Your coinsurance depends on your health insurance plan and your insurance provider. Well Co-pay I know you have to have an existing plan usually to your employer and you pay x amount of dollars for that service.

What Is Health Insurance Coinsurance Healthcare Com

What Is Health Insurance Coinsurance Healthcare Com

Heres a breakdown.

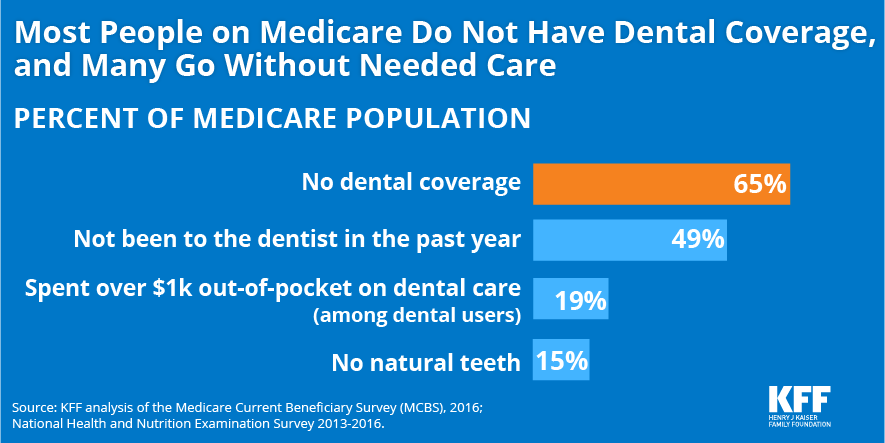

Is coinsurance what i pay. 0100 coinsurance 100 coinsurance - You pay 100 of the claim 1090 coinsurance 90 coinsurance - You pay 90 of the claim 2080 coinsurance 80 coinsurance - You pay 80 of the. Coinsurance is the amount you pay for covered health care after you meet your deductible. Coinsurance clauses can also be found in some directors and officers and errors and omissions policies.

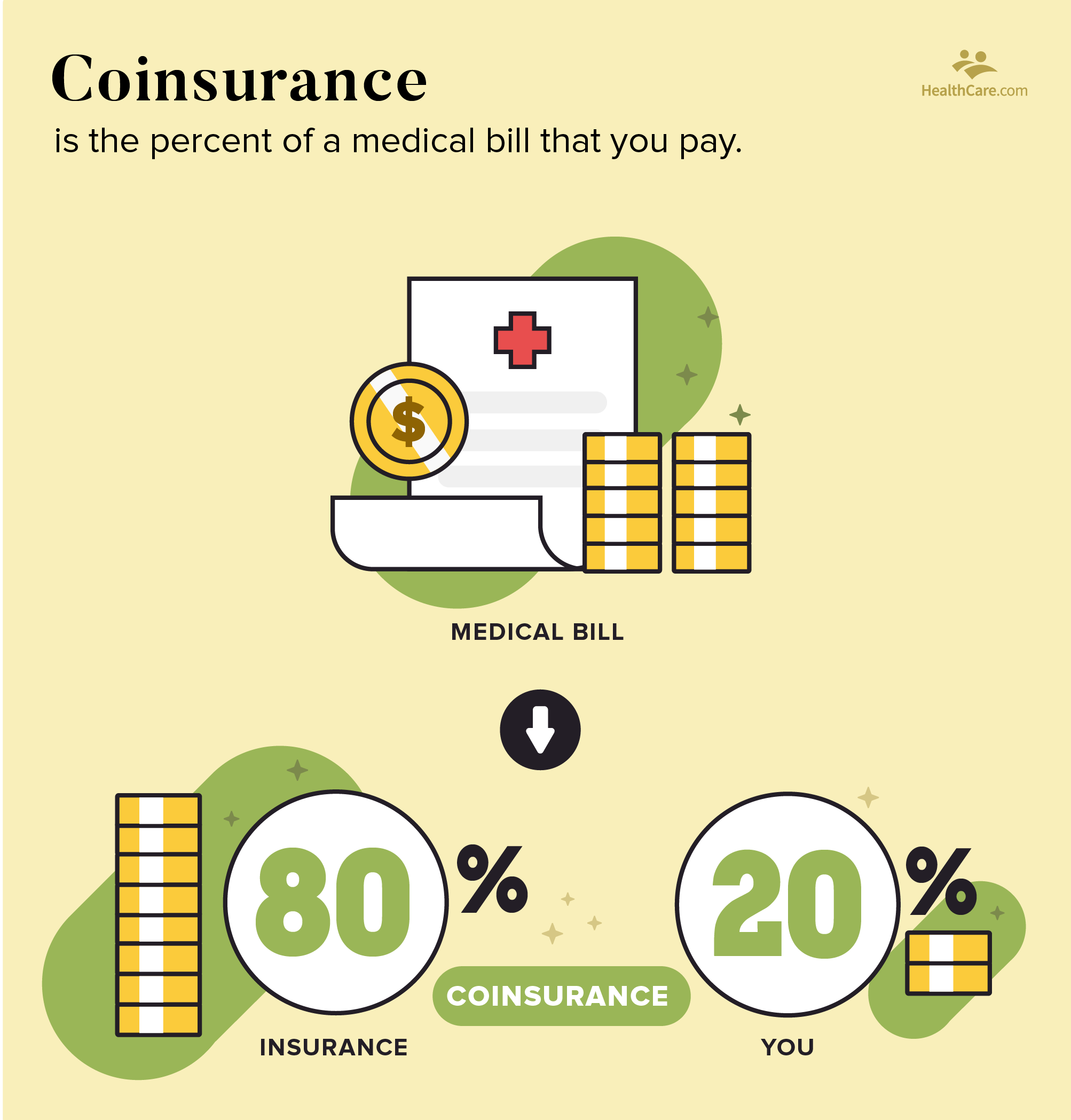

For example a very common coinsurance arrangement is that the medical insurance company pays 80 percent of costs for a given therapy with the patient paying 20 percent. Coinsurance is a form of cost-sharing or splitting the cost of a service or medication between the insurance company and consumer. Co-insurance is where I think this is a stab.

You typically pay coinsurance after meeting your annual deductible. Coinsurance is the percentage of your medical costs that you actually have to pay but it only applies after you hit your deductible. Practically every kind of health insurance plan has something known as coinsurance.

Instead of a flat fee like a copay the percentage of the total cost of your care that you pay is called coinsurance. Coinsurance is a percentage of the total cost. Coinsurance is what youthe patientpay as your share toward a claim.

While the most common coinsurance rate is 8020 sometimes shortened to 20 coinsurance other rates can include. This amount is a percentage of the total cost of carefor example 20and your Blue Cross plan covers the rest. If your plan calls for you to pitch in 20 percent you can.

The larger number 80 or 70 represents the percentage paid by the insurer for a covered service while the smaller number 20 or 30 is the percentage the insured person must pay. As mentioned earlier coinsurance is the percentage of health care services youre responsible for paying after youve hit your deductible for the year. Learn more about coinsurance and how to calculate your costs below.

