You have to buy it with Part A or not at all. Medicare Part B deductible in 2020 in 198.

2020 Part B Deductible 2021 Part B Deductible Medicare Life Health

2020 Part B Deductible 2021 Part B Deductible Medicare Life Health

Medicare Part B comes with a 198 annual deductible in 2020.

Medicare supplement part b deductible 2020. Medicare Supplement benefit Plan F will not be offered to individuals newly eligible for Medicare on or after January 1 2020. After you spend this amount out of pocket on covered services you will usually pay 20 of. Congress rationale for this is.

This deductible will reset each year and the dollar amount may be subject to change. And once it does you are still typically responsible for a 20 percent Part B coinsurance for approved services. First lets look at how you can purchase Part B.

Because of this Plans C and F arent available to people newly eligible for Medicare on or after January 1 2020. Do You Itemize Deductions. Part of MACRA states that as of January 1 2020 Medicare Supplement plans are not allowed to pay for the Original Medicare Part B deductible.

Understand however that you can only deduct the portion. Part B coinsurance is 20 of the Medicare-approved amount of the services you receive. The co-pays will stay the same as well as the Part B excess charges.

The deductible for Medicare Part B is 203 per year in 2021. Lets get right to the point. If you have the 2020 Medicare Supplement Plan G then the only out-of-pocket cost thats going to increase for you is the Part B deductible going up 1300 from 185 to 198.

Medigap premiums can also be tax deductible. Part B wont pay for anything until you pay that amount each year that you use the coverage. Except for Plan F all HPHC plans and Original Medicare require that you pay the 198 Part B Deductible before other cost sharing applies.

The annual deductible for all Medicare Part B beneficiaries is 198 in 2020 an increase of 13 from the annual deductible of 185 in 2019. 12 Zeilen As of January 1 2020 Medigap plans sold to new people with Medicare arent allowed to. Note that the threshold for deducting medical expenses was originally set at 10 percent for 2019 but a tax bill that was enacted in late 2019 provided a two-year extension of the 75 percent threshold which means medical expenses in excess of 75 percent of AGI can be deducted if you itemize your tax deductions for 2019 andor 2020.

The annual deductible for all Medicare Part B beneficiaries is 203 in 2021 an increase of 5 from the annual deductible of 198 in 2020. In addition to a Part B deductible you must also pay coinsurance. But your Part B costs dont end just because youve met the deductible.

If you have the 2020 Medicare Supplement Plan N the only out-of-pocket increase will be the Part B deductible as well. HPHCs Medicare Supplement Plan Partial listing - Please see the Outline of Coverage for a complete list of benefits. After you enroll in Original Medicare Medicare Part A and Part B you may incur some out-of-pocket Medicare costs when you use your coverage.

Medigap plans sold to people who are newly eligible for Medicare arent allowed to cover the Part B deductible. If you already have or were covered by Plan C or F or the Plan F high deductible version before January 1 2020 you can keep your plan. Part B wont pay for anything until you pay that amount each year that you use the coverage.

Todays Video is about the Medicare Part B 2020 Annual Deductible. This isnt something that you can buy from a private insurance company like you can Part C or Part D or even 2020 Medicare Supplement Plans. The 2020 Medicare Part B deductible is 198 per year.

You can only get it through Medicare itself. For 2020 the Medicare Part B Deductible is 198 before Medicare Outpatient and Doctor serv. How Much is the Medicare Part B Deductible in 2020.

For 2020 you can deduct medical expenses only if you itemize deductions and only to the extent that total qualifying expenses exceeded 75 of AGI adjusted gross income. This deductible will reset each year and the dollar amount may be subject to change. For example you have to meet the Medicare Part B deductible 203 in 2021 before Part B will start covering some of the costs of your care.

The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. Medicare Supplement insurance Medigap. If you were eligible for Medicare before January 1 2020.

Well outpacing the COLA Social Security adjustment. The Medicare Part B deductible for 2020 is 198 in 2020. Part B is firmly entrenched at Medicare proper and you cant buy it on its own.

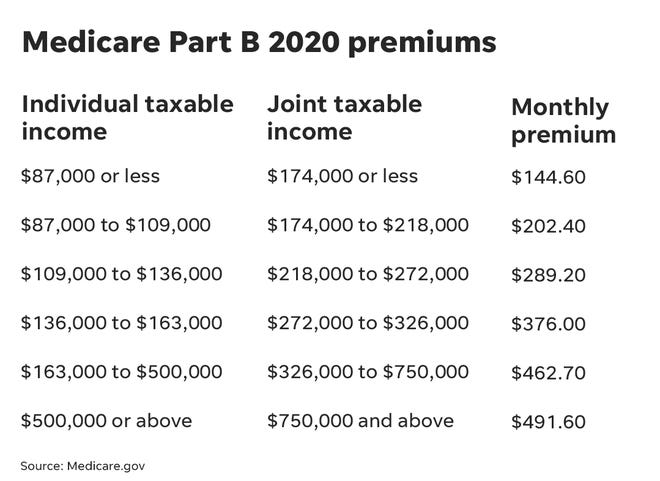

Medicare Part B premium in 2020 is 14460. This is a 1300 increase from where we were in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act 2021 and Other Extensions Act HR.

In 2020 the Medicare Part B deductible came in at 198.

:max_bytes(150000):strip_icc()/obamacare-explained-1272f608281e4887969aa0a14b1bff1c.png)

/GettyImages-1193052595-46eed140a7c54f758c94ddf7bfb2375f.jpg)