To transitionby January 2021the pharmacy services benefit in MediCal the states largest lowincome health care program from managed care to entirely a feeforservice FFS benefit directly paid for and administered by the state. You will soon get a Medi-Cal identification card called a Benefits Identification Card or BIC.

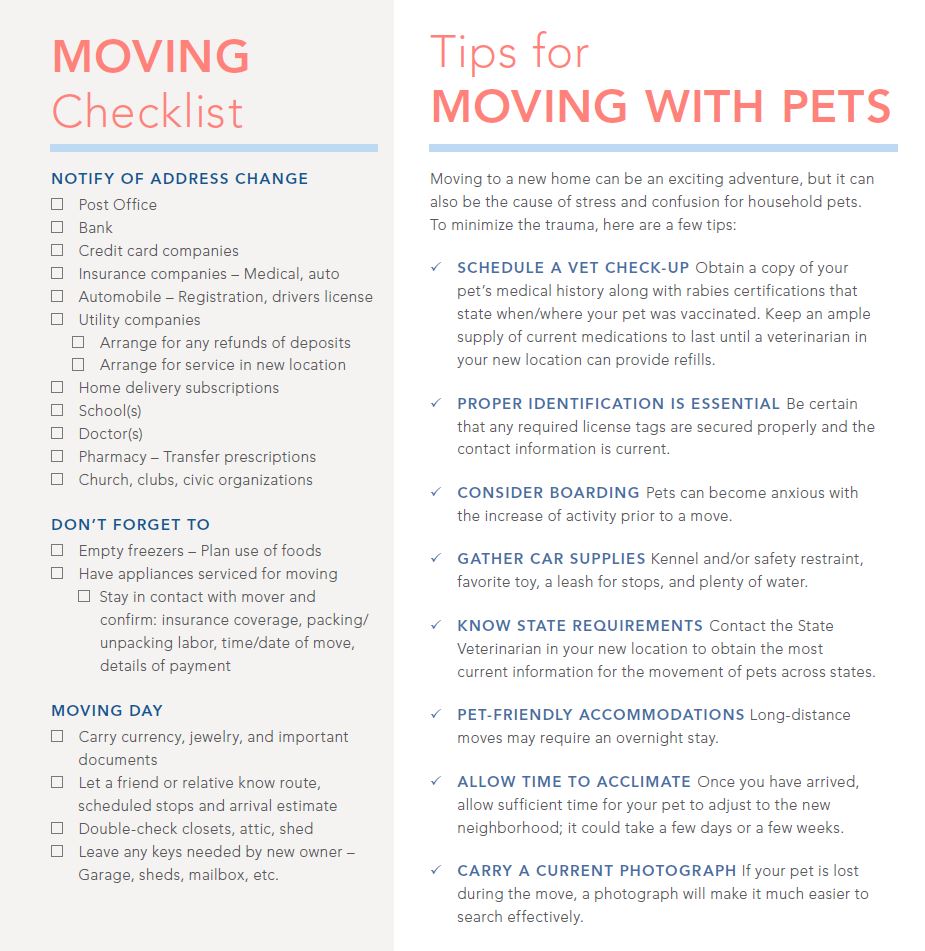

Moving Checklist Continental Title Company

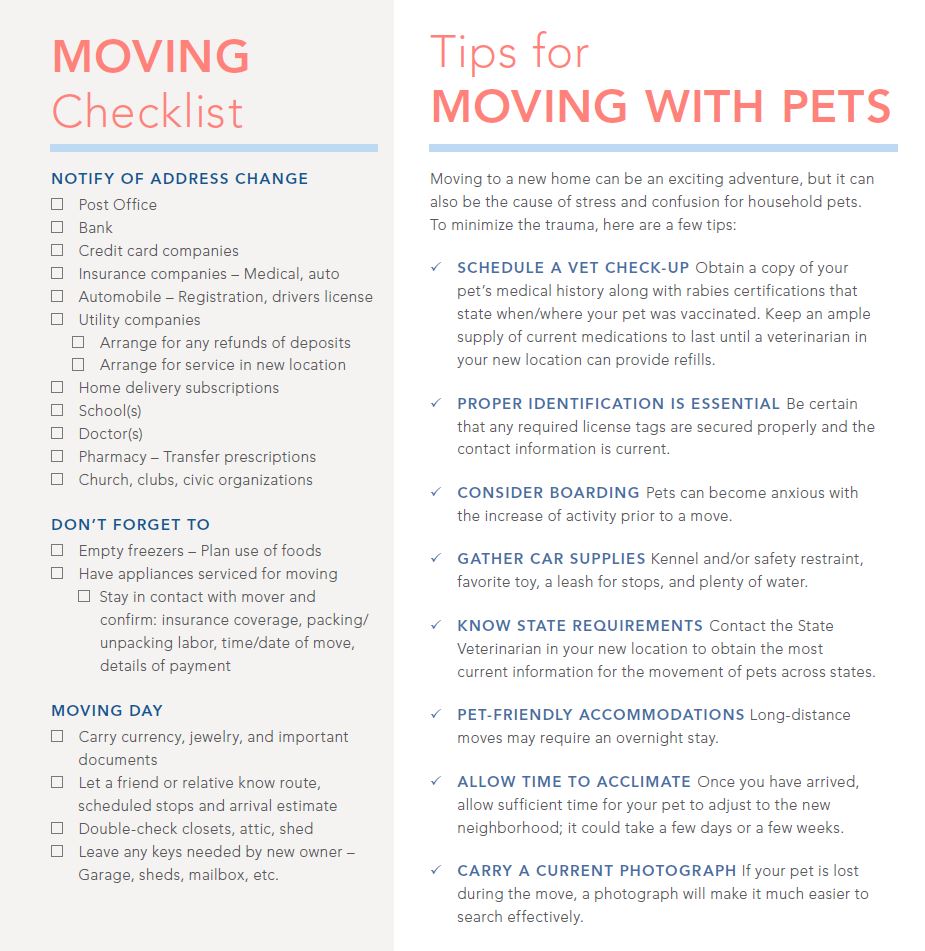

Moving Checklist Continental Title Company

Medi-Cal can end if.

Medi cal moving out of state. Submit an original signed and complete claim form. You tell your Medi-Cal worker you no longer want Medi-Cal. For eligibility purposes as an at-home spouse you are only allowed to keep up to 128640 in non-exempt assets for 2020.

ALL COUNTY MEDI-CAL PROGRAM SPECIALISTSLIAISONS. You move out of state. I have a Medicare Supplement Medigap plan and am moving out of state.

He can also apply to the Marketplace to have coverage start on the day the plan will end to ensure no coverage gap. You must provide the reason you want to withdraw your application and discontinue Medi-Cal. Moving to a new state.

Transferring medical records when moving will ensure that you receive effective health care in your new areaThe process however has its specifics. Complete a request for withdrawal form. This means that if youre moving to a different state your Medicare Advantage Plan will likely not follow you.

Wwwdhcscagov October 20 2015 Medi-Cal Eligibility Division Information Letter No. When billing Medi-Cal as an out-of-state provider you must. The State of California under a directive from Governor Gavin Newsom is carving out the pharmacy benefit for Medi-Cal beneficiaries from managed-care plans and transitioning to a fee-for-service FFS program moving 13 million Medi-Cal beneficiaries to a new.

An Intercounty Transfer ICT is to be init iated when a Medi-Cal client becomes the responsibility of a new county. It is white with blue writing and it has a picture of the seal of the State of California. Medi-Cal Eligibility Division 1501 Capitol Avenue MS 4607 PO.

Locate a new Medicare Advantage Plan in your new state and county. When you move to a new state you cant keep a health insurance plan from your old state. Is there any way I could lose Medi-Cal during the COVID-19 emergency.

Box 997417 Sacramento CA 95899-7417 916 552-9430 phone 916 552-9477 fax Internet Address. This report analyzes one of the two initiatives included in the executive order. This form states that you want to withdraw your application for Medi-Cal effective immediately.

There is a standard form you must fill out with your name and contact information. However there is an important timing issue here. You can move out of the home rent it or sell it all without affecting your spouses Medi-Cal eligibility.

If you do not find an answer to your question please contact your local county office from our County Listings page or email us. Back to Medi-Cal Eligibility. A child placed in out-of-state foster care under either of the following conditions.

This card will be sent to you in a separate letter. Medigap benefits can be used to cover costs from any provider that accepts Medicare regardless of the state. Refer to Medi-Cal Programs 50201 50203 50227 page 20-1 for definition of Interstate Compact or By a state or county agency responsible for the childs care.

ALL COUNTY WELFARE DIRECTORS. Through the Interstate Compact on the Placement of Children. A statewide electronic ICT eICT process must be followed by ALL counties in California to ensure that there is no interruption or overlapping of Medi-Cal benefits when a client moves from one county to another.

Medi-Cal Eligibility and Covered California - Frequently Asked Questions. You must give income and tax filing status information for everyone who is in your family and is on your tax return. It will also have your name on it.

You also may need to give information about your property. So then when youre moving out of state and youre covered by a Medicare Advantage Plan you have two options and 60 days to. If your insurer offers Marketplace plans in the state he is moving to he may simply be able to transition to another plan from that insurer.

Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients. In many cases you can stay with your current Medicare Supplement Medigap plan even if youre moving out of state as long as you stay enrolled in Original Medicare. This way you can enroll in a new plan and avoid paying for coverage you wont be able to use in your new state.

Find out how to transfer medical records to another state or city in a smooth and easy manner. Do not use red ink highlighter or correction fluid on your claim. You may begin using your BIC as.

Youll need a new health plan. You do not have to file taxes to qualify for Medi-Cal. To make sure you stay covered report your move to the Marketplace as soon as possible.

If you have Medigap and plan to move out of state you can keep your policy no matter where you live as long as you remain on original Medicare and dont switch to a Medicare. To qualify for Medi-Cal you must live in the state of California and meet certain rules. If there is Other Health Coverage OHC include OHC payment or denial information relating to the date of service.

There is a 60 day special enrollmentwindow that is triggered by moving out-of-state.