What is Deductible in Health Insurance. In 2014 theres a 6350 maximum for individual out-of-pocket costs for in-network services.

![]() Deductible And Coinsurance Useful Tips To Lower Health Insurance Costs

Deductible And Coinsurance Useful Tips To Lower Health Insurance Costs

Health insurance deductibles have been steadily rising for years.

Health insurance plans without deductible. The higher the FitScore a health plan has the more ideal match it is for your needs. On the other end of the spectrum low-deductible health plans typically charge more up front but require less of a financial commitment throughout the year. A zero deductible can mean different things for different types of insurances.

Yes it is possible to get a health insurance plan without a deductible. For homeowners insurance having a high deductible. The role of a deductible is to keep premiums low.

With HealthMarkets you can enroll in a plan for the same price youd pay if you purchased it directly from the insurance company. A zero deductible plan means that you dont have to pay for any costs upfront before receiving your benefits. The vast majority of employer-sponsored health plans require members to pay a deductible.

A no deductible insurance plan works just like a policy with a deductible except that when you need to use the policy you dont have to pay out of pocket until your deductible is met. Zero-deductible plans typically come with higher premiums whereas high-deductible plans come with lower monthly premiums. It does this by discouraging people from putting in small claims since they likely wont want to pay deductibles on such claims.

Is It Probable to be Insured Without a Deductible. These plans are referred to as zero-deductible plans. This means the insurer is bound to pay the claim amount after it exceeds the deductible amount.

Among these workers plans the average individual deductible was 1655 in 2019. If youre going to see the doctor every month because you have cancer or diabetes then youll want to sign up for a low-deductible plan. One option that appeals to many for 2019 coverage is typically found in the Individual Marketplace as a Gold Level plan and that is the no-deductible health insurance policy also referred to as an all copay plan.

Health Insurance With A Zero-Dollar Deductible. Some health insurance plans usually HMOs do not have a deductible at all. Next time you wonder How do I get low-cost health insurance let HealthMarkets help you find the right fit for you.

Screenings immunizations and other preventive services are covered without requiring you to pay your deductible. Yes a zero-deductible plan means that you do not have to meet a minimum balance before the health insurance company will contribute to your health care expenses. To understand the term better here is an example of how deductibles in health insurance.

Whether or not you can deduct the cost of health insurance on your income tax returns depends on several factors. If youre a full-time employee self-employed individual or you paid for your insurance using pre-tax or after-tax dollars all have an impact on what you can claim. Rather than making the subscriber meet a minimum balance health insurance with no deductible means the health insurance company will make payments up front paying out for doctor visits emergency care or other.

It can also depend on whether you take the standard deduction or itemize. This is dramatically higher than the average annual deductible a decade earlier which was just 533. These plans make sense for people with ongoing medical conditions or chronic illnesses.

What To Know About No-Deductible Health Insurance Plans. Many health insurance plans also cover other benefits like doctor visits and prescription drugs even if you havent met your deductible. Deductible in health insurance is the amount you have to pay before the health insurance company begins paying up the claim amount.

As mentioned the health insurance deductible may vary from plan to plan. IYC High Deductible Health Plan Provides local coverage and limited out-of-network coverage emergency and urgent care only IYC Access High Deductible Health Plan Provides nationwide coverage and out-of-network coverage. Some plans typically HMOs may not have a deductible at all.

These plans are known as zero-deductible plans. Centivo is a self-proclaimed new type of self-funded health plan that removed confusing high deductibles that keep people from getting the care they need Their focus is on connecting patients with quality primary care providers to not only improve health outcomes but also control cost. However this only means you pay a higher monthly premium.

Many members contribute the money they save on their health insurance. No-deductible health insurance is a kind of health insurance that doesnt include a required up front payment by the enrolled member each year. If you enroll in one of these plan options you must enroll in the state-offered HSA program.

Your insurance company will cover your allowable claims right away. Our Best Price Guarantee means that you wont find a lower price anywhere for an insurance. Its important to take your time to compare plans side by side since higher plan deductible may be offset by lower cost sharing or premiums and vice versa.

An insurance plan with no deductible may appeal to consumers who frequently visit. Zero-deductible plans usually come with higher premiums while high-deductible plans typically come with lower premiums. The biggest advantage of a deductible as a policyholder is that the higher the deductible the lower the premium.

