Member should include previous Blue Cross. Certain life events like moving into the Independence Blue Cross coverage area allow you to apply for a health plan up to 60 days before a qualifying life event.

Qualifying life events are defined in Federal Law.

Qualifying life event blue cross. Anthem Blue Cross and Blue Shield is the trade name of. Information as of February 1 2016 226364-16. You also may be able to select a plan up to 60 days in advance of some qualifying life events.

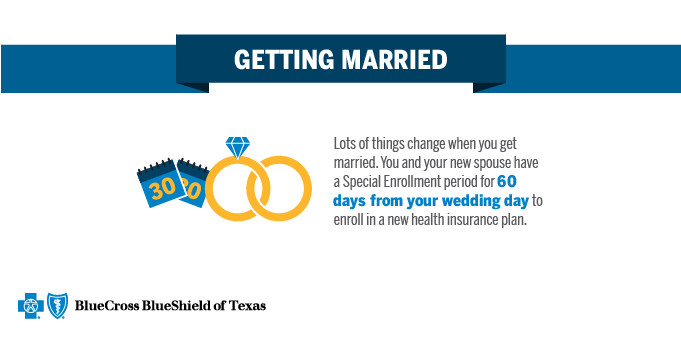

An application for coverage due to a qualifying event must be received within 60 days after the qualifying event. These are called qualifying life events. Under no circumstances will coverage become effective prior to the qualifying event date.

When something like this happens you become eligible for a Special Enrollment Period. 60 days before and after event. Within 60 days of event.

Find out if you can shop today. Policyholder enrolls in Medicare Medicaid Medicare Supplement Medicare Advantage Veteran Affairs VA coverage TRICARE or group coverage. 60 days before and after event.

Rocky Mountain Hospital and Medical Service Inc. You may be eligible to enroll or make a change to your plan any time of the year. An application is not complete and will not be considered for coverage unless proof of the qualifying event is received and validated by the required date.

HMO products underwritten by HMO Colorado Inc. Basic types of qualifying life events can be loss of coverage getting married adopting a child a change in household size a permanent move plus more. Anthem Insurance Companies Inc.

Effective date is calculated upon approval. If youre shopping for medical coverage we require proof of your qualifying life events. This can be during open enrollment or.

Qualified Life Events Time Period To Apply. Death of a policyholder. Your health care coverage will begin on the first of the month after you apply.

Birth adoption guardianship or fostering of a child. Certain changes in your life situation are known as qualifying life events like a loss of health coverage a change in your household or a change in residence. A Special Enrollment period occurs if you have a qualifying life event.

Our limited COVID-19 enrollment period gives you extra time to shop for coverage. BCBSAZ requires proof of the qualifying event. If not you may have other choices.

In Missouri excluding 30 counties in the. Turning 26 years old. You have a new dependent either through marriage domestic partnership birth or adoption or been granted court-appointed testamentary child support order or other court order of a child or qualified dependent.

If youre buying a BCBSIL health plan during the new SEP offered February 15 August 15 2021 you will not have to provide proof of a qualifying event. Anthem Health Plans of Kentucky Inc. Qualifying life events are a major change in your situation like losing your employer-sponsored health insurance getting married or divorced having a baby moving and more.

A full list is available in our article about special enrollment. These qualifying events give you the opportunity to sign up for a new health insurance plan or modify an existing health insurance plan outside the traditional Open Enrollment Period. Qualifying Life Event You can only purchase a plan outside of Open Enrollment if you have one of the following qualifying life events.

You may qualify to buy a Blue Cross and Blue Shield of Texas BCBSTX health plan during the Special Enrollment Period SEP. 60 days before and after event. SEP QUALIFYING LIFE EVENTS.

Documentation submitted is subject to validation and must support the qualified event or eligibility requirements. Anthem Health Plans Inc. Another common qualifying life event is the birth or adoption of a child.

SEP Qualifying Life Event and Documentation You could lose your job-related health plan for many reasons. After a qualifying life event you have a period of 60 days to change your plan or enroll in a new plan. 15 Zeilen Life event.

Qualifying Life Event Required Documents Loss of Blue Cross of Idaho coverage No documentation required. In that case the special enrollment period allows you to add the child as a dependent on your plan within 60 days of his or her birth or adoption date. What are qualifying life events.

The ability to apply up to 60 days prior to qualifying event date. Qualifying life events typically. In most cases you will have 60 days after the qualifying life event to enroll in or make changes to a health plan.

If you are losing health care coverage provided by an employer you will have up to 60 days before and after this qualifying life event. Anthem Health Plans of Maine Inc.