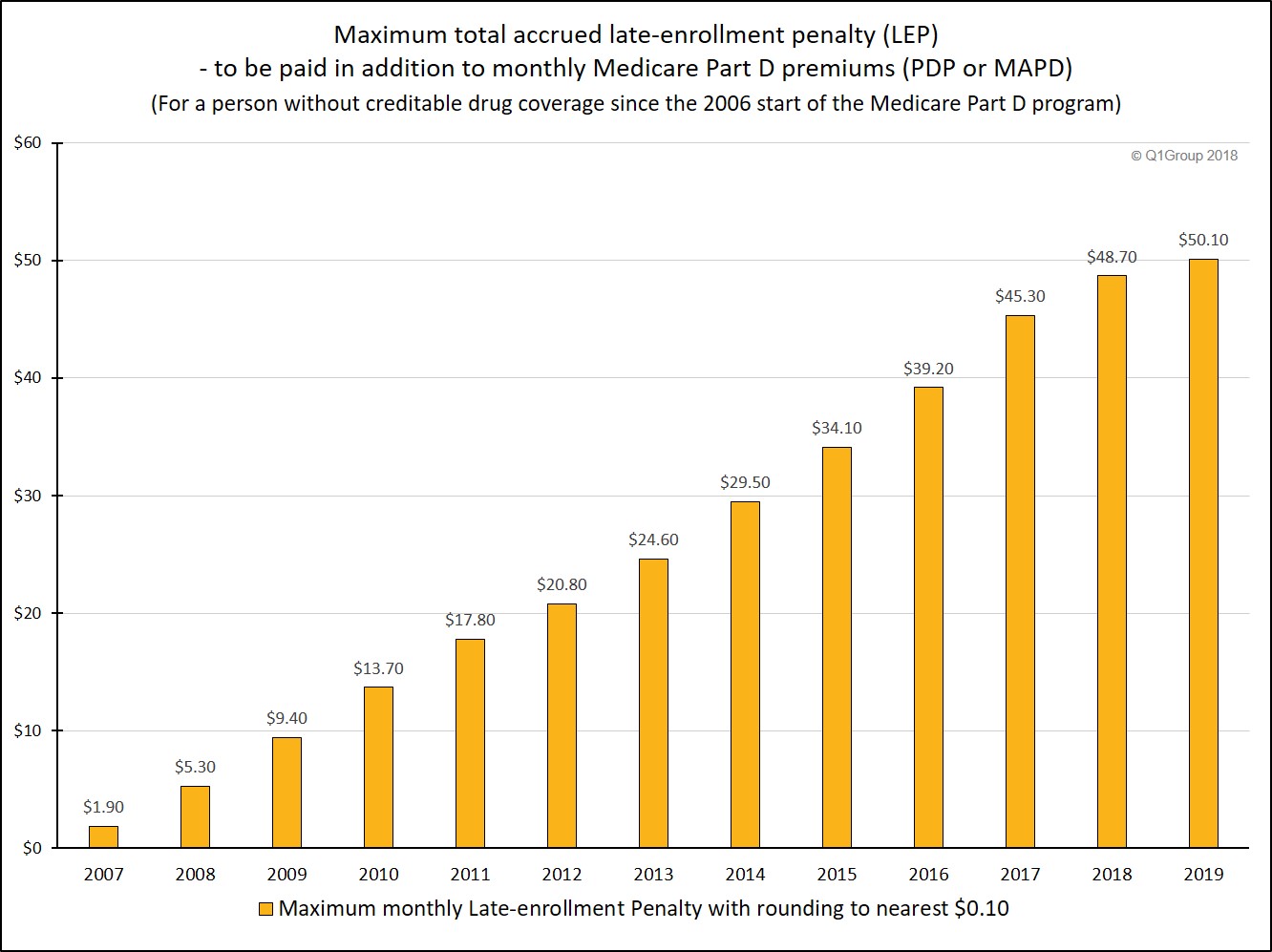

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

In general youll have to pay this penalty for as long as you have a Medicare drug plan.

