Will it be like paying for a doctor visit without having insurance until the. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Https Www Xavier Edu Hr Documents Xavier University Ppo Hsa 3500 Option 1 1 2021 Pdf

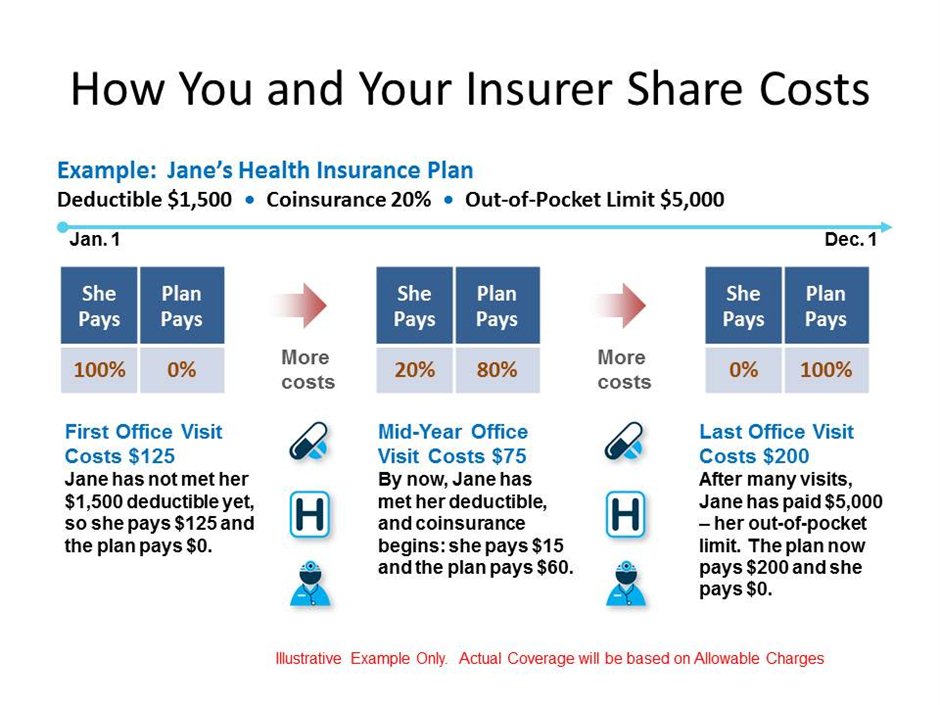

Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent.

What is 0 coinsurance after deductible. For example if your coinsurance is 20 percent you pay 20 percent of the cost of your covered medical bills. Yup in health insurance no-coinsurance plan may mean that you are not required to pay any out-of-pocket expense apart from the said deductible at the time of need. Both deductibles and coinsurance are a way of ensuring that you pay part of the cost of your health care.

Coinsurance is a portion of the medical cost you pay after your deductible has been met. This means that once your deductible is reached your provider will pay for 100 of your medical costs without requiring any coinsurance payment. You would pay 100 along with 30 percent of the remaining 900 up to your out-of-pocket maximum which would.

I understand how a deductible and coinsurance works in regards of say hospital bills but for a normal doctor visit I dont get it. Lets use 20 coinsurance as an example. Its not based on a percentage of the charge so it might be higher or lower than what a coinsurance would be usually lower.

Practically every kind of health insurance plan has something known as coinsurance. As mentioned earlier coinsurance is the percentage of health care services youre responsible for paying after youve hit your deductible for the year. An example of paying coinsurance and your deductible would be if you have 1000 in medical expenses and the deductible is 100 with 30 percent coinsurance.

0 coinsurance is a rare thing in todays market of insurance but the more common amount is 10 to 50 coinsurance. So the average cost-sharing value for the tier of your insurance plan may not be the same as your coinsurance percentage. A copay is a fixed amount that you pay regardless of the allowed charge for a service.

