For example the average 2021 monthly premium for an HMO is 427 5124 annually compared to a monthly average of 517 for a PPO 5628 annually. Well youre paying for access to a.

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

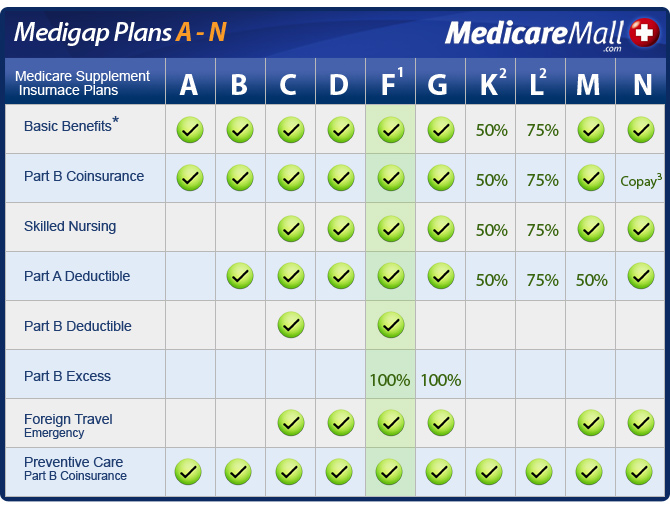

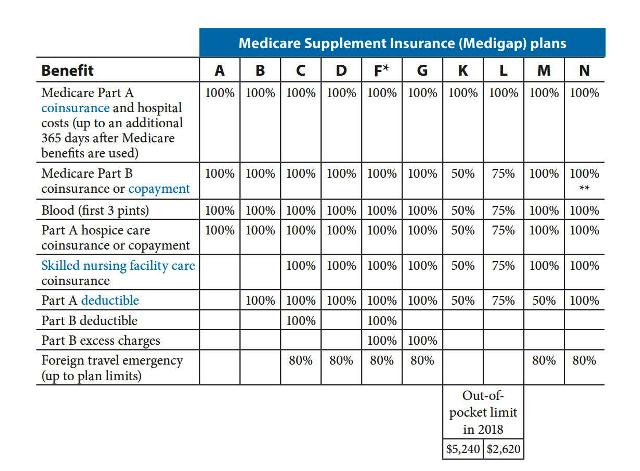

PPO and HMO comparison chart There are a lot of similarities between Medicare Advantage PPO and HMO plans such as the costs of premiums deductibles and other plan.

Compare hmo and ppo. What is a POS. The HealthHearty write-up below gives you a detailed HMO vs. Under HMO only doctors from the selected network can be chosen whereas the employee can choose services from within the preferred network in PPO or can also consult someone from outside and then file for reimbursement with PPO.

The table below compares these three types of Medicare plans. HMO plans are generally cheaper than PPO plans but the gap has narrowed in recent years. Another key selling point to an HMO is its low or no annual deductible.

Only for out-of-network claims. Do you know the distinct advantages of one versus the other. An HMO generally only covers care received from the plans contracted providers known as in-network providers.

7 Generally the out-of-pocket costs for an HMO may be lower than those of a PPO. Plan Comparison Plan Networks. HMO PPO EPO and POS are various health insurance plans sold by companies and which vary from each other in features like deductibles and payments.

PPOs typically allow you to see both in-network and out-of-network providers but you may pay more for out-of-network care. Networks are one way to lower. If required PCP does it for the patient.

You pick your winner. An In-depth Comparison of HMO PPO EPO and POS Health Insurance Plans. Most HMOs will require you to select a primary care physician who will be the primary point of.

Health Maintenance Organization and Preferred Provider Organization what s the difference. The best part of PPOs is that even out-of-state providers can be preferred. Typically lower in-network higher for out-of-network.

That means the amount you have to pay before coverage kicks in could be as little as zero bucks. This is because your insurance company pays the provider directly. This makes HMO plans a more economical choice than PPOs.

If you are interested in joining a PPO make sure to speak to a plan representative for more information. A defining feature of HMO and PPO plans is that they both have networks. Out-of-network care may have different rules.

PPOs typically have a higher deductible but theres a reason why. PPOs dont require you to choose a PCP though having one is always a good idea. An HMO offers no coverage outside of the network but patients typically enjoy lower premiums.

PPO networks are often much larger than HMO networks so it is more likely that a specialist provider a patient wants to see will be part of a PPO network. Though more people choose PPO plans HMO plans are rated more favorably by subscribers. Many HMO providers are paid on a per-member basis regardless of the number of times they see a member.

The hitch is that youll likely pay higher monthly premiums for a PPO rather than an HMO. Blue Cross offers associates a Health Maintenance Organization HMO medical plan option and High Deductible Health Plan HDHP Preferred Provider Organization PPO medical plan option. In some cases with a PPO you will have to pay a doctor for services directly and then file a claim to get reimbursed.

Preferred Provider Organization PPO While both Medicare HMO and PPO typically have more similarities than differences the main contrast comes down to premiums or higher costs in When choosing a Medicare plan that is best for you or your loved ones you may want to consult a plan representative to better understand the advantages of each plan. Its up to you to decide each year which type of plan works best for you. Last but not least in the HMO vs PPO vs POS breakdown is POS otherwise known as a point of service healthcare plan.

If required PCP likely does it. Difference between HMO and PPO. With a PPO the deductible like the monthly premium is typically higher than an HMO.

And both can be winners at meeting your healthcare needs. There are several differences in costs and coverage among Original Medicare Preferred Provider Organizations PPOs and Health Maintenance Organizations HMOs. Referrals arent needed to see a specialist.

Yes but requires PCP referral. PPO plans are typically more flexible and may cost a bit more than HMOs. Since HMOs only allow you to see in-network providers its likely youll never have to file a claim.