What is the maximum part d late enrollment penalty. Therefore you pay a 10 percent penalty for two years. For every full year you fail to. Your Part D penalty will be rounded to the nearest 10 and added to your Part D premium.

Based on the newly released national base Medicare Part D premium the 2021 Part D Late-Enrollment Penalties will increase slightly. The Medicare Part D penalty is 1 for each month you went without prescription. 2019 Medicare Part D Late-Enrollment Penalties will decrease by 523 - But maximum penalties can reach 601 per year.

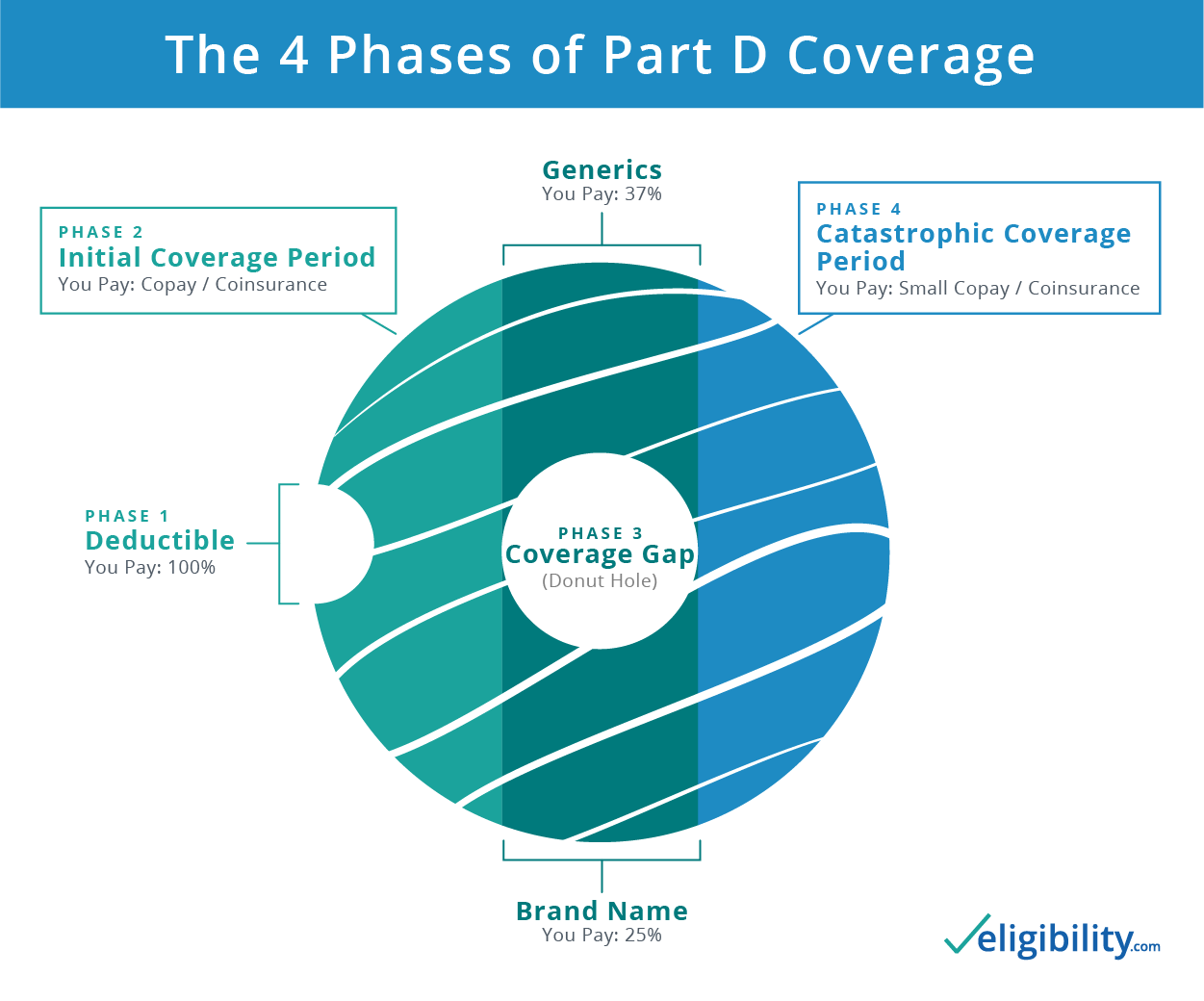

Learn how the Part D late enrollment penalty. The Part D penalty is the number of full months you were eligible for Part D prescription drug coverage but didnt enroll in a Medicare plan providing this coverage and didnt have other creditable coverage multiplied by 1 of the national base beneficiary premium which is 3306 in 2021. In a Medicare drug plan may owe a late enrollment penalty if he or she goes without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more in a row after the end of his or her Initial Enrollment Period for Part D coverage.

The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Part A Late Enrollment Penalty Medicaregov Part B Late Enrollment Penalty Medicaregov Part D Late Enrollment Penalty Medicaregov. The figure is rounded to the nearest 010.

When you return to the country you will receive a special enrollment period to choose a Part D plan and wont have to pay a penalty for not being enrolled in that coverage. Generally the late enrollment penalty is added to the persons monthly. So heres an example to show how this works.

If you dont meet one of the four requirements above for a period of 63 days or more in a row you will face a penalty that requires some complicated math to figure out. Based on the newly released national base Medicare Part D premium the 2020 Part D Late-Enrollment Penalties will decrease for the third year in a row - although maximum penalties can reach up to 641 per year. The penalty is calculated by multiplying 1 of the national base beneficiary premium 3306 in 2021 times the number of full uncovered months you didnt have Part D or creditable coverage.

