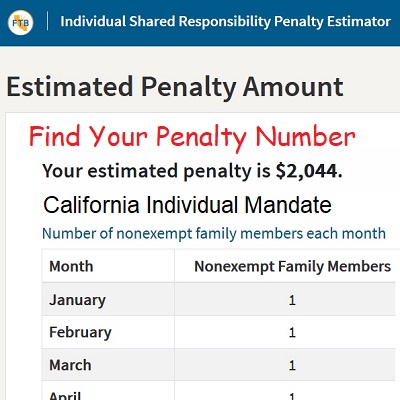

Since the percentage of household income was higher than the flat amount the penalty amount for this family is 252288. California residents with qualifying health insurance and new penalty estimator.

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

If you arent covered and owe a penalty for 2020 it will be due when you file your tax return in 2021.

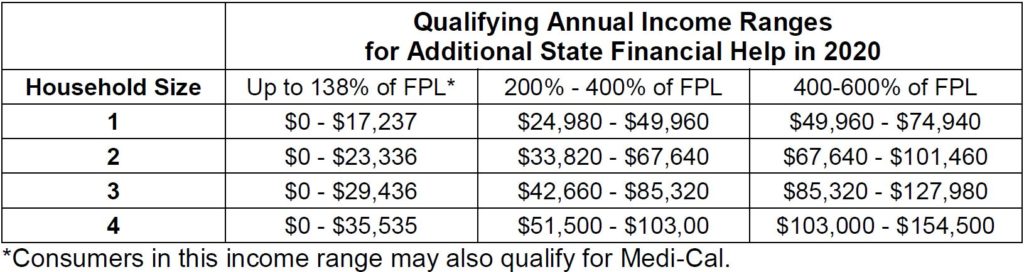

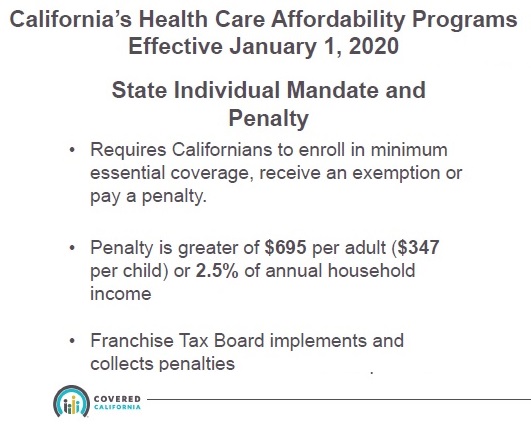

Ca state health insurance penalty. The Franchise Tax Board FTB urges Californians to get health care coverage now and keep it through 2020 to avoid a penalty when filing state income tax returns in 2021. For the 2019 taxable year the applicable dollar amount for adults was 695. Beginning January 1 2020 California residents must either.

Most exemptions may be claimed on your state income tax return while filing. Have qualifying health insurance coverage. The penalty for a dependent child is half that of an adult.

If an applicable individual isnt 18 years old as of the beginning of the month that persons penalty that month shall be equal to one-half of the applicable dollar amount 34750 for 2019. If you arent covered and owe a penalty for 2020 it will be due when you file your tax return in 2021. Get an exemption from the requirement to have coverage.

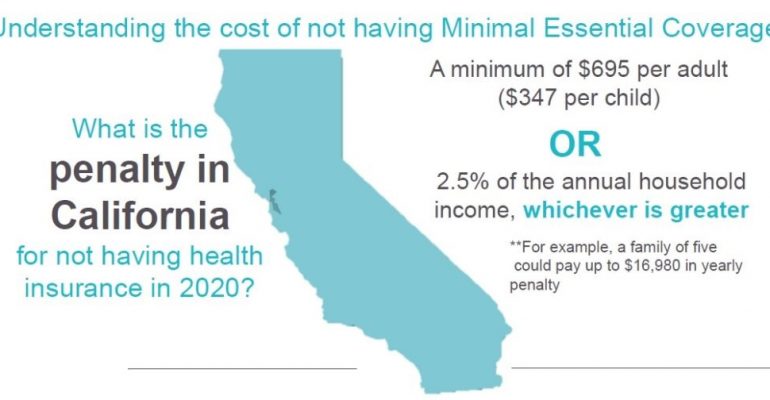

Have qualifying health insurance coverage Obtain an exemption from the requirement to have coverage Pay a penalty when they file their state tax return You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021. Beginning in 2020 California residents must either. Under the new California state law the failure to obtain minimal coverage before January 1 2020 will result in penalties of.

