Once we hit that out-of-pocket max our insurance covers our costs 100 percent. Its not a form of health insurance.

Comparing Medical Plans Hmo Ppo Hdhp Youtube

Comparing Medical Plans Hmo Ppo Hdhp Youtube

We dont go to the doctor often our current family doctor takes the coverage and the husband has a CPAP machine.

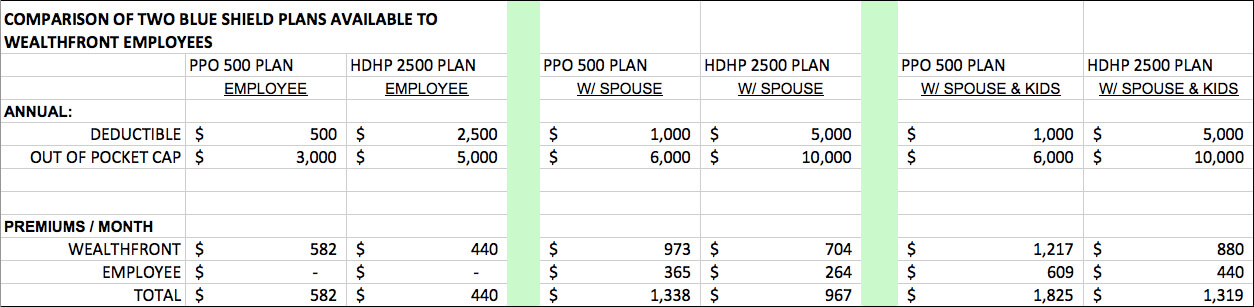

Ppo or hdhp. An HSA account helps you save for medical expenses. Should I go with PPO until I have my emergency fund and savings set up Their employer provided a summary document illustrating key points for the two available health plans High Deductible Health Care and Preferred Provider Organization. HDHPs will have lower premiums than PPOs.

You save more money with an HDHP plan. The PPO has a lower deductible but doesnt. HDHP cost OOP annual premium employer HSA contribution 5000972-1500 4472.

Both plans cost you the same in the end. PPO or HDHP What do I pick. An HSA Health Savings Account is a savings account you can use with a high-deductible health plan HDHP.

Take your first example for a family that has a 100k medical cost and OOP is hit. And in order to open an HSA you need to be covered by an eligible high deductible health plan HDHP and have no other coverage. Based on your current medical needs deciding between an HDHP vs.

HDHPs or High Deductible Health Plans Like the name says this type of plans deductible is higher than most traditional plans. The amount you pay in premiums is gone to the insurance company forever. You do not get to keep that money or roll any over to another year.

You save more money with a PPO plan. Our HDHP has a deductible of 2800 and after we meet that our coinsurance kicks in and we are responsible for 20 percent up to 7000. A High-Deductible Health Plan is a type of health insurance plan that as its name implies has a higher deductible than traditional insurance plans such as an HMO EPO or PPO.

To qualify as an HDHP the IRS says a plan must have a deductible of at least 1350 for an individual and 2700 for a family. A high deductible health plan or HDHP has gained popularity in recent years as healthcare costs continue to rise and paying a larger deductible is one way to keep costs down. But one crucial thing to remember is that unlike a PPO plan an HSA is not a health insurance plan.

The HDHP costs less each month in exchange for a higher deductible. People who buy coverage outside the workplace may face a similar choice. Heres a great question that came in recently.

My household is myself my husband and our youngest child 14 year old daughter. For 2020 the IRS defines an HDHP as any plan with a deductible of at least 1400 for individuals and 2800 for a. 1 When an HDHP is offered employees often have a choice between the HDHP and a traditional preferred provider organization PPO plan.

This video provides a simple explanation of how an HDHP and a PPO are the same and different. Type Deductable In-Network OOP Max Non-Network OOP Max Doctors Visits Hospital Stay Per-Paycheck Cost Annual Employer HSA Contrib. What is an HDHP.

HDHPs can vary and operate as both HMO and PPO plans. An HDHP plan is typically about 10 cheaper than a traditional preferred provider organization PPO plan and is usually associated with a company funded tax-advantaged health savings account HSA that is meant to fund some of your medical expenses. It is not always true that families with high medical cost will pay more in a HDHP.

The two plan options I was offered are a PPO costing 375 twice a month and a HDHP with a high deductible costing 206 twice a month. Often the HDHP option has a lower overall cost regardless of your medical cost. One way to have more money is to spend less money.

The HDHP costs less on a monthly basis than the PPO and provides protection for you and your family when you need health insurance. Both plans pay 100 of the cost of preventive care and protect wallets with an annual out-of-pocket maximum. My company is providing benefits through Humana and Ive been presented with 3 options.

Making Health Insurance Choices More than half of large US. In fact youll find high deductible plans in both HMOs and PPOs. What are the top two advantages of choosing an HDHP over a PPO.

PPO plan comes down to three scenarios. I was looking at my health insurance options for my new job. So when youre thinking about your HSA vs.

A PPO Preferred Provider Organization refers to the network coverage your health plan gives you access to. Companies offer employees a high-deductible health plan HDHP. The other advantage is that the HDHP gives you access to the HSA which Baylor helps to fund.

PPO choice what you really should be pondering is HDHP vs.