I know this probably very difficult to hear. Medicare multiplies this 1 by the number of months you. Medicare calculates the late-enrollment penalty by multiplying the 1 penalty rate of the national base beneficiary premium 3306 in 2021 by the number of full uncovered months you were eligible to enroll in a Medicare Prescription Drug Plan but did not assuming.

As with Part B the Part D late enrollment penalty is based on the amount of time you were without coverage. The maximum penalties can reach up to 695 for the year. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over theres a period of 63 or more days in a row when you dont have Medicare drug coverage or other.

The Medicare Part D penalty is calculated by multiplying 1 of the national base beneficiary premium 3306 in 2021 by the number of full months that you were eligible for but didnt enroll in a Medicare Prescription Drug Plan and went without other creditable prescription drug coverage. Part D premium for as long as he or she has Medicare prescription drug. Your penalty for 2021 would be 33 cents x 12 for the 12 months of 2020 you werent covered or 396.

Since the penalty is always based on the current years national beneficiary premium it may change or go up each year. In most cases if you dont sign up for Medicare when youre first eligible you may have to pay a higher monthly premium. More information on Medicare late enrollment penalties.

The penalty applies for as long as you are enrolled in a Part D plan. Medicare decides the Part D late enrollment penalty using 1 of the national base beneficiary premium. Part D late enrollment penalty The late enrollment penalty is an amount thats permanently added to your Medicare drug coverage Part D premium.

Part D late enrollment penalty calculation can be hard to figure out. Medicare rounds this amount up to the. If your premium is 458 per month your penalty is 4580 per month for 24 months.

Powered by Q 1 Group LLC Education and Decision Support Tools for the Medicare Community. So instead of paying the base rate of 3319 per month for Medicare Part D in 2019 your monthly costs with the late enrollment penalty would be 3719. When calculated this penalty is rounded to the nearest 010 and added to the base monthly premium youre required to pay.

If you have creditable prescription drug coverage when you first become eligible for Medicare generally you can keep it without paying the late enrollment penalty if you sign up for Part D later.