Document showing you lost coverage due to death of a family member including. Loss of Coverage Letter Letter from your previous health carrier indicating an involuntary loss of coverage.

Proof Health Insurance Letter Template Employer Loss Coverage Renewal Hudsonradc

Proof Health Insurance Letter Template Employer Loss Coverage Renewal Hudsonradc

Proof of loss refers to the legal document a policyholder files to their insurance company to claim coverage for a loss.

Proof of loss health insurance. Proof of loss of health insurance form. A proof of loss is a formal document you must file with an insurance company that initiates the claim process after a property loss. Example of an acceptable document.

Health Plan Proof of Loss Form 1. Hier sollte eine Beschreibung angezeigt werden diese Seite lässt dies jedoch nicht zu. The insurer determines whether to approve the claim and thereby cover the loss or not.

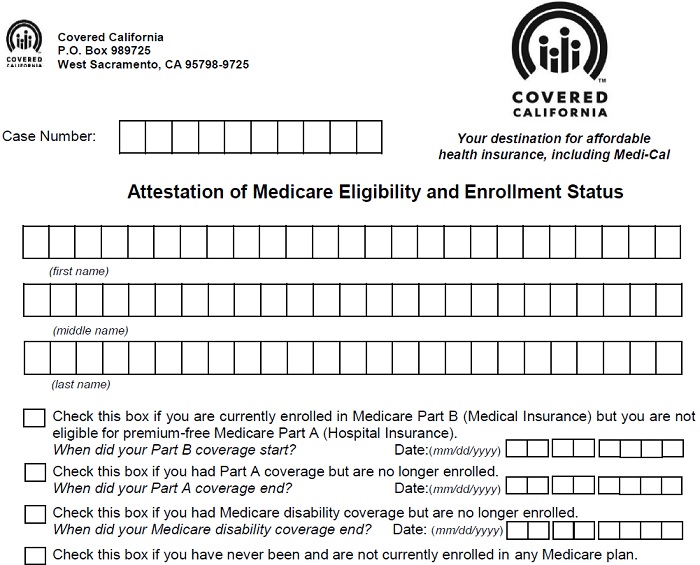

Please fully complete this side of form. The documents that support the amount of loss claimed. Loss of eligibility for Medicare.

Proof of Insurance Letter - Health Keywords. INSTRUCTIONS FOR FILING CLAIM 1. Document showing you lost coverage due to death of a family member including.

Your insurance company will either accept or reject your claim for items you have noted on the form. A death certificate or public notice of death and proof that you were getting health coverage because of your relationship to the deceased person like a letter from an insurance company or employer that shows the names of the people on the health plan. The policy will determine what must be in a proof of loss and most often includes.

Proof of Insurance Letter - Health Author. Well this is a document that lists out all of the important information regarding your property damage claim. The parties claiming the loss under the policy.

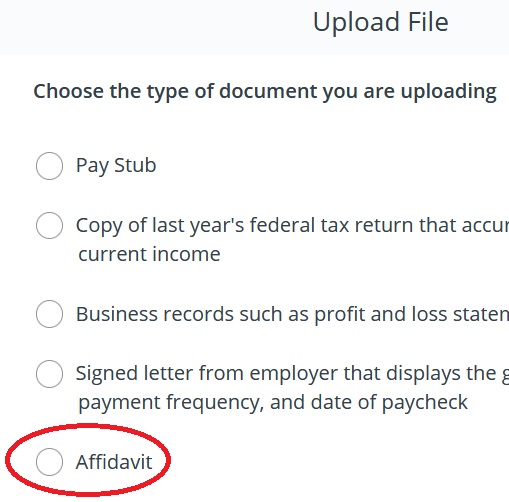

You will need to provide a Loss of Coverage Letter or if you lost an employer-sponsored plan a letter from your previous employer. A death certificate or public notice of death and proof that you were getting health coverage because of your relationship to the deceased person like a letter from an insurance company or employer that shows the names of the people on the health planOther confirmation that shows you lost or will lose coverage because of. You may qualify if you turn 26 and can no longer be on a parents plan or lose health coverage through a spouse due to a divorce legal separation or through the death of a family member.

It provides the insurer with specific information about an incident its cause resulting damage and financial impact. When you or a member of your household loses health insurance a special enrollment period that extends 60 days from the loss of the job and health insurance will. First and foremost what is a proof of loss at all.

Accordingly the claimant policyholder will either receive or be denied any amount for the loss. The Certificate of Creditable Coverage COCC below is a good example of a loss of coverage document because it has the official insurance carrier logo at the top of the page and includes the name of the member to whom it applies as well as the coverage effective date and cancellation date. You may qualify if you become ineligible for premium-free Medicare Part A.

The supporting document must indicate your name the names of any dependents that were covered under the prior plan and the date the previous health. This document helps justify the value of a claimants loss to the insurance. Proof of loss is an insurance form filled out by a policyholder for an insurance claim when property damage occurs.

Its there because you need to provide some elementary details on the accident thats happened in order for. Proof of loss Original documentation needed to support your claim. Document showing you lost coverage due to death of a family member including.

The amount of loss claimed. Once submitted this document is reviewed. Amount of loss that the policyholder is claiming documentation.

A death certificate or public notice of death and proof that you were getting health coverage because of your relationship to the deceased person like a letter from an insurance company or employer that shows the names of the people on the health plan. Voe Form With Verification Of Employment Loss Of Income Form In 2020 Substitute Teacher Business Cards Teacher Business Cards Form. Once you complete and submit the proof of loss form the following takes place.

Loss of coverage through a family members plan. Proof of Insurance Letter - Health Created Date. If you re losing health coverage.

Health plan proof of loss form 1. Please fully complete this side of form. When the review is complete your insurer will determine a total loss value for your claim and contact you.

Your documentation is thoroughly reviewed. Please fully complete this side of form. Specifically the purpose of a proof of loss is to provide the insurer with specific information pertaining to the formal claim of damages.

This includes the claim application form itemized hospital invoices and statements name of healthcare provider contact information date of service description of care and diagnosis and receipts.