If you have other family members on the plan each family member must meet their own individual deductible until the total amount of deductible expenses paid by all family members meets the overall family deductible. The SilverScript Plus plan offers a 0 deductible on medications in all tiers.

How Does Health Insurance Work A Silver Plan In Action

How Does Health Insurance Work A Silver Plan In Action

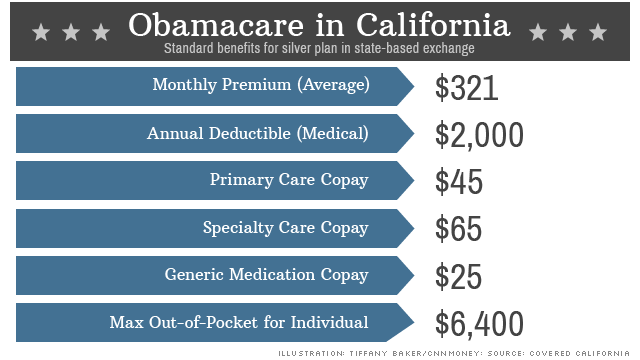

The monthly premium for a Silver Plan depends on the insurer from whom you purchase the plan the number of people to be insured by.

What is the deductible for silver plan. 1500 Member 3000 Family deductible for Tiers 3 and 4 for prescription drug coverage. Youll have lower copayments or coinsurance. 0 deductible for tier 1 drugs and a 445 deductible for tiers 2 to 5.

For example this plan covers certain preventive services without cost-sharing and before you meet your deductible. Individual Family Plan Type. This plan covers some items and services even if you havent yet met the deductible amount.

U5371 1018 85736MN 0230003-01. But a copayment or. You must pay all of the costs for these services up to the specific deductible amount before this plan begins to pay for these services.

How each silver plan makes you pay your share of the costs will vary. Bright Health Silver plans have been rated 2 and 4 position in Cook County. HMO UC FVC_10012018_3_M IA 10012018 1 of 8.

Individual or Family Plan Type. Silver 0 Deductible Coverage for. The SBC shows you how you and the plan would share the cost for covered health care services.

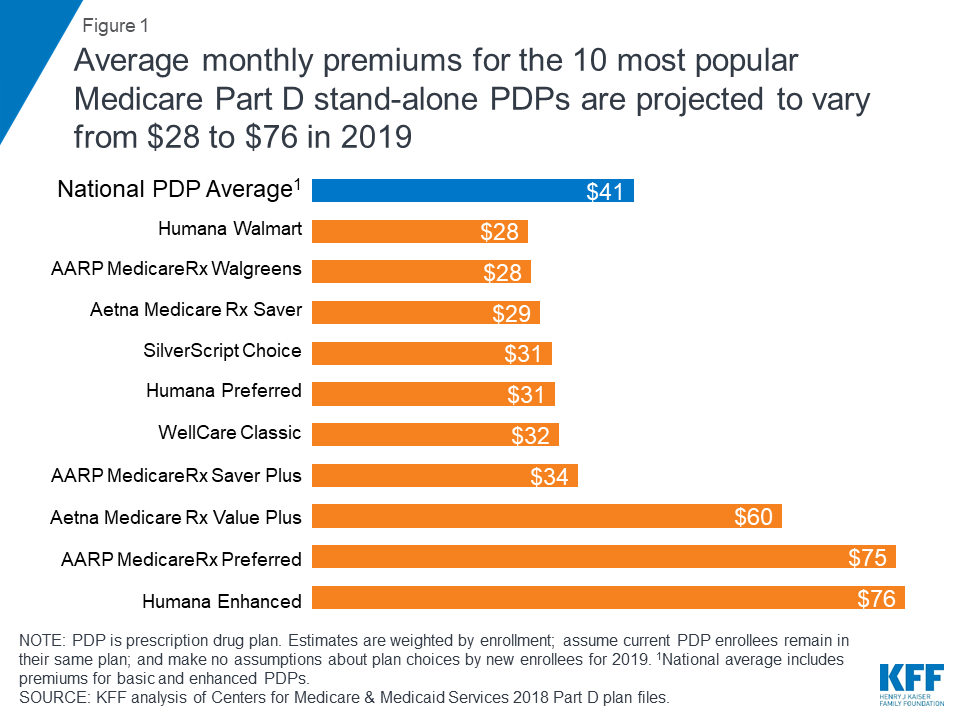

This Aetna Medicare plan offers a 410 Part D Basic Premium that is not below the regional benchmark. For example one silver plan might have a 4000 deductible paired with a 20 coinsurance. But if you qualify for cost-sharing reductions your deductible for a Silver plan could be 300 or 500 depending on your income.

Now a regulatory filing for 2017 plans shows that Blue Cross of Idaho is set to push the envelope even further with a 6850 silver-plan deductible and. Silver plans are the most common. Heres a breakdown of how each plan handles annual deductibles.

What is the out-of-pocket limit for this plan. There are no other specific deductibles. The policy has even more drug coverage than the Choice.

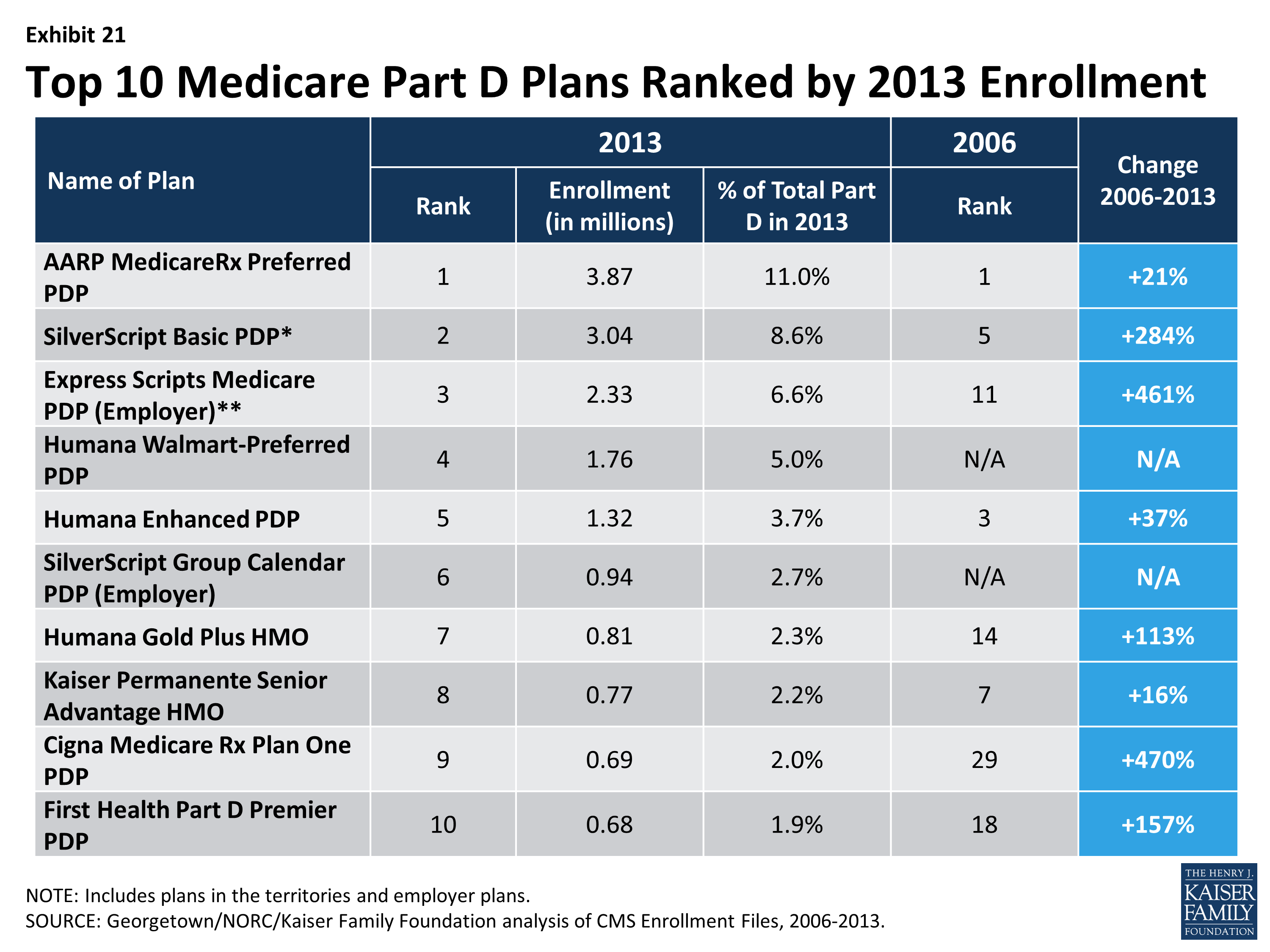

The Silver Plan pays 70 of covered medical costs for a typical enrollee. For example Silver Plan A which generally pays 70 of your health care expenses offers a high 2000 deductible and a. The SilverScript SmartRx PDP plan has a monthly drug premium of 730 and a 4450 drug deductible.

These are the payments you make each time you get care like 30 for a doctor visit. 01012019 12312019 UCare Silver Coverage for. Summary of Benefits and Coverage.

Silver Plans are also the only metal plans which offer cost-sharing reduction CSR versions to consumers that require financial assistance for out-of-pocket costs. Another plan might offer a low deductible with higher coinsurance. You pay moderate monthly premiums and moderate costs when you need care.

What this Plan Covers What You Pay For Covered Services Coverage Period. Generally you must pay all of the costs from providers up to the deductible amount before this plan begins to pay. How much does a Silver Plan cost.

If you qualify for cost sharing reductions or extra savings you can save a lot of money on deductibles copayments and coinsurance when you get care but only if you pick a Silver plan. HMO The Summary of Benefits and Coverage SBC document will help you choose a health plan. Bright Health has a total of 4 Silver plans.

You can get your med delivered to you and may also have 0 copays for those prescriptions. A competing silver plan might have a lower 2000 deductible but pair it with a higher coinsurance and a. The Summary of Benefits and Coverage SBC document will help you choose a health plan.

This covers the basic prescription benefit only and does not cover enhanced drug benefits such as medical benefits or hospital benefits. See a list of covered. This does not mean that 70 of actual costs will be covered for anyone given person.

Silver plans fall about in the middle. This means that a Silver plan must cover an average of 70 of all that plans enrollees covered out-of-pocket costs based on a standard population. CSRs lower the deductible copayments and coinsurance you pay if you enroll in a Silver plan.

These plans may have a higher premium but the overall cost of healthcare is often lower after the discounts.