With High Deductible Plan F Medicare first pays its share. While monthly premiums for this option may be lower you must pay a deductible before Plan F begins paying for benefits.

High Deductible Plan F High Deductible Medicare Supplement

High Deductible Plan F High Deductible Medicare Supplement

High deductible Plan F provides the same level of coverage as the standard Plan F with potentially lower monthly premiums.

How does medigap plan f high deductible work. It is only available to those who turned 65 or went on Medicare on or after 112020. The benefits each plan offers is standardized by the federal government but the insurance companies get to decide what monthly premium to charge. For people turning 65 in 2020 or after it is a new option and one that some companies are aggressively marketing.

Under the Medigap High-F if the client has not yet reached the annual deductible of 2240 he or she would pay the 20 OOP cost. The high-deductible Plan F offers the same benefits as the standard plan. However Plan F is still among the more expensive of the Medigap policies.

Medicare Supplement High Deductible Plan F. A high deductible Plan F supports the concept of affordability with fully comprehensive benefits after reaching 2300 2019. February 10 2021 By Garrett Ball Leave a Comment.

Then you agree to pay the first 2370 of your share in 2021. 19 rows Medigap Plan High F is one of the Medicare Supplement Insurance plans. As noted above annual deductible for high-deductible plans is 2370 in 2021.

That is your maximum out-of-pocket on High Deductible Plan F. Plan F also has a high deductible option. The primary difference in the benefits of these two plans is that high-deductible Plan F covers the Medicare Part B deductible while high-deductible Plan G will not.

With a High Deductible Plan F you have to pay the first 2180 2016 of charges out of your pocket. The difference is the beneficiary agrees to pay the deductible before full coverage kicks in. After that amount the plan pays 100 of the costs not covered by Medicare.

A High Deductible Plan F Works the Same as a Standard Medigap Plan F. It should not be disregarded over the big 3 if you live in some select coastal areas. If you choose the high-deductible option it means you must pay for Medicare-covered costs coinsurance copayments deductibles up to the deductible amount of 2370 in 2021 before your policy will pay anything.

It works the same with only one difference. For 2021 this deductible is. Each year Medicare might adjust the deductible amount.

