It used to be easier to assess the value of Medicare Advantage. Im not saying its easy to get those butts when youre not in network.

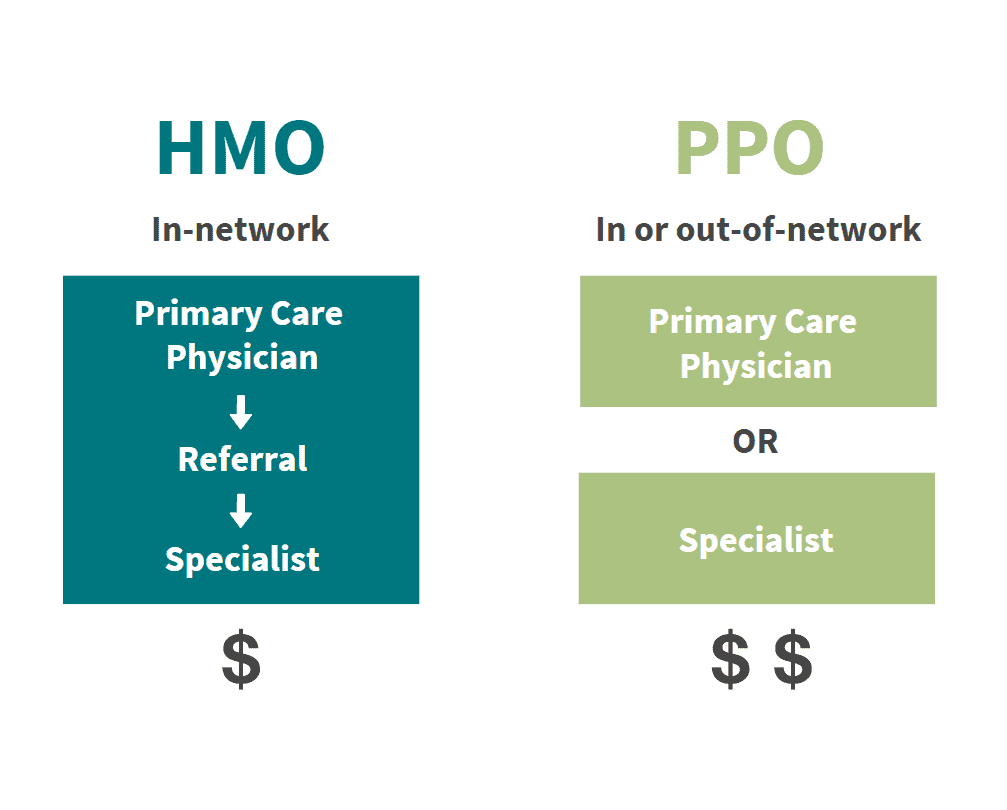

What S The Difference Between An Hmo And A Ppo Aspen Wealth Management

What S The Difference Between An Hmo And A Ppo Aspen Wealth Management

You need cash to pay down debt fund retirement plans build.

Why is ppo more expensive. HMOs have lower to no premium lower co pays and lower out of pocket maximums. This money saving perk is why many patients choose EPO insurance over other options like PPO. Therefore the absolute only reason youre in-network with the PPOs is to get butts in the chair.

In the early 2000s Medicare Advantage plans also cost taxpayers more than traditional Medicare. In exchange for the lower cost your employees will have less flexibility with getting care. In addition PPOs are generally more expensive for a plan with comparable cost-sharing because they give you more freedom of choice in.

PPO health plans are typically more expensive than HMO plans. But there are key differences that people ignore as they rush to purchase a HMO on price alone. Like HMOs PPOs cost incentivize their members for using its in-network services including physicians laboratories x-ray facilities or hospitals.

BUT they have no out of network benefits. They are cheaper and sometimes much less expensive than PPO plans. A PPO plan cost 19003 more than 1000 higher per year.

Heres Why and What to Know. The organization will typically pay a range of 70 to 80 percent of accrued expenses with the patient paying the remaining balance out-of-pocket. A PPO health insurance plan provides more choices when it comes to your healthcare but there will also be higher out-of-pocket costs associated with these plans.

And yep thats marketing. Count on a copay with an HMO. Depending upon the PPOs terms of coverage a doctor or hospital outside the preferred provider list will cost more than those in the network.

Of course the suites at ASMu are larger. With their expanded networks and access to and partial coverage for out-of-network care PPOs are the more expensive option. However unlike HMOs PPOs provide partial coverage for out-of-network care and.

PPOs are usually more expensive because they are more flexible in allowing you to seek treatment outside of their network of preferred providers. Plus there is also an annual deductible that must be met. With a PPO the deductible like the monthly premium is typically higher than an HMO.

The standard room size at all 3 All Star resorts and Pop Century is exactly the same. The rack rate at all 3 All Star resorts is exactly the same. As EPO plans limit a patients access to a targeted group of providers within a network patients are better equipped to negotiate more favorable reimbursement rates with those healthcare providers resulting in lower monthly premium payments.

The medical providers who join the HMO network agree to discount their services so they gain more patients. Most of the rooms at Movies are Preferred but theyre the same price as Sports and Music. However due to the pooling of people in a PPO network fees associated with health care will be lower for participants.

PPO plans generally are more expensive than HMO plans. PPOs less common more expensive According to new research from the Kaiser Family Foundation the cost of PPO health plans are less and less common and more and more expensive than in the past. Both types of plans are good.

Kimberly-Clark the maker of Scott Cottonelle and Viva will begin to increase prices on some of its products. Well youre paying for access to a greater network of providers and more flexibility with who you can see and where you can see them. Some Toilet Paper Is About to Get More Expensive.

Thats why its more expensive. In other words you will pay far less for services if you are in. Your employees will also have lower out-of-pocket costs for using medical care with an HMO.

Your monthly premiums will be higher and your copays for office visits will also cost more. PPOs typically have a higher deductible but theres a reason why. Movies is not more expensive.

Im just saying its extremely expensive and can dramatically slow down your path toward financial independence. The cost of a PPO plan will also increase the more often you take advantage of that freedom as you are expected to cover a higher proportion of the costs incurred in seeing healthcare providers from outside the network.