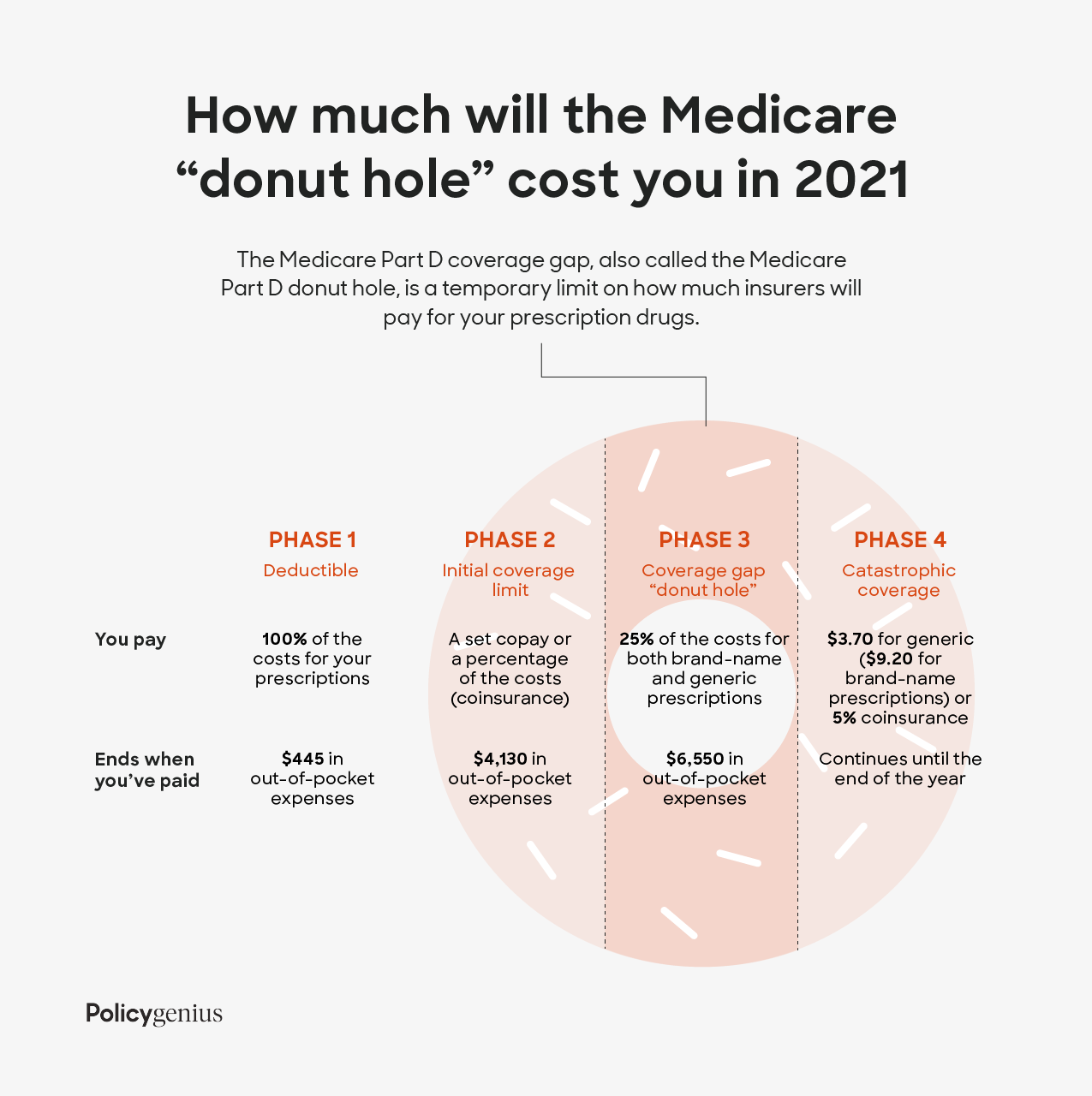

However the Center for Medicare and Medicaid Services CMS sets minimum coverage guidelines for all Part D plans. Overview of what Medicare drug plans cover.

Medicare Part D Senior Plan Advisors

Medicare Part D Senior Plan Advisors

Enrollment in SilverScript depends on contract renewal.

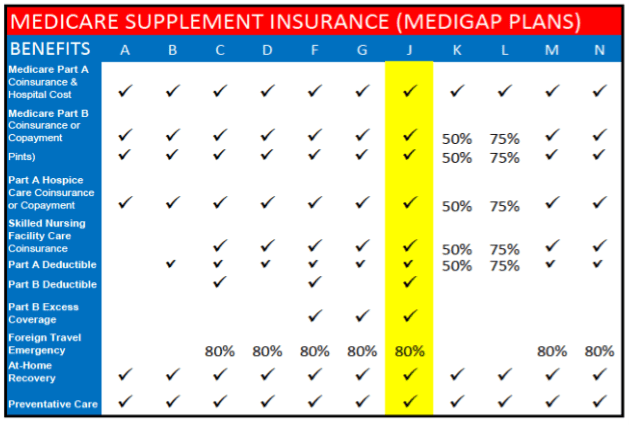

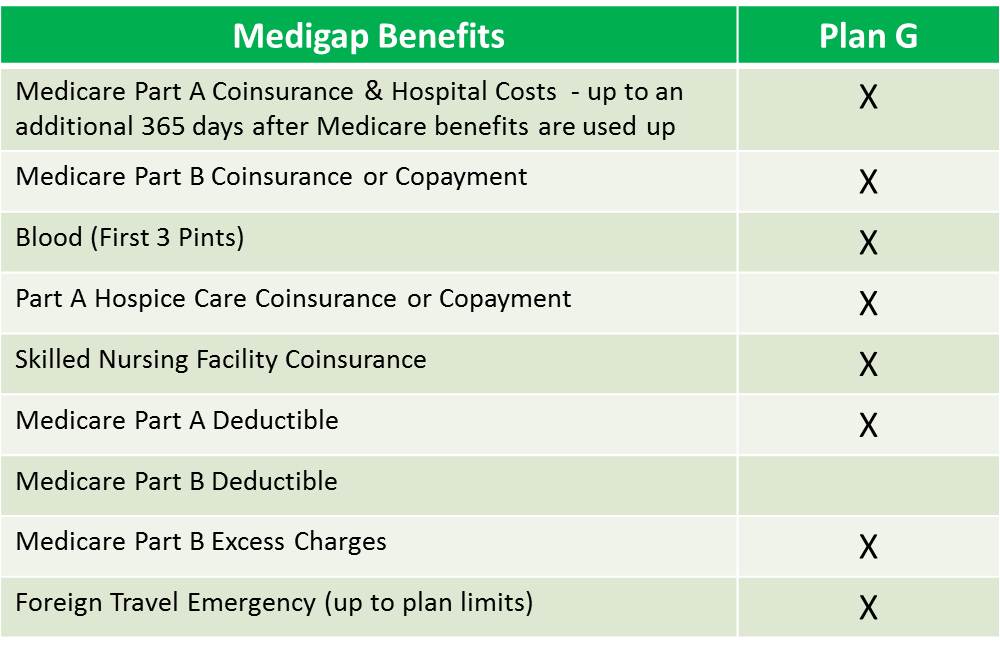

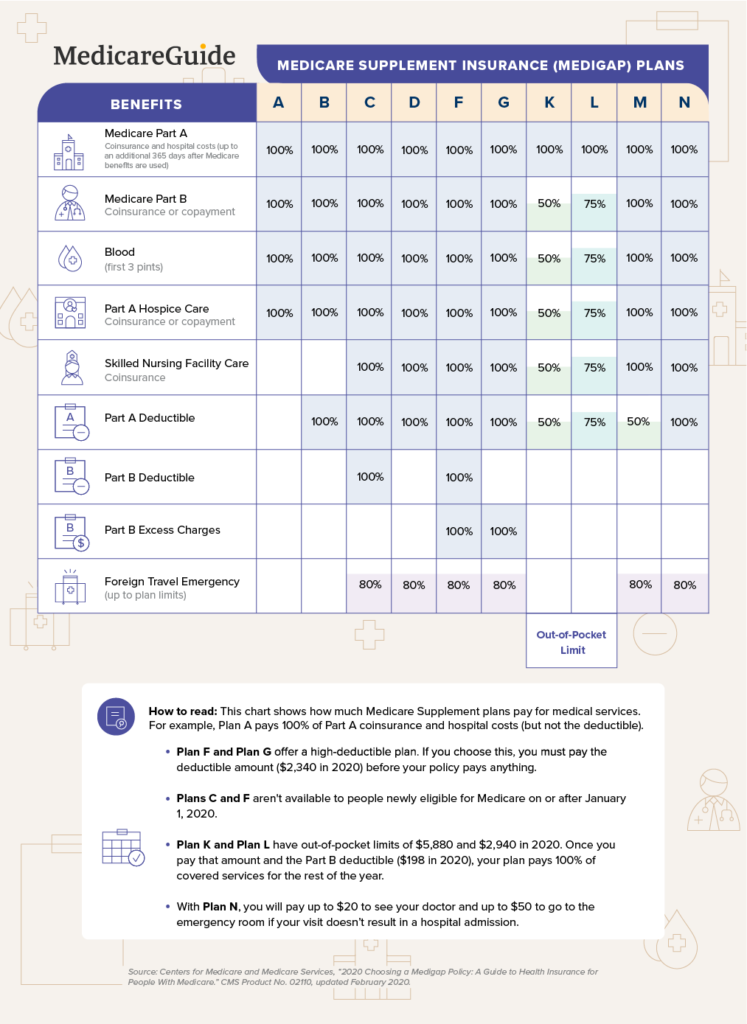

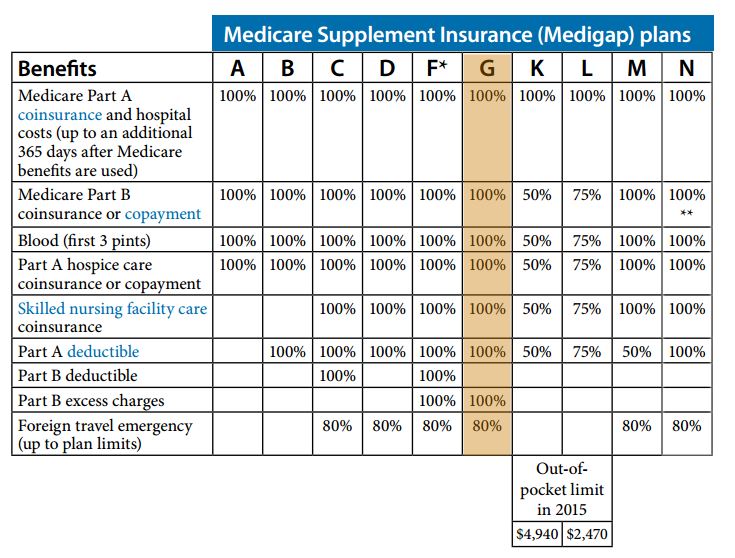

Medicare part d supplement plans. Dental exams and cleanings at no additional cost. Every Medicare Prescription Drug Plan has its own formulary or list of covered drugs. Part A hospital coinsurance and hospital costs up to an extra 365 days after Original Medicare benefits are exhausted.

So if you dont have regular prescriptions or your prescriptions are few and common your cost will be minimal. Medicare Part D wont cover anything that is used for cosmetic reasons such as weight loss drugs. This additional coverage gives you.

This is the best Medicare Part D plan option for seniors as it mixes low co-pays with competitive premiums and has a network of preferred providers. Some Medicare Prescription Drug Plans offered under Medicare Part D by private Medicare-approved insurance companies might cover certain vitamins and supplements. Plan D does not cover Medicare Part B deductible payments or Part B excess charges.

