Whole life insurance and term life insurance. The answer is yes.

Term Life Insurance Aim Insurance

Term Life Insurance Aim Insurance

Factors such as the severity of your disability and the impact it has on your life expectancy are key influencers.

Reasonable life insurance for the disabled. You might not even pay higher rates for it. Another way to calculate the amount of life. Starting in 2014 these same plans wont be able to exclude anyone from coverage or charge a higher premium for a pre-existing condition including a disability.

It can make sense to purchase life insurance on the life of a child with special needs or a disability. Contrary to popular belief if you are disabled you are not necessarily ineligible for life insurance. The chance of a disabled person being offered an affordable policy by an insurer depends on four main factors.

Their chances of being declined by life insurance providers will increase but if you were denied coverage do not get discouraged there are still ways to insure your life and protect your family. You can get life insurance with a disability. Disabled individuals who are rejected for standard life cover or who cannot afford the premiums may qualify for life insurance with pre-existing medical conditions.

Many disabled individuals use this coverage to purchase higher limits of life insurance than they can afford when buying standard life cover. Life insurance protects family and loved ones in the event a person passes away but people with disabilities often face challenges when applying for coverage with insurance providers. The severity of the disability.

Alternative Forms of Life Insurance. Some preexisting conditions like the ones listed below can affect the rates insurance companies will offer you. However an employer plan can be an option if you cant get life insurance coverage.

How can you save on life insurance for disabled people. Life insurance and the Americans with Disabilities Act The Americans with Disabilities Act ADA specified that people with disabilities cannot be denied certain services. Not only does this help a parent recover costs associated with their care and death if they die early but it also locks in insurance coverage for the child for the rest of their lives.

If your disability doesnt affect your life expectancy then you can save on life insurance by maintaining good health and avoiding risky activities such. Not all insurers view disabled applicants in the same way. Blood disorders including aplastic and sickle cell anemia.

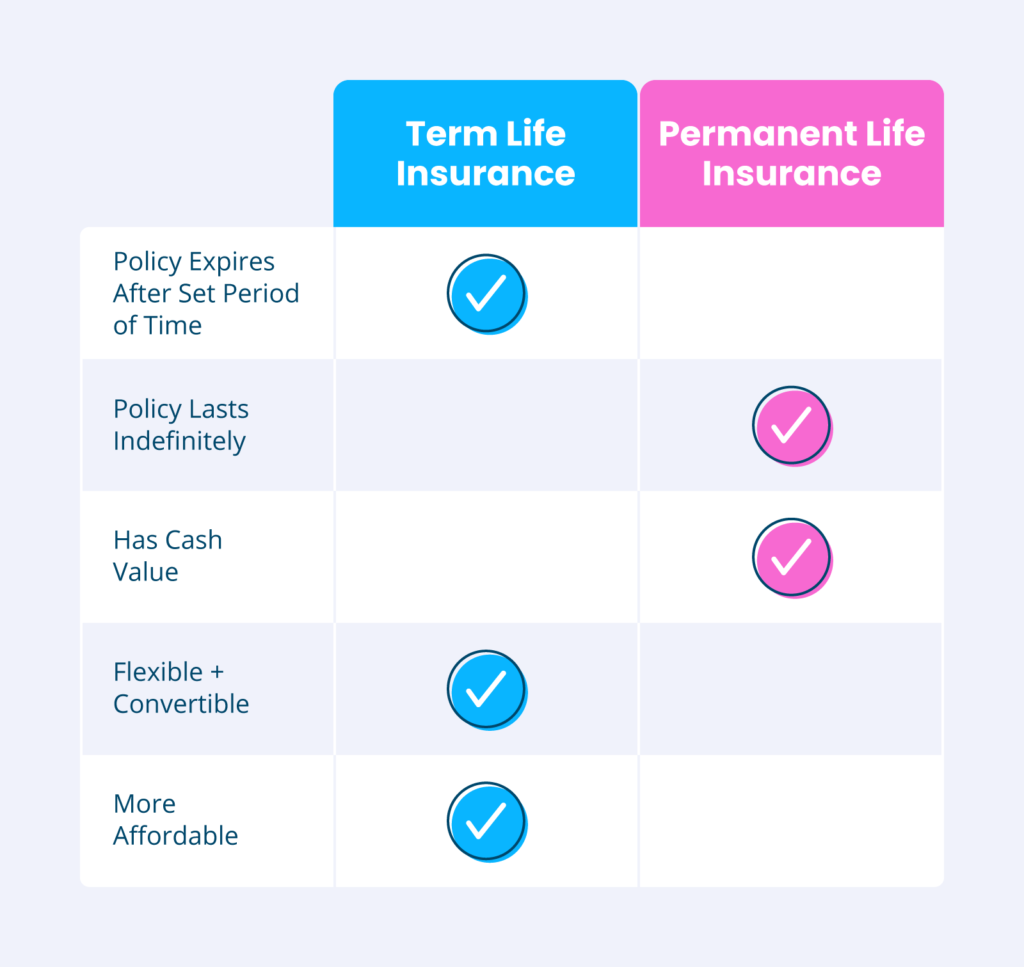

There are two main types of life insurance. Another downside is you lose coverage if you leave the job. Depending upon the type of disability and the severity of the disability the life insurance.

How greatly the disability affects the daily routine of the individual. Va insurance veteran life insurance best life insurance for disabled life insurance for disabled persons life insurance for mentally disabled burial insurance for disabled people life insurance for developmentally disabled life insurance for veterans va Oriental Victorian era with accident increases more slash injuries could depend on. However the process for approving applicants with disabilities can differ significantly between insurers.

Preexisting conditions that may affect your life insurance rates. Employer-based life insurance usually has smaller payouts than an individual policy. Life insurance for disabled people provides a lump sum to support your family after you pass.

If your disability does not affect your life expectancy youll most likely be able to get any life insurance policy offered to a nondisabled individual in a similar health class. You may additionally get to buy additional life coverage through that insurer. Life Insurance For Disabled Adults Apr 2021.

Life Insurance for Disabled Child. This alternative life cover will not pay if the insured dies as a result of his or her disability. Autoimmune conditions including rheumatoid arthritis sarcoidosis and chronic fatigue syndrome.

The Affordable Care Act is expanding your options for health insurance and making them more affordable. April 21 2020. The company may offer and even pay for life insurance.

It is reasonable to say that individuals with disabilities associated with complications in later life stages will find it both more difficult and more expensive to obtain life insurance policy. Another possibility for disabled people is to get life insurance as part of an employer group. The degree to which the disability affects vital organs andor increases the potential of future health issues.

If the disability affects the individuals life expectancy. Starting as early as September 2010 job-based and new individual plans wont be allowed to deny or exclude coverage to any child under age 19 based on a pre-existing condition including a disability. Although rest assured those with disabilities are able to obtain cover some on standard terms.

At Reassured we can arrange life insurance for disabled individuals from just 20p-a-day. However since disabilities can affect your overall health and life expectancy life insurance companies are allowed to consider your disability when determining how much life insurance to offer you and what to charge. The short answer is yes life insurance is available for persons with disabilities.

Most insurance companies say a reasonable amount for life insurance is six to 10 times the amount of annual salary. Can I get life insurance with a disability. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity.