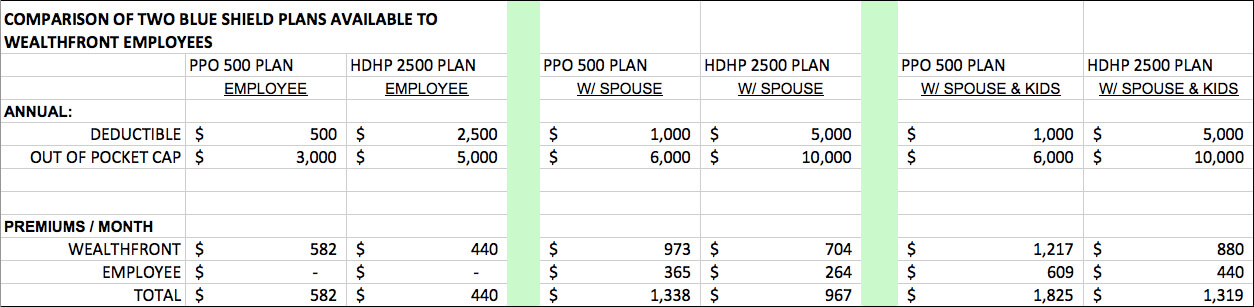

Some employers choose to offer narrow networks that have limited options in their network. ACA Basic High Deductible Meets the minimum essential coverage and affordability requirements for benefits-eligible employees.

Stanford Encourages Employees To Review And Confirm 2020 Medical Plan Coverage Stanford News

Stanford Encourages Employees To Review And Confirm 2020 Medical Plan Coverage Stanford News

Employee demand for health insurance and employer health plan choices M.

Stanford employee health insurance. Jeffrey Pfeffer and colleagues at the Stanford Graduate School of Business recently found that administrative sludge in health insurance costs employers and the economy billions of dollars in squandered work time employee stress absenteeism and reduced productivity. Eligible employees can earn incentives for participating. Your go-to source for health well-being.

Now new research from Stanford University has put a price tag on the problem finding the time employees spend on health insurance hassles adds up. For Stanford University these benefits presently are administered by Zurich North America. Stanfords medical plans for active employees have two types of fee structures.

Wellness initiatives life insurance disability benefits and long-term care. Our core benefits include medical insurance dental insurance vision insurance an employee assistance program savings and spending accounts disability life and accident insurance and COBRA. Plans with a Copay You pay a fixed fee when you use services.

Stanford is increasing its contribution to employees who sign up for a Health Savings Account HSA to 750 for employee-only coverage or 1500 for family coverage. Visit the BeWell site. Each type of plan is compatible with a tax-advantaged savings or spending account you may use to pay for eligible medical expenses.

Accepted 1 October 2001 Abstract. Kate Bundorf Department of Health Medicine HRP Rewood Building Stanford University School of Medicine RmT257 Standford CA 94305-5405 USA Received 1 August 2000. Pfeffer and his colleagues found that.

Whether youre considering insurance through your employer or purchasing coverage on your own we can help guide you through your different options so you can get the coverage you need. Stanford University offers medical insurance. City of Burlington 400 Washington Street Burlington IA 52601 Phone.

The true extent of that waste according to a new study led by Jeffrey Pfeffer at the Stanford Graduate School of Business is even more shocking. Coverage for your care at Stanford Health Care is determined by your insurance company and is based on the provisions of your specific plan. Stanford University offers a wide range of health and life benefits to help meet the needs of employees and their families.

Aetna Choice POS II Group 868026 Aetna Concierge 1-888-922-3862. The Internal Revenue Service IRS has also increased the annual contribution limits for HSAs. For medical insurance you have the choice of three generous health plans through Stanford Health Care Alliance Aetna or Kaiser Permanente.

We help individuals select and purchase quality health and life insurance. Stanford Health Care accepts most major commercial health plans that employers offer their employees. Learn about Stanford Health Care including insurance benefits retirement benefits and vacation policy.

The different options are summarized below. Each plan includes 100 coverage for preventive care. A study in 2019 estimated that administrative complexity was the single biggest source of waste in health care bigger even than fraud or over-pricing and imposes an annual cost of 265 billion.

Stanford Health Care Alliance SHCA Stanford care with a copay in a select local network. Stanford HealthCare Alliance SHCA Group 109047 Member Services. Employees who are unable to work because of a work-related injury or illness may be entitled to partial income replacement in the form of disability benefits and medical treatment based on the nature of the injury.

Benefits information above is provided anonymously by current and former Stanford Health Care employees and may include a summary provided by the employer. Employer Verified Available to US. These affordable policies pay benefits in addition to your regular health insurance.

Stanford provides no-fault Workers Compensation insurance. We also assist in creating a financial safety net for unforeseen accidents and sudden or chronic health issues with Supplemental Policies. Stanfords world-class employee wellness program offers personalized wellness services classes and events.

Stanford Health Care is contracted with most major health insurance carriers. Coverage Through Your Employer. For more information about your benefit options see Cardinal at Works Benefits Rewards site.