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

Find Affordable Health Insurance And Compare Quotes

Find Affordable Health Insurance And Compare Quotes

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

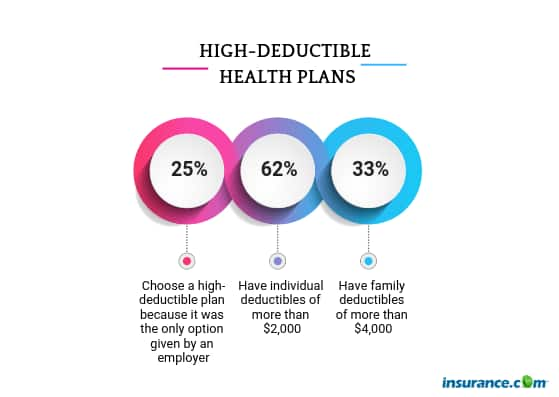

Health Plan Survey Insurance Com

Health Plan Survey Insurance Com

Illumination Wealth Managementunderstanding Your Health Insurance Plan Options Illumination Wealth Management

Illumination Wealth Managementunderstanding Your Health Insurance Plan Options Illumination Wealth Management

Short Term Health Insurance Vs High Deductible Health Plans

Short Term Health Insurance Vs High Deductible Health Plans

Problems With Health Insurance Plan By Deductible Download Scientific Diagram

Problems With Health Insurance Plan By Deductible Download Scientific Diagram

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Embedded Deductibles Source Of Consumer Confusion Center On Health Insurance Reforms

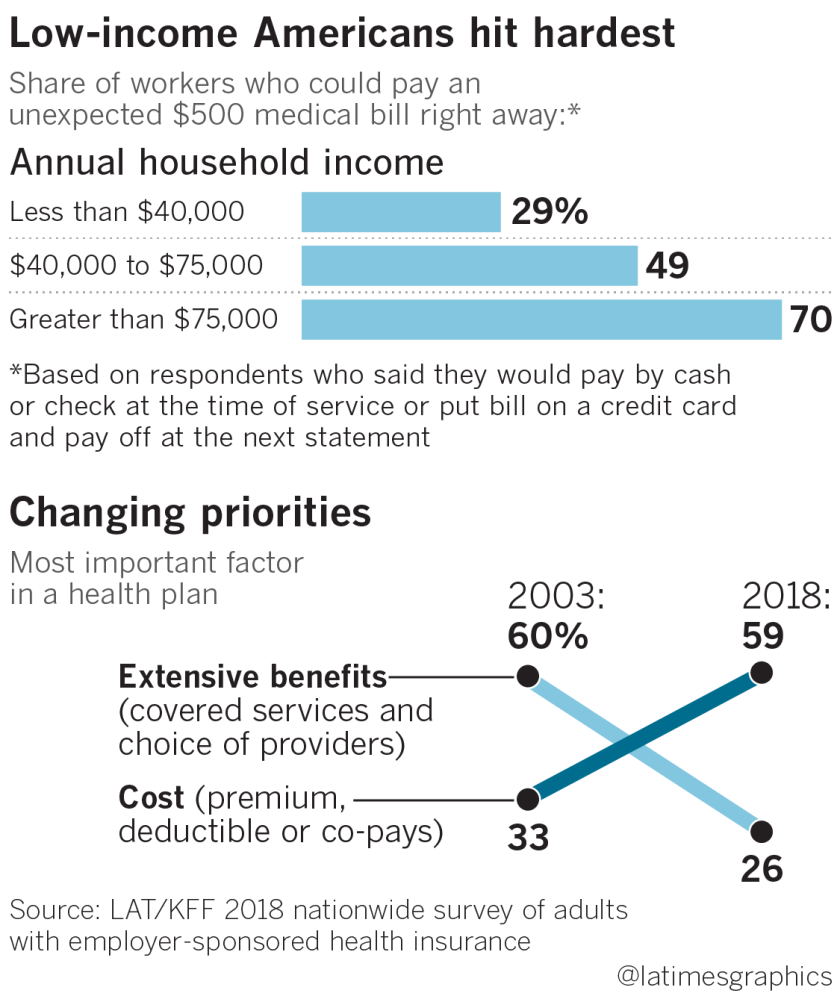

Rising Health Insurance Deductibles Fuel Middle Class Anger And Resentment Los Angeles Times

Rising Health Insurance Deductibles Fuel Middle Class Anger And Resentment Los Angeles Times

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

Know Your Plan Washington Health Benefit Exchange

Know Your Plan Washington Health Benefit Exchange

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.