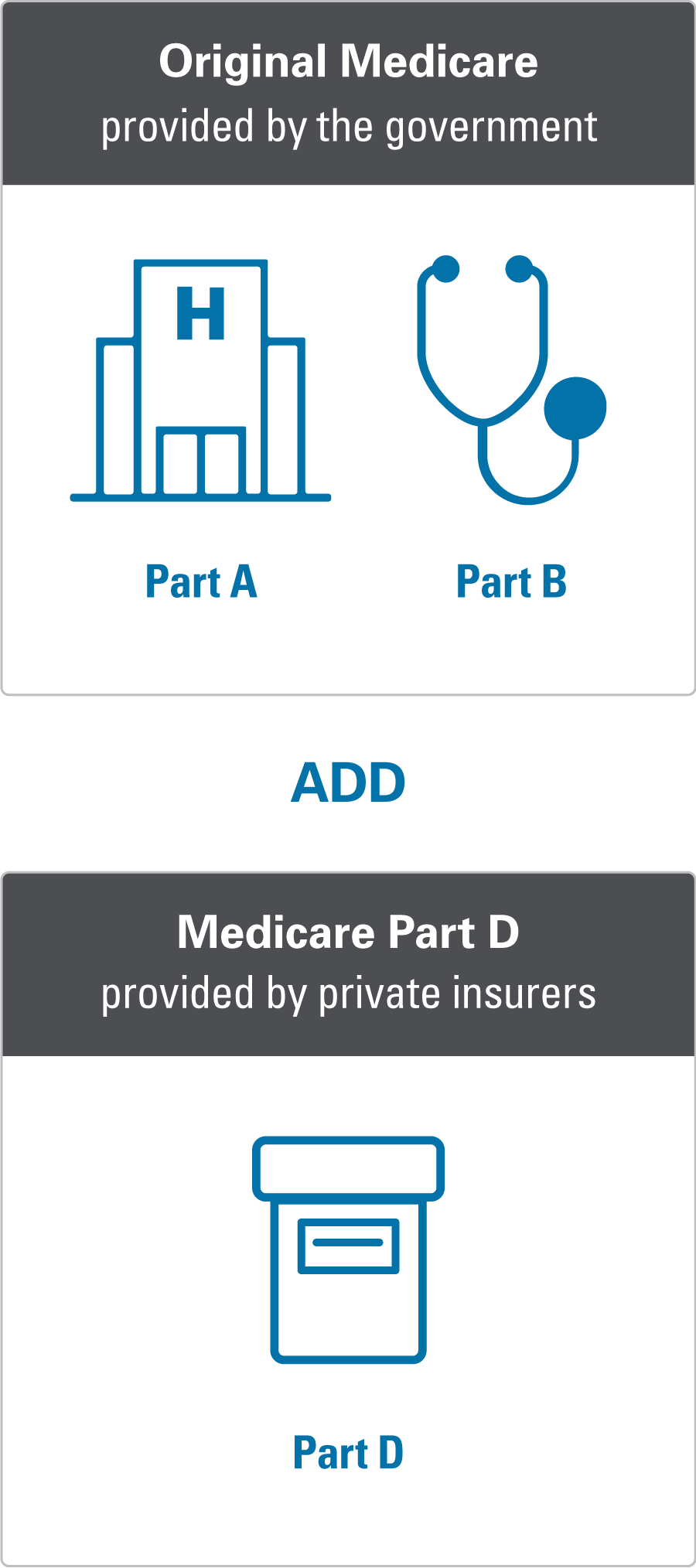

Coinsurance is different from a copay which is a flat fee you pay anytime you get certain types of health care services. Although original Medicare part A and part B covers most of your medical costs it. Coinsurance is the percentage of costs of a healthcare service youre required to pay after youve hit the deductible on your health insurance plan.

You pay a fixed amount for particular services. Say the cost of X-raying diagnosing and putting a cast on that pesky broken wrist adds up to 1200. You can think of it as cost sharing between you and the health insurance plan.

Coinsurance is the percentage of covered medical expenses you pay after youve met your deductible. This is the percentage of a covered health service you will pay for yourself after you have met your deductible. Your health insurance plan pays the rest.

Coinsurance is the amount you will pay for a medical cost your health insurance covers after your deductible has been met. Lets say your health plan has 20 coinsurance. You pay a fixed percentage such as 20 percent of the cost of every medical service you receive.

This is different from a copay which is a fixed fee youre required to pay for certain services. That portion of the bill is your responsibility. How Coinsurance Affects the Cost of Your Health Care.

Copayments and coinsurance along with deductibles are examples of cost sharing. FYI while premiums are paid by the consumer. With coinsurance youre splitting the cost of medical services with your health insurance until you reach your out-of-pocket maximum.

Medicare coinsurance is the share of the medical costs that you pay after youve reached your deductibles. Coinsurance is the percentage that you and the plan pay for the covered medical expenses until you reach your out-of-pocket maximum. Coinsurance is a type of insurance in which the insurer and the insured split risks with each other.

Lets use 20 coinsurance as an example. In other words until your deductible is met you will pay the. For example you may have to pay a 20 copay every time you see.

Your coinsurance is usually a percentage of the cost of your healthcare servicesso you may be required to pay 25 percent of the cost of your X-ray and surgery. In addition to lowering the cost of insurance for the insured coinsurance also benefits other people who are insured with the same company by ensuring that the insurance company will be able to pay.