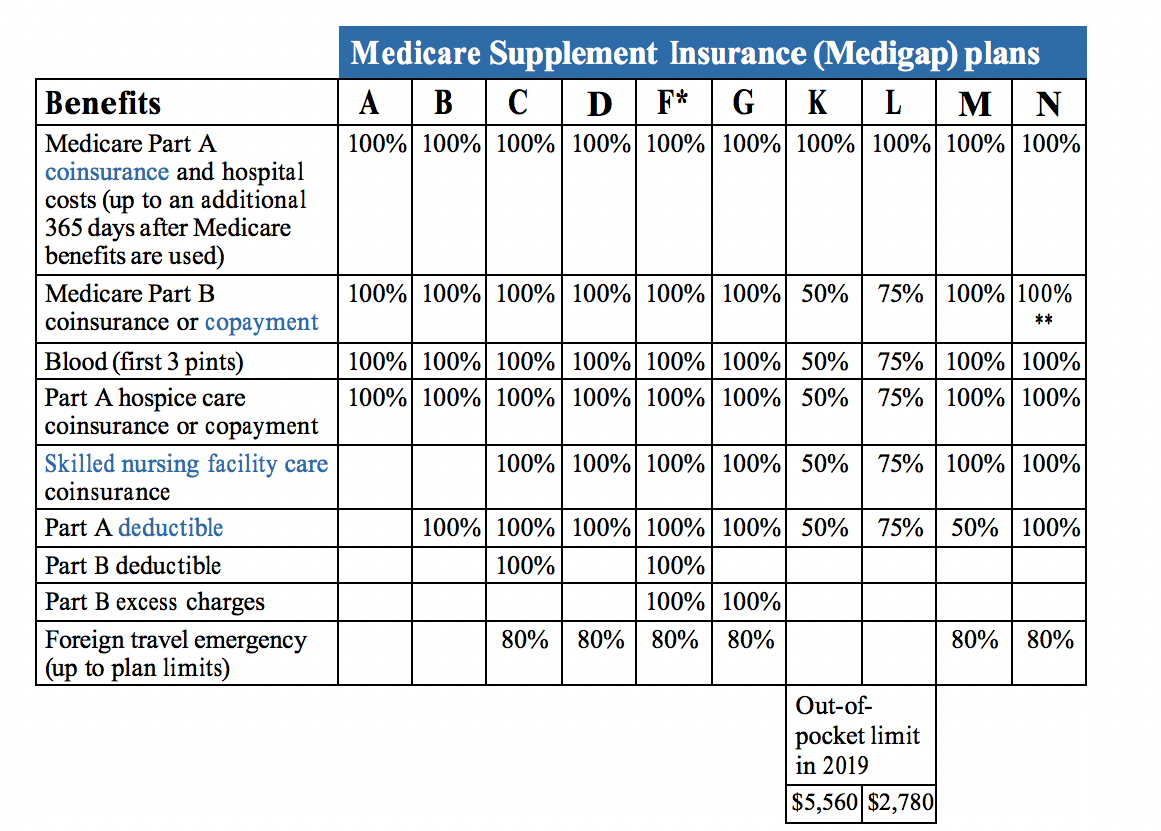

How Does High Deductible Medicare Supplement Plan F Work. In 2019 the Medicare Part B deductible is 185 for the year. With High Deductible Medigap Plan F Original Medicare will continue to pay its usual portion usually about 80 of the bill but youll need to pay 2370 out-of-pocket before the plan kicks in.

Once youve paid that amount your Plan F coverage will kick in. The only difference between regular Plan F and High Deductible Plan F is just that the deductible. This annual deductible went from up 2240 in 2018.

You can also choose a high-deductible Plan F offered by select insurance companies in some states. The tradeoff for these lower monthly premiums is a high deductible. High Deductible Plan F is an alternative version of the standard Plan F.

Once you reach the deductible the plan covers the left-over costs going forward keeping the monthly premium low. Lets say you had a hospital stay early in the year. With this plan you must pay Medicare-covered costs such as copayments and coinsurance up to the deductible amount before your plan will pay anything.

The Medicare beneficiary will continue to pay the amount that Medigap F would have paid for medical services. High Deductible Plan F is one of the most popular Medigap plans. The only difference between regular Medigap Plan F and High Deductible Plan F is the deductible.

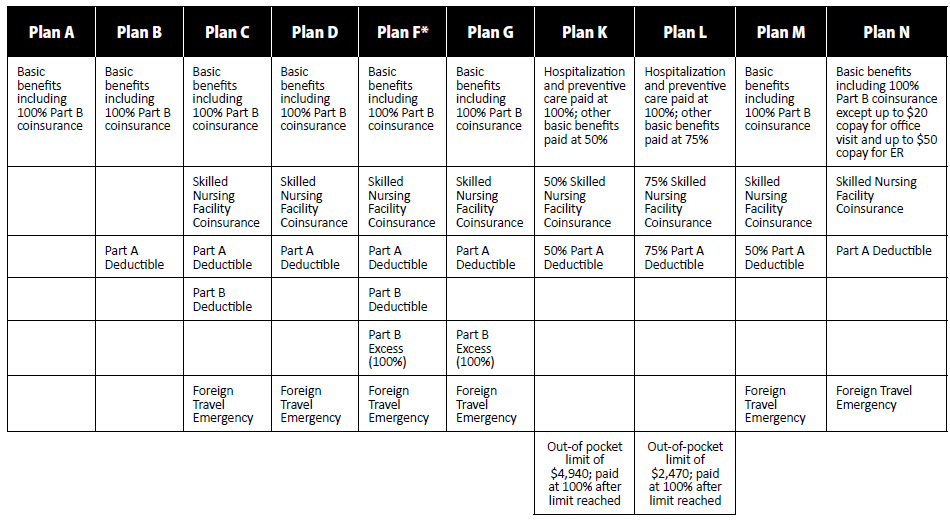

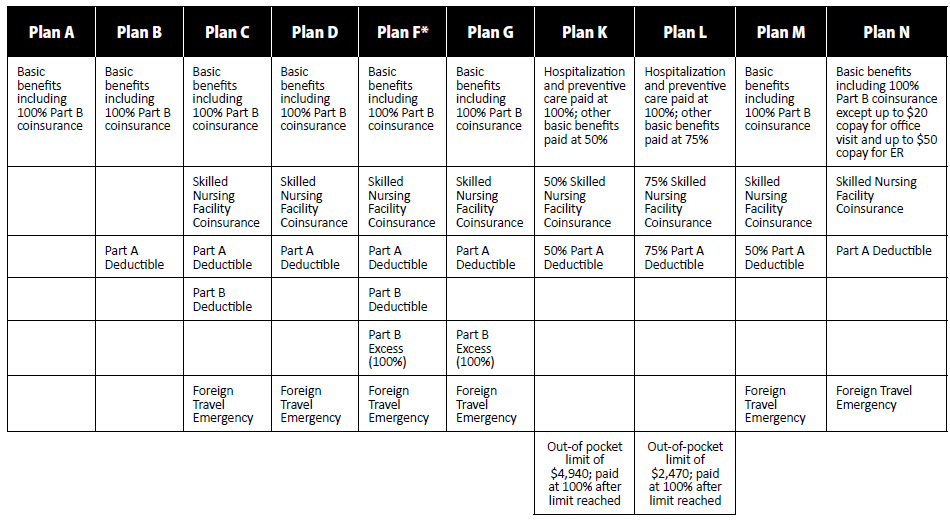

Medicare Supplement Plans Comparison Chart 2021 Medigap Plan F is also offered as a high-deductible plan some insurance companies in some states. The Medigap plan known as high deductible G or HDG is a relatively new option for Medicare beneficiaries. High-deductible Plan F allows users to pay lower monthly premiums than the standard Plan F.

What benefits does Medigap Plan F cover. The only difference is youd need to pay all costs for Medicare-covered services until a deductible amount is reached. But with a high-deductible plan you have to meet the Medicare Supplement deductible for the year before the plan helps pay your Medicare out-of-pocket costs.

Compare Medicare Supplement insurance plans. In 2021 the standardized deductible amount for high-deductible Plan F is 2370 for the year. Beginning in 2020 Plan G and Plan F will be the only two Medigap plans to offer a high-deductible option.

With this plan you have to pay Medicare-covered costs like coinsurance and copayments up to the deductible amount before your plan will bear the expense.

High Deductible Plan F High Deductible Medicare Supplement How To Plan Medicare Supplement Social Security Benefits Retirement

High Deductible Plan F High Deductible Medicare Supplement How To Plan Medicare Supplement Social Security Benefits Retirement

High Deductible Medigap Plan Makes Sense For Some

High Deductible Medigap Plan Makes Sense For Some

High Deductible Plan F High Deductible Medicare Supplement How To Plan Medicare Supplement Medicare Supplement Plans

High Deductible Plan F High Deductible Medicare Supplement How To Plan Medicare Supplement Medicare Supplement Plans

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medigap High Deductible Plan F Made Simple 2019 Bridge Insurance

Medigap High Deductible Plan F Made Simple 2019 Bridge Insurance

High Deductible Medigap Plan Makes Sense For Some

High Deductible Medigap Plan Makes Sense For Some

High Deductible Plan F High Deductible Medigap Plan Medicarefaq

High Deductible Plan F High Deductible Medigap Plan Medicarefaq

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medigap Plan F High Deductible Nevada Medicare

Medigap Plan F High Deductible Nevada Medicare

Medigap Plan F The Most Common And Comprehensive Plan

High Deductible Medicare Supplement Crowe Associates

High Deductible Medicare Supplement Crowe Associates

Comparing Medigap Plans Senior65

Comparing Medigap Plans Senior65

How Does High Deductible Medigap Plan F Work Medicaresupplement Com

How Does High Deductible Medigap Plan F Work Medicaresupplement Com

Your Guide To High Deductible Plan F Vs Medicare Supplement Plan F Medicareguide Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.