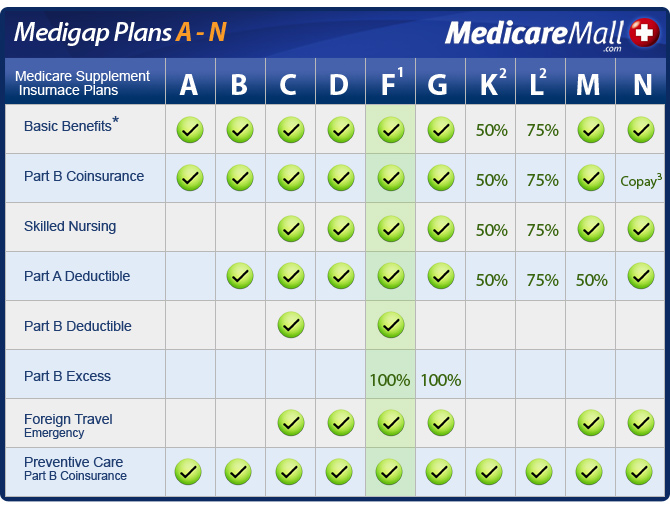

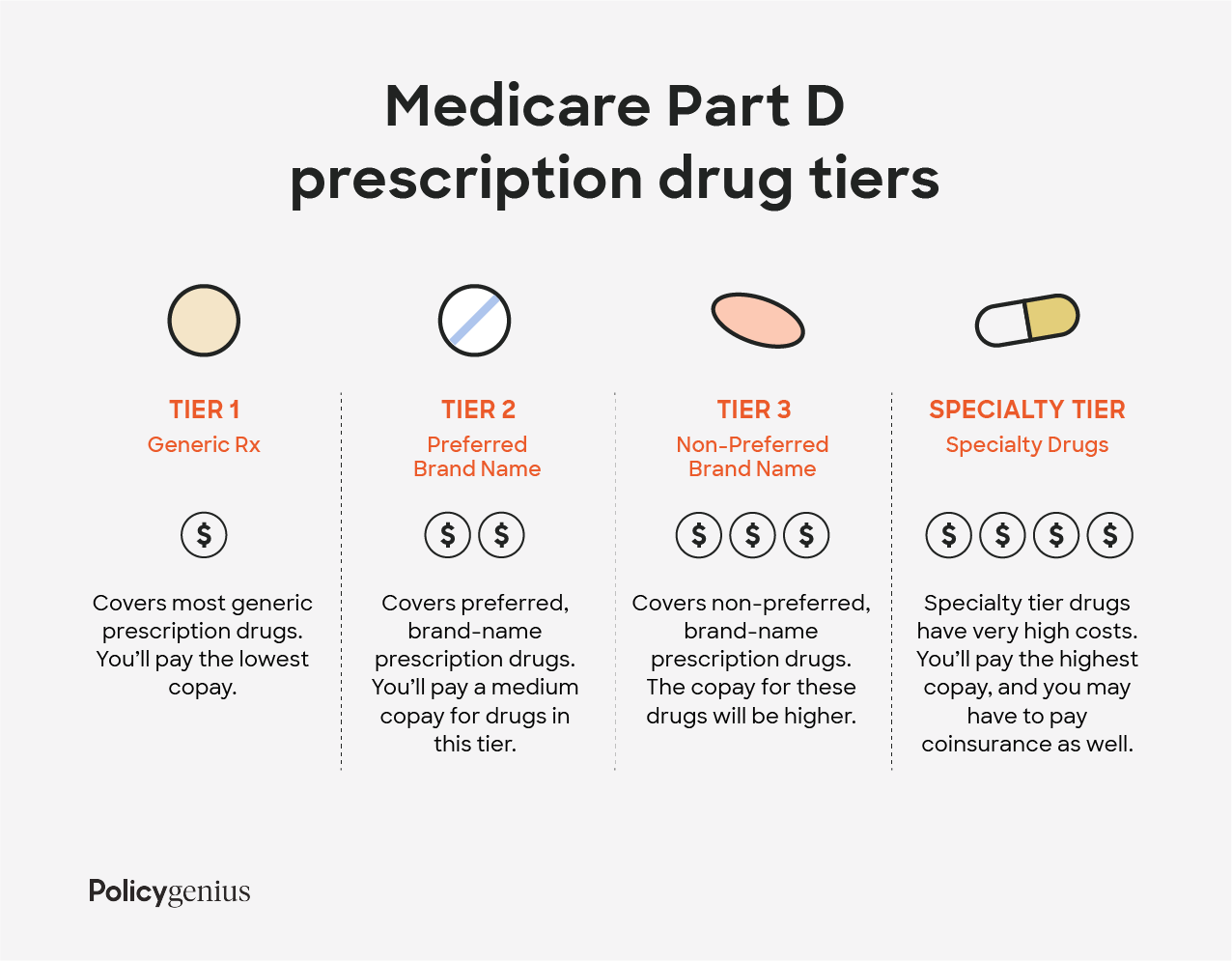

Learn about formularies tiers of coverage name brand and generic drug coverage. Costs for Medicare drug coverage. Medicare Part D is a collection of prescription drug plans while Medigap Plan D or Medicare Supplement Plan D is a plan that covers some of Medicares out-of-pocket expenses.

Medigap Plan D provides the following benefits. Starting Feb 1 2021 Blue Cross will offer this package to all Medicare Supplement members. Medicare Supplement Medigap Plan.

Medicare Part D is designed to be very affordable. Medigap Medicare drug coverage Part D You cant join a Medicare Prescription Drug Plan and have a Medigap policy with drug coverage If your Medigap policy covers prescription drugs youll need to tell your Medigap insurance company if you join a Medicare Prescription Drug Plan. Generally Medicare Part D doesnt cover vitamin supplements as mentioned above.

Learn about the types of costs youll pay in a Medicare drug plan. Get the right Medicare drug plan for you. A Medicare Prescription Drug Part D plan can help cover the costs of your medication.

Can have either Part A or Part B to enroll. All Medicare Part D plans have a monthly premium. If you do join a Part D plan you could use your individual insurance to supplement Medicare coverage if the terms of your policy allow this.

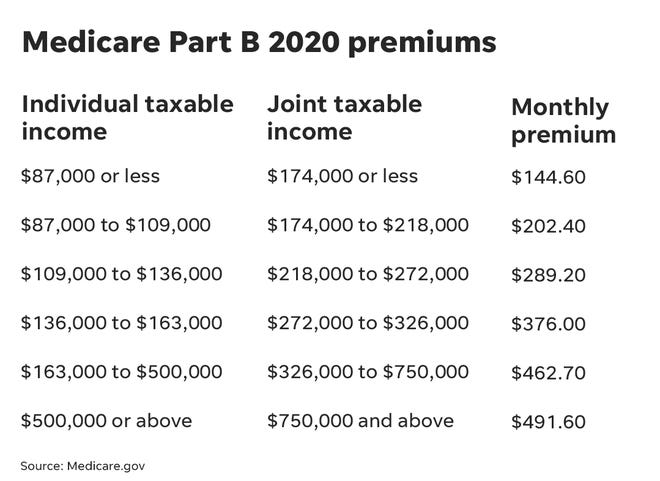

The national average is around 34 a month and that will vary of course based on which insurer you pick and where you live. AARP MedicareRx plans offered through UnitedHealthcare can help you save money on your prescription drugs and give you peace of mindeven if your health changes. Medicare Supplement Insurance Plan D Medicare Supplement Medigap insurance Plan D is one of the 10 standardized Medigap plans available in most states Wisconsin Minnesota and Massachusetts have their own standardized Medigap plans.

Every plan has to cover at least two drugs that are the most commonly prescribed. Medicare Part D Medicare prescription drug coverage helps cover some of the costs of prescription drugs for Medicare beneficiaries. Part D plans are optional and.

This plan also does not cover medications for fertility or erectile dysfunction. Coverage can begin as early as April 1 2021. Medicare Part D plans have a list of medications called a formulary detailing what medications they cover.