In other words until your deductible is met you will pay the full negotiated rate for a given covered health care cost in full. You might see this referred to as 8020 coinsurance. There are plans that offer 100 after deductible which is essentially 0 coinsurance.

It says nothing bout a co-pay so how can I know what Ill pay for a normal doctor visit. Deductible and coinsurance decrease the amount your health plan pays toward your care by making you pick up part of the tab. This benefits your health plan because they pay less but also because youre less likely to get unnecessary healthcare.

What is the difference between coinsurance and copay. Does it all just depend on the doctor. Coinsurance is the percentage of covered medical expenses that you are required to pay after the deductible.

While they are similar they work. Some plans offer 0 coinsurance meaning youd have no coinsurance to pay. It is your share of the medical costs which get paid after you have paid the deductible for your plan.

The deductible for this certain plan is 450. A copay is a type of insurance cost that is a set amount designated to be paid by the insured party whereas coinsurance is a percentage of health care costs covered by the insurer after the deductible is met. After your deductible is met though you will pay the.

Coinsurance is the amount you will pay for a medical cost your health insurance covers after your deductible has been met. Coinsurance- the you pay for services that dont have a specific copay after your deductible is reached out of pocket maximum- the amount at which the coinsurance stops and coverage is 100 probably subject to other conditions. It means you are responsible for 0 of the out of pocket expenses after your deductible is met.

What does this mean 0 coinsurance after deductible. Normally these plans charge higher premium than policies with deductibles and co-insurance. With coinsurance youre splitting the cost of medical services with your health insurance until you reach your out-of.

Your deductible if you werent aware is the amount you have to pay. You typically pay coinsurance after meeting your annual deductible. In what way does a deductible help an insurance company.

This is the percentage of a covered health service you will pay for yourself after you have met your deductible. We discuss in detail how coinsurance is a valuable insurance option to some than to others. In fact its possible to have a plan with 0 coinsurance meaning you pay 0 of health care costs or even 100.

Coinsuranceis what youthe patientpay as your share toward a claim. 0 copay means no cost to you. 100 coinsurance essentially means the same thing.

0 coinsurance means that the moment you reach your deductible the insurance company will be bound to ay you 100 of the contracted amount for some of the services that they cover which include clinic visits and Rx that most commonly. If you had a 10 coinsirance you would be responsible for 10 of the medical expenses after the deductible is met until you reach the out of pocket maximum not including copays and out of network expenses. Coinsurance is a form of cost-sharing or splitting the cost of a service or medication between the insurance company and consumer.

Both copays and coinsurance are forms of cost-sharing meaning you are splitting medical bills with your health insurance company. The 6040 cost sharing factors in copays coinsurance and the costs you will pay before and after hitting your deductible.

Mg3 You Are Considering The Choice Between The Fo Chegg Com

Mg3 You Are Considering The Choice Between The Fo Chegg Com

Https Www Centergrove K12 In Us Site Handlers Filedownload Ashx Moduleinstanceid 9596 Dataid 20761 Filename 2020 20hdhp 20summary Pdf

Coinsurance After Deductible How To Choose Between 100 And 0

Coinsurance After Deductible How To Choose Between 100 And 0

Http Www Capitol Group Com Steps 41 20anthem 20healthkeepers 20hsa 205000 0 6550 Va Pos Large 20group 42eb 20 20 20 20summary Pdf

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Oklahoma

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Oklahoma

Is There A Difference Between Coinsurance And Coinsurance After Deductible Personal Finance Money Stack Exchange

Is There A Difference Between Coinsurance And Coinsurance After Deductible Personal Finance Money Stack Exchange

Distribution Of Deductibles And Coinsurance Rates Download Scientific Diagram

Distribution Of Deductibles And Coinsurance Rates Download Scientific Diagram

Health Insurance Basics How To Understand Coverage

Health Insurance Basics How To Understand Coverage

What Is Coinsurance Healthmarkets

What Is Coinsurance Healthmarkets

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.