Low cost or no cost health insurance coverage that is. Most types of TRICARE coverage.

How To Get Cheap Health Insurance In 2021 Valuepenguin

The National CLAS Standards are intended to advance health equity improve quality and help eliminate health care disparities by establishing a blueprint for individuals and health care organizations to follow.

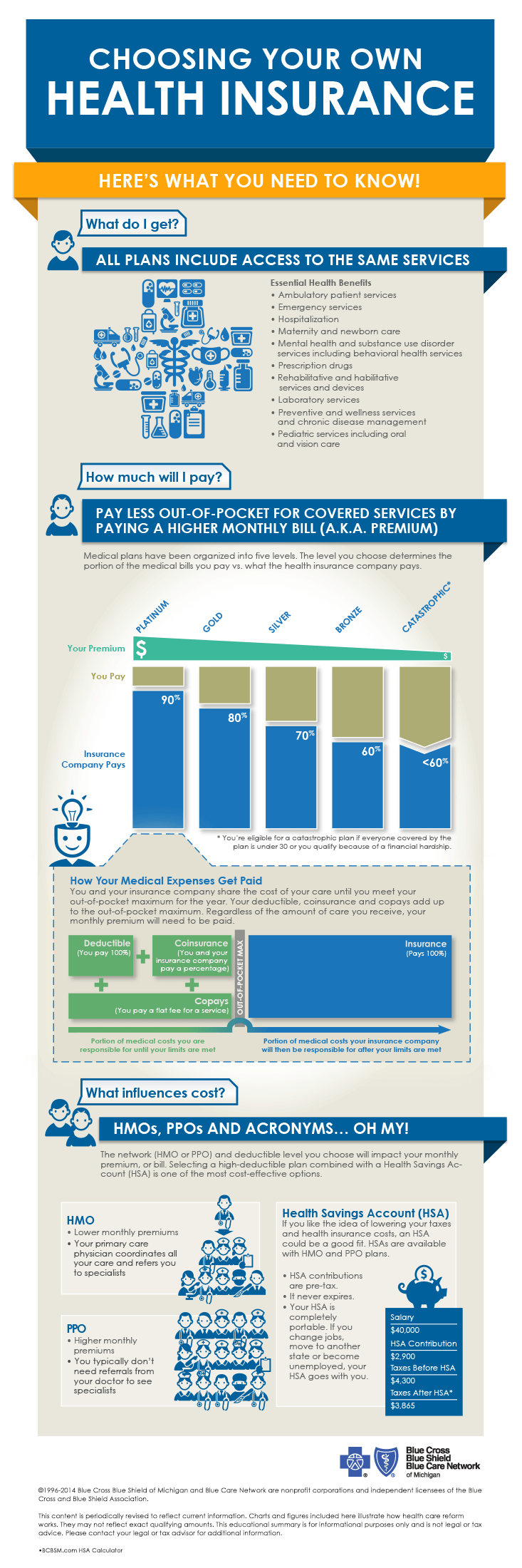

Independent medical insurance plans. Independent Care Health Plan has adopted all National Standards for Culturally and Linguistically Appropriate Services CLAS. According to eHealth Insurance the average cost of an individual plan purchased on your own is 440 per month. Individual major medical insurance purchased from the Health Insurance Marketplace ie HealthCaregov or a state-based exchange Health insurance purchased in the private market eg directly from an insurance company Most Medicaid.

3 BCBS members have access to plans through health maintenance organizations HMOs exclusive provider organizations EPOs and preferred provider organizations PPOs. To put it simply the broker may not mislead or lie to either you or the insurance. The California Department of Insurance CDI administers an Independent Medical Review program that enables you the insured to request an impartial appraisal of medical decisions.

This means that after you have found the plan that is in your best interest the broker must represent the insurance company while helping you complete the application. Group health insurance and health benefit plans are insured or administered by CHLIC Connecticut General Life Insurance Company CGLIC or their affiliates see a listing of the legal entities that insure. Get Medical Plans are an independent medical insurance adviser for personal healthcare business healthcare dental Insurance.

There are 36 BCBS independent health insurance companies in the US. Independent Health offers a wide variety of health plans and services to meet the needs of you and your family. Enrollment in Independence Medicare Advantage plans depends on contract renewal.

Choose your plan based on your health care needs preferred providers and how much you can afford. Individual and family medical and dental insurance plans are insured by Cigna Health and Life Insurance Company CHLIC Cigna HealthCare of Arizona Inc Cigna HealthCare of Illinois Inc and Cigna HealthCare of North Carolina Inc. However costs vary among the wide selection of health plans.

Shop and compare health insurance plans. Click the buttons below to explore these two main options. Insurance bundles that let you personalize your coverage by purchasing two or more plans together such as vision and dental insurance short term coverage and dental insurance and more.

An independent insurance broker is appointed with many different competing insurance companies and they can meet with you in person to show you all of the plans available in your state so that you can make an informed decision on what may be the best fit. 0 Preventive Services FREE preventive care services including routine annual checkups immunizations mammograms and more. Stay up-to-date on COVID-19 Coronavirus For Our Members For Our Providers.

Comparison shopping between healthcare plans such as Medigap versus Medicare Advantage can be quite confusing. Independent medical insurance is typically more affordable than COBRA coverage. Our selection of family and individual health insurance plans offers you the perfect coverage.

Take the time to get several quotes and find a policy that will cover your current needs. At a price that. Click the icons below to learn more about our helpful plan benefits that are available with many of our plans right from the start.

Look at several insurance companies and plans and shop for the best coverage and price. If you missed the deadline you may be able to enroll if you experience a Qualifying Life Event. Based in London we offer advise on products from leading medical insurance providers working closely with you until we have found a plan which you are satisfied with.

The next Open Enrollment period beings November 1 2021. The average cost of a family plan is 1168. See if you qualify.

You must be enrolled in Part A and Part B in order to enroll into Medicare Advantage or Medicare Supplement. And most have an AM Best financial strength rating of A excellent. In 2020 the average national cost for health insurance is 456 for an individual and 1152 for a family per month.

Understanding the relationship between health coverage and cost can help you choose the right health insurance for you. This comes to 5280 per year for an. Before you choose one of these options you first need Part A and Part B of Medicare.

Independence Blue Cross offers products through its subsidiaries Independence Hospital Indemnity Plan Keystone Health Plan East and QCC Insurance Company independent. Your agent will compare your options to find the coverage thats right for you. Once the independent Medicare insurance broker and you have selected the insurance plan and price that is in your best interest the independent Medicare insurance broker must then act as a field underwriter.

Open enrollment ended January 15 2021. See affordable health insurance plans. Medicare Advantage Plans and Medicare Supplement Plans are the two most popular options.

Learn more about private health insurance and how it works. Independence Blue Cross offers Medicare Advantage plans with a Medicare contract. An Independent Medical Review IMR is a process in which expert independent medical professionals are selected to review specific medical decisions made by the insurance company.

To be eligible for one of our plans you must be a resident of Pennsylvania and live in one of the following counties served by Independence. When it comes to considering your Medicare options you can spend hours doing your own research or you can speak to a local licensed agent with HealthMarkets. Medicare Part A coverage.