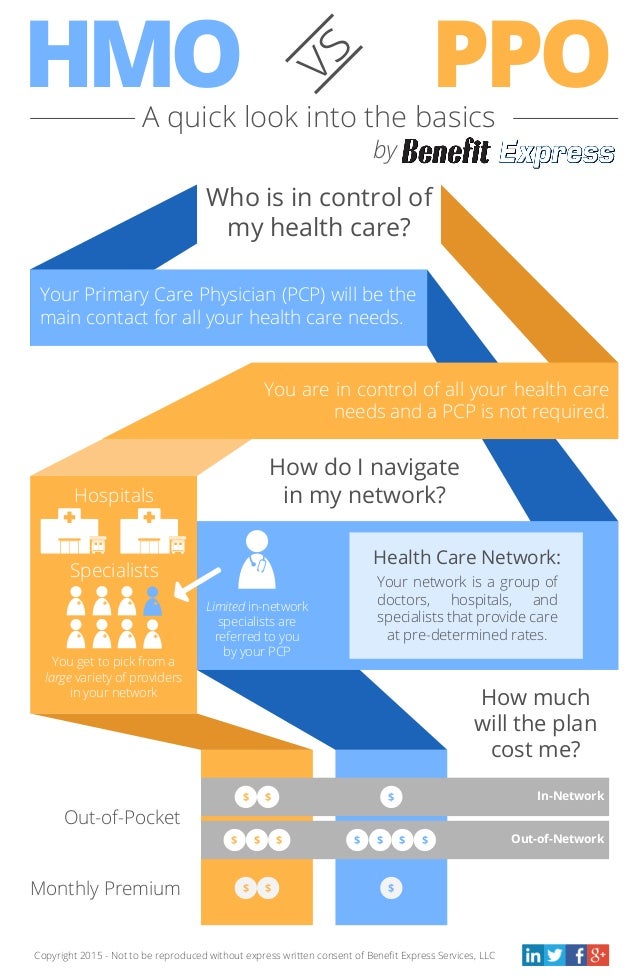

If you are new to health insurance you may want to choose a PPO for the flexibility. HMO plans have fixed prices for services PPO plans have varied costs.

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

Like HMOs many POS plans require you to have a PCP referral for all care whether its in or out-of-network.

Should i get hmo or ppo. With an HMO you will have a. Making a decision about the best health insurance plan for you or your family is a difficult choice. HMO costs are prepaid PPO costs are not.

The coverage for out-of-network services. The pros of an HMO plan is the cost which normally have lower premiums than PPOit really depends on your employer. A Preferred Provider Organization or PPO allows you to go to any health care professional without a referral.

Size of the network. Generally HMOs are cheaper so if cost is the bottom line an HMO. Youd also likely pay smaller co-payments to see specialists as opposed to other plans.

However the cons of having an HMO health insurance plan during pregnancy is that you are restricted to your primary care physician. Overall the differences between the two plans will sway your decision on which one you would prefer to get. What Should You Get.

If you have diabetes you should always have a PPO I dont know if that is the right advice or just some BS by that particular medical professional who maybe wouldnt be covered under the HMO plan. These can be done retroactively as well but its important to have a PCP that isnt an atomic douchnozzle. The size of the in-network.

The monthly payment for an HMO plan is. Choosing between an HMO or a PPO health plan doesnt have to be complicated. HMOs typically give you more coverage but the network is usually pin thin when it comes to dental.

Unlike an HMO PPO plans give participants the freedom to seek care from any in- or out-of-network provider. If you see a provider in your network you will have smaller copays. The cost of the plan.

The biggest difference between a PPO and HMO is the pre-authorizations required for specialist care. What are the differences between HMO and PPO plans. POS plans resemble HMOs but are less restrictive in that youre allowed under certain circumstances to get care out-of-network as you would with a PPO.

The ability to see specialists without referrals. The big difference between HMO and PPO for many individuals and families is the primary care doctor. HMO plans do not require a deductible PPO plans do.

Should I get HMO or PPO. The major differences between HMO vs PPO plans can be found in the. Also many HMO plans completely cover the cost of maternity care or a large portion of it.

I was told in the past when I had to choose my first insurance plan with diabetes to never go with the HMO option. If you have a big family and know what doctor you want to use as your family doctor getting their preferred HMO is certainly a good bet. PPO coverage typically extends further than that of other common health insurance plans.

- Health Insurance Jun 3 2019 Unlike an HMO a PPO plan allows members to see any health care provider who is within the insurance. Yet because of the overall lower in-network costs PPO premiums tend to rise high. In a PPO you just go to any covered physician or facility.

PPOs still have networks but they tend to be wider and you can roam outside the network you just pay more. If you see a provider who is not on your network you can expect a higher out-of-pocket cost and there may be some services that are not covered. Depending on the carrier you enroll with for example it may be able to cover alternative procedures like.

Preferred Provider Organization PPO A Preferred Provider Organization or PPO is a type of health insurance plan that provides a network of healthcare providers much like a Health Maintenance Organization. Certain services and medications must be pre-authorized and your doctor may need to do the paperwork. HMOs arent better than PPOs rather it depends upon your family and your region which one will be better for you.

Should I Get an HMO or PPO. Between talk of deductibles copays coinsurance and coverage areas your head is likely. You need to have your PCP put in an authorization.

Whereas in an HMO you cant. The main differences between the two are the size of the health care provider network the flexibility of coverage or payment assistance for doctors in-network vs out-of-network and the monthly payment.

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg)