Count on our dedicated small business focus to get the protection you need. And how can you go about getting it.

Buying Group Life Insurance For Small Businesses Employee Services Division Of Globe Life

Buying Group Life Insurance For Small Businesses Employee Services Division Of Globe Life

All in one offering specially designed with your small business in mind.

Group life insurance for small business. Most Group Life Insurance policies require at least 2 people to form a group. Choosing small group health insurance for your employees is not an easy decision for any small business owner. If your group has less than 10.

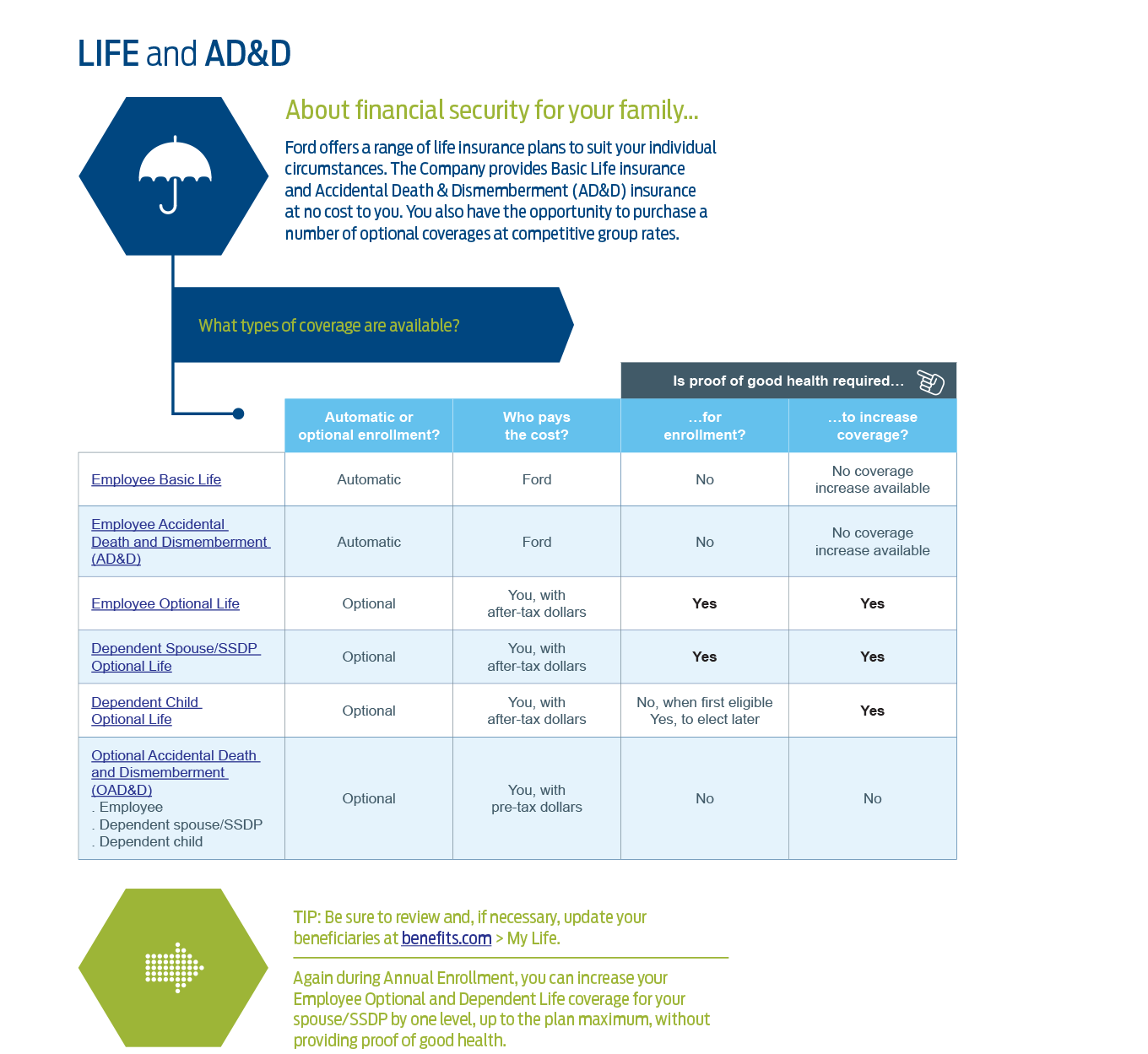

Your companys group life policy will be priced based on your company size the average age of your employees males vs. How does Group Life Insurance work. The insureds must be employees or corporate officers under a group policy.

Only the first 50000 of premiums paid are deductible. Call 1-888-674-0385 to get started. Anthem Blue Cross and Blue Shield understands you need a plan as unique as your business and your employees.

