Coverage can begin as early as April 1 2021. 1 of 2 Benefit Plans A Select B Select D and Select E See Outlines of Coverage sections for details about ALL plans.

Https Www Bcbsil Com Medicare Pdf Pdp Eoc Plus Il 2021 Pdf

Dental benefits for more than 370000 Albertans are paid according to the Alberta Blue Cross Dental Schedule.

Blue cross plan d coverage. The Blue Cross Part D benefit is an annual benefit that may be renewed annually. Starting Feb 1 2021 Blue Cross will offer this package to all Medicare Supplement members. Read our BCBS Medicare Advantage plans review.

Insurance companies have the option of not renewing a Part D Plan for a particular State or can change the plans benefits and premiums. Or to bundle all your Medicare coverage into one plan consider Medicare Advantage Part C. Blue Cross Blue Shield members can search for doctors hospitals and dentists.

Blue Cross MedicareRx PDP Plan Blue Cross MedicareRx goes beyond Original Medicare to offer coverage for prescription drugs. They also sell Medigap plans to supplement your Original Medicare. This is true of any Part D coverage no matter which insurance.

With the constant changes in provincial health care plans affordable protection against unexpected medical expenses is important to. Private insurance companies such as BlueCross BlueShield offer Medigap policies to new enrollees. BLUE CROSS AND BLUE SHIELD OF FLORIDA INC OUTLINE OF MEDICARE SUPPLEMENT COVERAGE Cover page.

Up to 300 allowance for eyeglass frames or contact lenses. These charts show the benefits included in each of the standard Medicare supplement plans. Blue Cross Coverage Whether youre an employer looking for a benefits plan to offer your employees self-employed between jobs or retired there is a perfect health care package of benefits available through the Blue Cross in your area.

Outside the United States. In the United States Puerto Rico and US. And with copays as low as 0 weve got your Medicare Part D benefits covered.

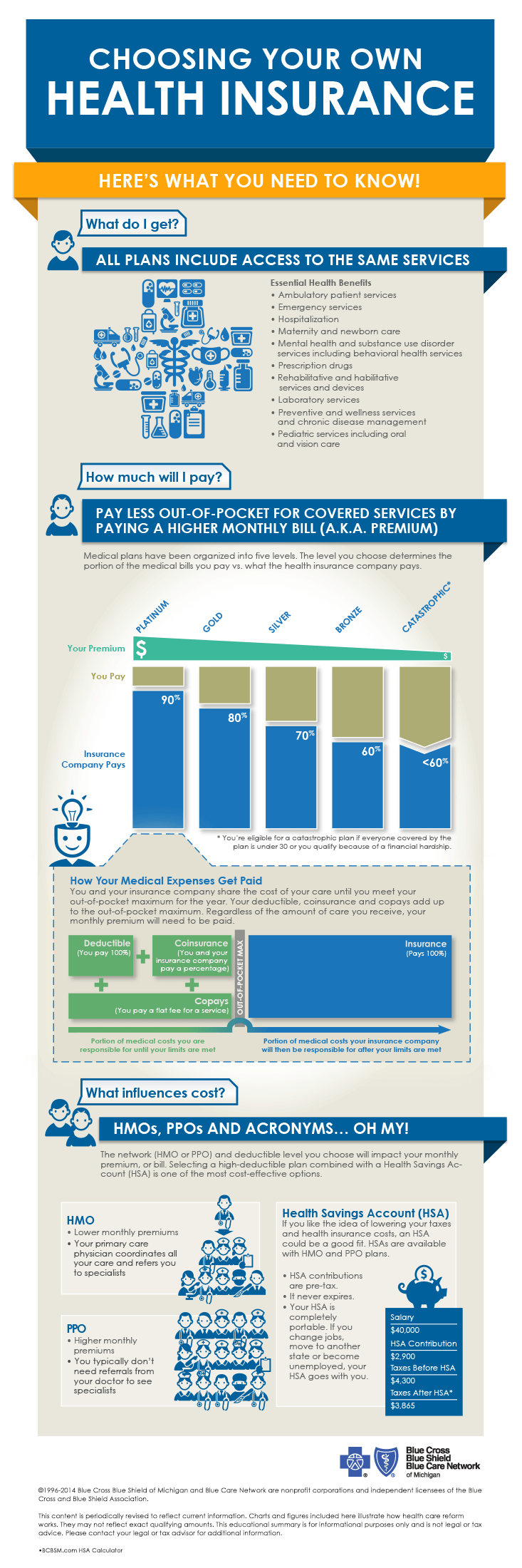

Anthem offers Medicare Part D plans with excellent coverage low monthly premiums and low or no deductibles. Our HMO Blue Blue Choice and Blue Care Elect Preferred SM plans include coverage for one routine eye exam per calendar year. To save money for you and your plan Alberta Blue Cross individual health plans that provide prescription drug coverage pay according to the Least Cost Alternative LCA price where interchangeable products can be used.

Our HMO Blue New England and Blue Choice New England plans include coverage for one routine eye exam every. These policies help with Medicare out. Even better 24000 of those are preferred pharmacies we work with to help you save on many prescription drugs.

Dental exams and cleanings at no additional cost. Every company must make available Plan. You should review your Part D coverage on an annual basis to ensure that any changes will still give you the coverage you need.

Select Blue Cross Blue Shield Global or GeoBlue if you have international coverage and need to find care outside the United States. We have more than 66000 pharmacies in our network thats almost every pharmacy in America. Learn more about Medicare Part D.

Blue Cross and Blue Shield of Vermont in a joint venture with three other New England Blue plans contracts with the Federal Government to offer Medicare prescription drug coverage called Blue MedicareRx PDP. MedicareBlue Rx is closely monitoring the spread of the novel coronavirus and the disease it causes COVID-19 to determine how it could affect our members employees and the communities that we serve. Blue Cross Blue Shield BCBS offers far more than Part D coverage.

If you have a few prescriptions or a lot Blue Cross and Blue Shield of Illinois offers plans that can work for your health care needs and budget. Whether youre self-employed working without employer benefits or an early retiree Alberta Blue Cross has an individual health plan for you. Our Medicare Part D plan offers you the power of Blue.

A formulary is a list of covered drugs. Independence Blue Cross contracts with FutureScripts Secure to provide Medicare Part D prescription benefit management services. MediBlue Rx Enhanced Part D Plan Lowest premium of all 3 plans.

If you are enrolled in a Medicare Advantage plan and enroll in Blue MedicareRx you will be automatically disenrolled from your Medicare Advantage plan. As a California resident you could save on medications with a Medicare Part D prescription drug plan PDP from Anthem Blue Cross. Find coverage to suit your lifestyle and budget.

If you already have a Medicare Advantage plan with Part D coverage Medicare HMO Blue or Medicare PPO Blue plans you wont need to purchase a prescription drug plan. Part D coverage from Blue Cross Blue Shield Manage your costs with a prescription drug plan from MedicareBlue Rx. Original Medicare doesnt cover the drugs you get from a pharmacy so adding a California Medicare Part D plan to your Medicare coverage can be valuable.

This list of drugs is carefully selected by the plan with help from a team of doctors and pharmacists. This additional coverage gives you.