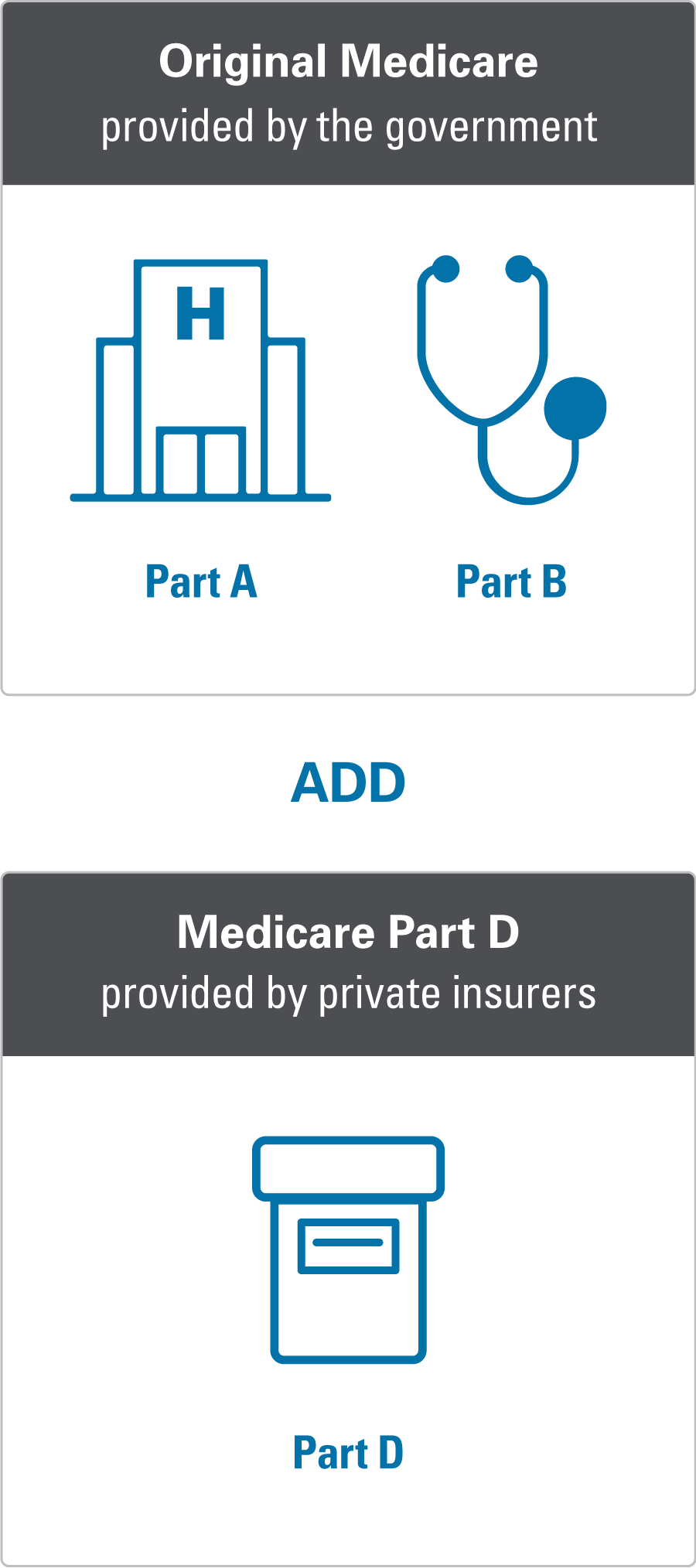

Medicare Supplement insurance is designed to work alongside your Original Medicare Part A and Part B. Original Medicare Parts A and B dont include prescription drug coverage. Some states are simply going to have a higher average price for these plans than other states will.

For a little more than 15 a month you can add dental vision and hearing coverage to your Medicare Supplement plan. Multivitamins cough medicines and benzodiazepines are also excluded from the Medicare Part D formulary. If you want to find Medicare prescription drug coverage you can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit.

However in most states plans start around 20. Medicare Part D plans are sometimes called Prescription Drug Plans PDP. Under Medicare Part D prescription drug plans are available from private Medicare-approved insurance companies so benefits and cost-sharing structures differ from plan to plan.

AARP Medicare Rx with services provided by United Healthcare is an excellent all-round provider of Medicare Part D plans and is the only range of plans backed by AARP. Learn about Medicare drug plans Part D Medicare Advantage Plans more. The average nationwide monthly premium for 2020 is around 3250.

What Medicare Part D drug plans cover. Medicare Supplement Plan D and Medicare Part D Differences Provides prescription drug coverage to Medicare beneficiaries A standalone Part D plan works with Original Medicare but prescription drug coverage can be included in a Medicare. But any payments made by your insurer for drugs in the coverage gap would not count toward your out.

SilverScript is a Prescription Drug Plan with a Medicare contract marketed through Aetna Medicare.