California utilizes two different ways to assess insurance penalties. 695 per each adult in a household as well as 34750 per each child. Beginning January 1 2020 all California residents must either.

Starting in 2020 California residents must have qualifying health insurance coverage or face a penalty when you file your state tax returns. The penalty will amount to 695 for an. Effective January 1 2020 a new state law requires California residents to maintain qualifying health insurance throughout the year.

Have qualifying health insurance coverage orPay a penalty when filing a state tax return orGet an exemption from the requirement to have coverageAbout the Penalty Generally speaking the penalty will be 695 or more when you file your 2020 state income tax return in 2021. Obtain an exemption from the requirement to have coverage. Some people with higher incomes instead will have to pay 25 of their income which could make their penalty quite a bit heftier.

Does California have a health insurance penalty. Unless they qualify for an exemption those who go without coverage could face a penalty of 695 or more for an individual adult. This requirement applies to each resident their spouse or domestic partner and their dependents.

A taxpayer who fails to get health insurance that meets the states minimum requirements will be subject to a penalty of 695 per adult and 34750 per child under 18 or 25 of annual household income whichever is higher when they file their 2020 state income tax return in 2021. According to the California Franchise Tax Board FTB the penalty for not having health insurance is the greater of either 25 of the household annual income or a flat dollar amount of 750 per adult and 375 per child these number will rise every year with inflation in. What is the Penalty for Not Having Health Insurance.

What is the penalty for not having health insurance. You are leaving ftbcagov We do not control the destination site and cannot accept any responsibility for its contents links or offers. Pay a penalty when they file their state tax return.

You may qualify for an exemption to the penalty. Starting in 2020 California residents must either. The individual health care mandate patterned after the ACA requires Californians to maintain qualifying health insurance coverage.

The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in 2021. Covered California the states Affordable Care Act insurance exchange will allow residents to enroll in a healthcare plan through March 31 to avoid paying the individual mandate which can be. The penalty will amount to 695 for an adult and half that much for dependent children.

You may either be charged a flat amount of 695 for each adult or 34750 for each child without insurance or you may be charged 25 of your gross income that is in excess of the filing threshold in the state. 49085 is the state filing threshold for a married couple both under 65 years old with one dependent for the 2019 tax year.

California Enacts Individual Mandate For 2020 Core Benefits Insurance Services

California Enacts Individual Mandate For 2020 Core Benefits Insurance Services

2017 Health Insurance Penalty Health For California

2017 Health Insurance Penalty Health For California

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Covered California Announces New Law Requiring Health Insurance Susan Polk Insurance Agency Inc San Luis Obispo California

Covered California Announces New Law Requiring Health Insurance Susan Polk Insurance Agency Inc San Luis Obispo California

California Reintroduced Health Insurance Mandate Enforced By New Tax Penalty Solid Health Insurance

California Reintroduced Health Insurance Mandate Enforced By New Tax Penalty Solid Health Insurance

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

The 2020 Changes To California Health Insurance Ehealth

The 2020 Changes To California Health Insurance Ehealth

California Individual Mandate Penalty Cheap Compared To Cost Of Health Insurance

California Individual Mandate Penalty Cheap Compared To Cost Of Health Insurance

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

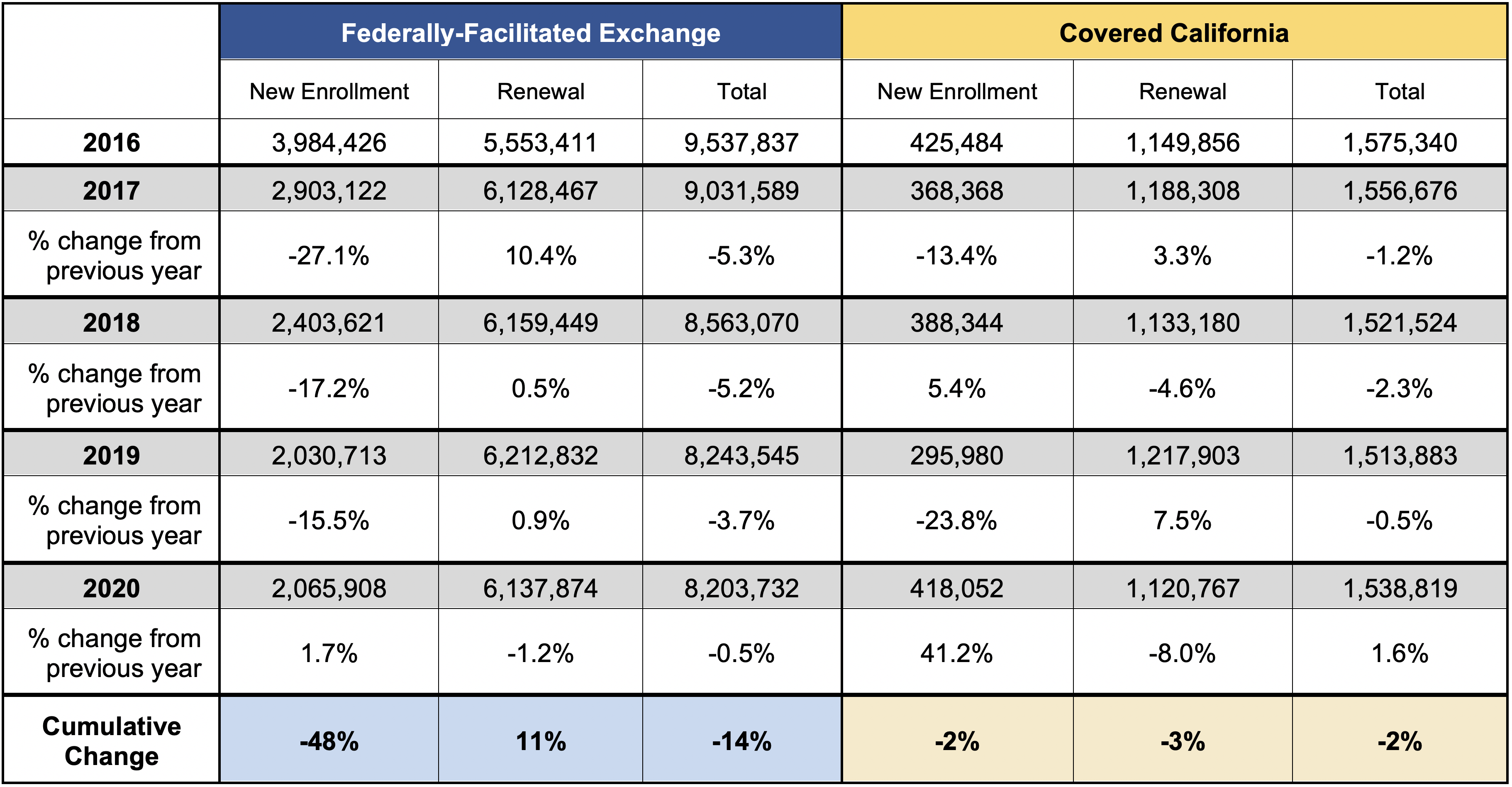

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

Mandate Health Insurance Tax Penalty California Mec Qhp 5000 A

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

California Franchise Tax Board Individual Mandate Penalty Flyer

California Franchise Tax Board Individual Mandate Penalty Flyer

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.