Group Life Insurance is usually term life insurance that is renewed annually by your company. That means you can offer your employees valuable options paired with MetLifes service and provider networks at competitive group rates. It is a single contract or policy that covers an entire group of employees and is often provided in addition to other group benefits such as group health insurance dental insurance and disability insurance.

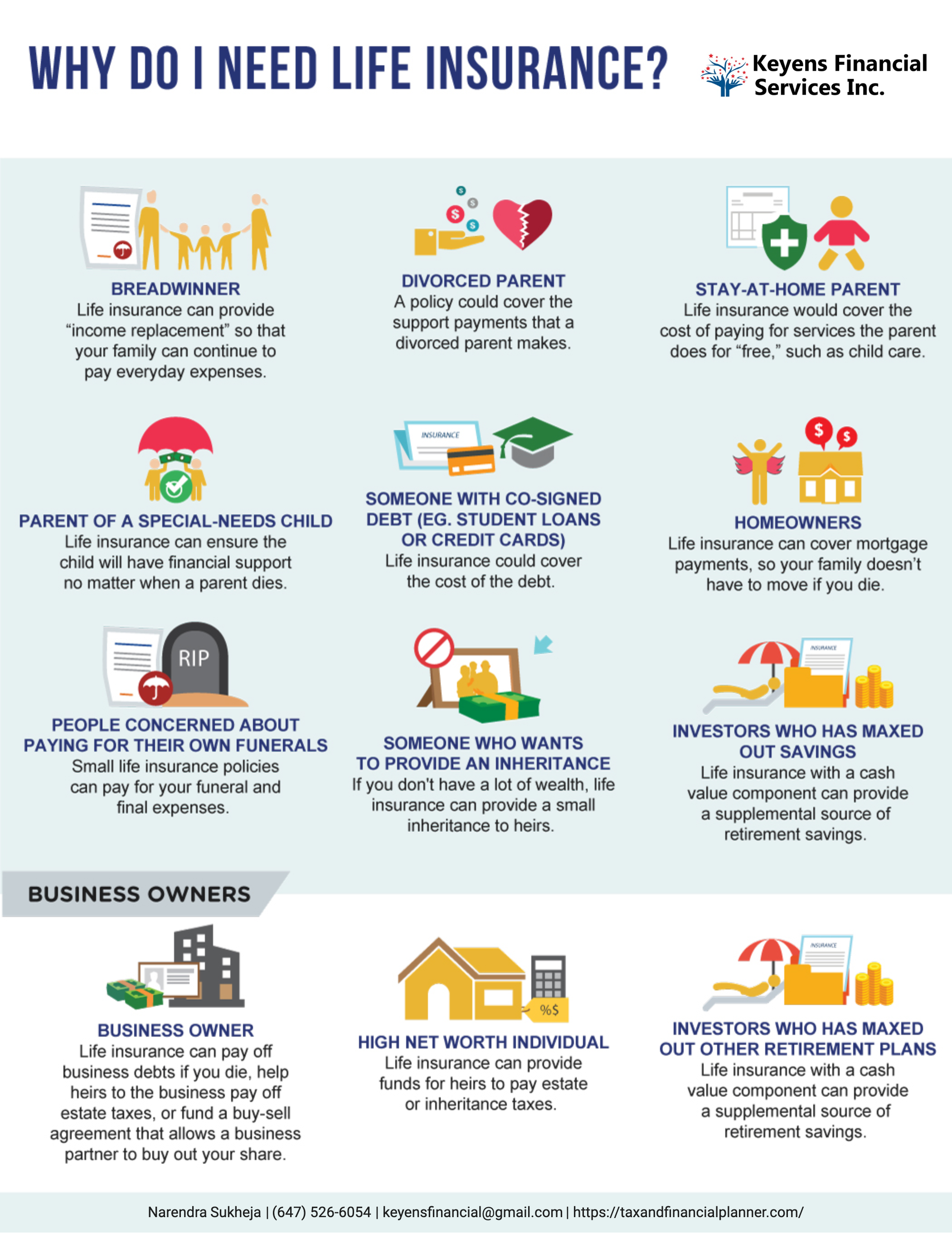

Unfortunately life insurance is a type of coverage that small business owners may overlook or dont think they need. Group term life insurance is a benefit offered by employers to help employees have easy access to life insurance coverage. Our small business health plans offer whole person care with coverage options for medical dental vision life.

Fringe benefits involving life insurance such as Split Dollar Executive Bonus and Non-Qualified Deferred Compensation allow you as a small business. Group Life Insurance Life Benefits for Your Business State Farm has Group Life insurance that offers benefits for both you and your employees. The main advantage of group life insurance for small businesses is that the group members can get coverage at a lower rate than if they bought an individual policy.

Group life insurance can be part of an employee benefit plan that is paid for by the employer or a voluntary offering whereby the employee pays for the coverage. Thats why weve built plans with the total person in mind. One such benefit includes life insurance.

Female ratio and your industry. Protect the health financial well-being of your employees and yourself with group insurance plans from Nationwide Employee Benefits. Small business life insurance can help ensure the continuation of your business when you are gone and help make this time of transition run more smoothly.

State Farm offers group life insurance to enhance the benefits offered to employees. So why is small group life insurance important for your small business. While some companies offer 401 ks and dental life insurance is becoming increasingly important to employees with families or other loved ones they want to protect against the unexpected.

You can get the benefits typical for larger groups like surplus sharing fewer taxes and fees and high-cost claims protection. The company CANNOT be named as the beneficiary of the group life insurance policy. Youve worked hard to grow your business and to provide for the people you love so dont risk it all by not having the right life insurance in place.

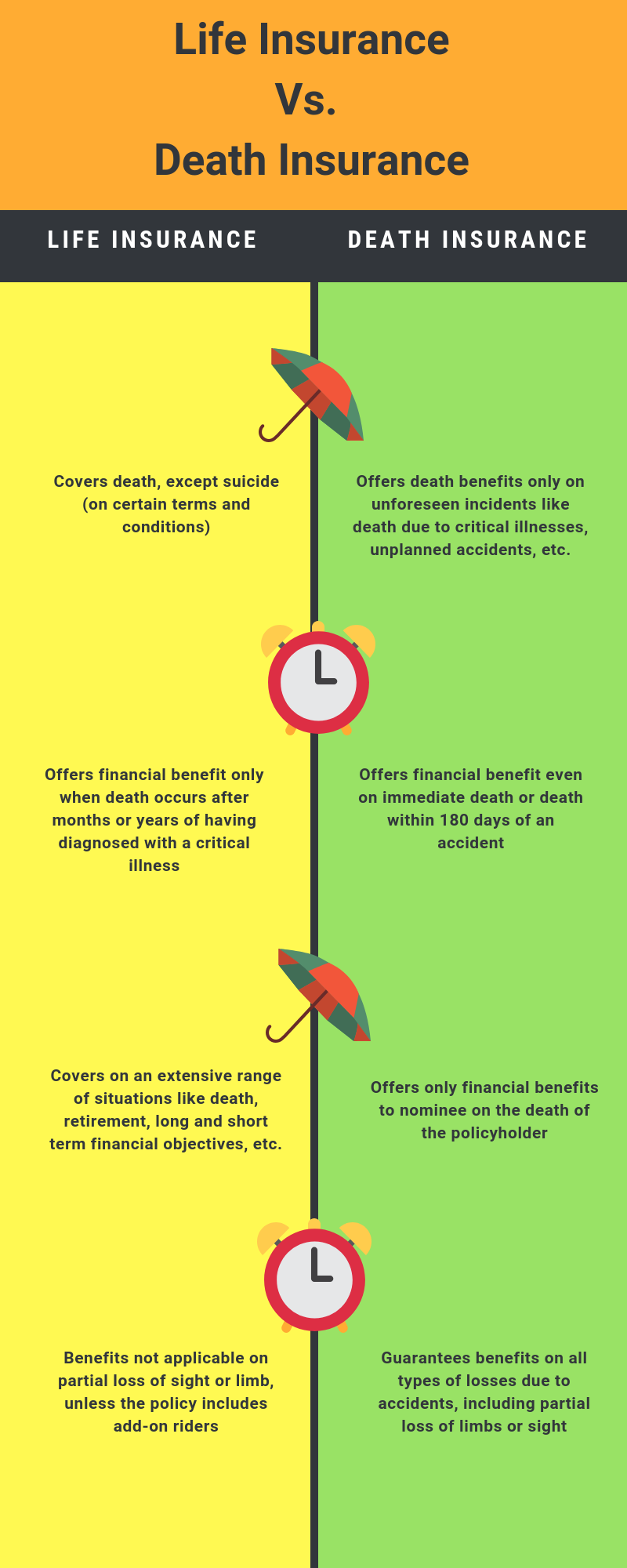

Group coverage is almost always term insurance as opposed to whole life insurance. As a small business owner you are aware of the importance of employee benefits and their contribution to your business success. It can also play a critical role in your compensation plan helping you recruit retain and reward your employees.

Anything after that is no longer deductible. Small Business Health Plans. Life Insurance for Small Business Life insurance can do more than help your business recover from the death of a key employee.

Whole life insurance has a higher premium but builds cash value. Self-insured funding built for small businesses Control rising health care costs with Aetna Funding Advantage SM health plans. Group life insurance costs.

As an employer you are aware of the importance of employee benefits and their contribution to your business success. Plus MetLife offers coverage for your business itself including business owner policies and commercial auto insurance. A manufacturer will pay more than say a white-collar company.

Some small business owners offer group life insurance to employees. Larger companies that already have policies in place will also pay based on past claims. As small business owners themselves Farmers agents understand that you have needs.

Find life insurance dental vision disability and more non-medical benefits for your small business.