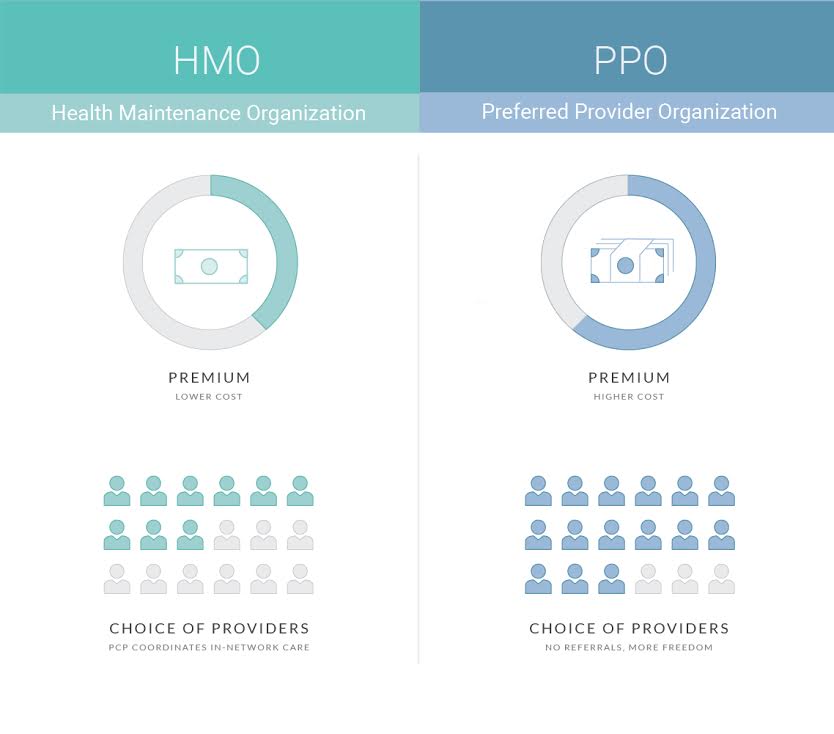

The difference between them is. PPOs are the most common type of health plan in the employer-sponsored health insurance market.

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo What S The Difference

HMO plans are generally less expensive than PPO plans with lower monthly payments making them ideal if your favorite doctors are already in the network or if.

What is the difference between hmo and ppo insurance. HMO stands for health maintenance organization. However PPO plans offer flexibility by covering out-of-network providers at. Thus the difference between HMO and PPO plans include network size ability to see specialists costs and out-of-network coverage.

5 Zeilen To start HMO stands for Health Maintenance Organization and the coverage restricts patients to a. The differences besides acronyms are distinct. But the major differences between HMO and PPO plans are based on the cost size of the plan network your ability to see experts and coverage for out-of-network services.

5 Zeilen The additional coverage and flexibility you get from a PPO means that PPO plans will generally. PPO stands for preferred provider organization. A PPO insurance plan gives greater choices.

What is PPO insurance. HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs. What Is the Difference Between an HMO and a PPO.

An HMO insurance is a Health Maintenance Organization while PPO stands for Preferred Provider Organization. All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care. If the alphabet soup of health insurance jargon still has you scratching your head take heart.

HMOs have lower premiums and out-of-pocket expenses but less flexibility. 7 Differences Between an HMO vs. The differences besides acronyms are discrete.

You dont need a referral from a primary care physician to see most specialists and you can visit providers not contracted by the insurance company. But the major differences between the two plans. The cost of HMO plans is less but PPO plans offer greater flexibility and have larger networks compared to HMO plans.

Both HMO and PPO plans rely on using in-network providers. Lets take a look at some of the most common differences between these two types of health insurance plans. Here is a quick rundown of these two popular health insurance options and the difference between an HMO and PPO.

An HMO is a Health Maintenance Organization while PPO stands for Preferred Provider Organization. Selecting health insurance is often one of the most important decisions you will make. HMOs have smaller costs and out-of-pocket costs but are less flexible- Lower rates and out-of-pocket costs are the biggest draws for HMOs.

Health maintenance organizations HMOs and preferred provider organizations PPOs are types of managed health-care plans and can cost much less than comprehensive individual policies.