Do not confuse your Medicare Supplement Plan D insurance coverage with Medicare Part D prescription drug coverage. All Medicare Supplement Plan D policies cover the same expenses no matter which health insurance company you choose.

Medicare Plan D What You Need To Know Ensurem

Medicare Plan D What You Need To Know Ensurem

Plan D will cover some costs which are not fully covered by your Medicare health insurance coverage.

Medicare supplement plan d. Medigap Plan D is one of the standardized Medicare Supplement plans that private insurers offer to cover the gaps in your Original Medicare coverage. Medicare Supplement Plan D and Medicare Part D Differences Provides prescription drug coverage to Medicare beneficiaries A standalone Part D plan works with Original Medicare but prescription drug coverage can be included in a Medicare. Find a Medicare plan You can shop here for drug plans Part D and Medicare Advantage Plans.

Plan D covers most of the expenses that are not paid by Medicare. Medicare Supplement Plan D also referred to as Medigap Plan D is an insurance plan that companies offer consumers to cover the gaps in Original Medicare. Because people have different needs circumstances expectations and budgets Indiana Farm Bureau Health Plans offers four Medicare Supplement plans.

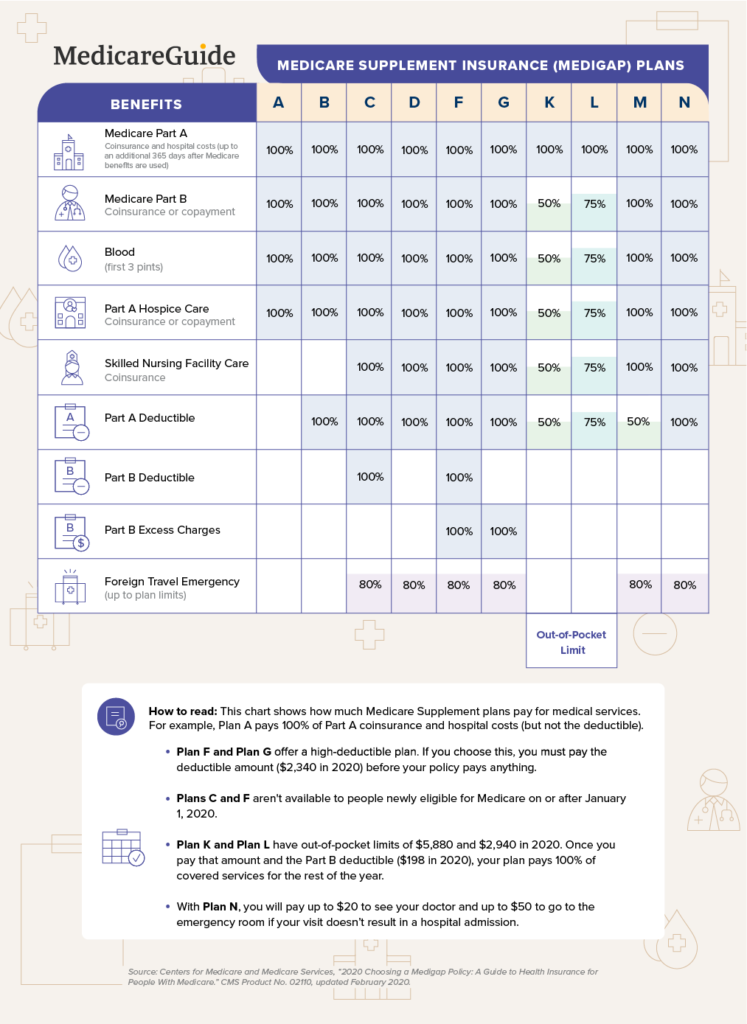

Starting Feb 1 2021 Blue Cross will offer this package to all Medicare Supplement members. Part A hospital coinsurance and hospital costs up to an extra 365 days after Original Medicare benefits are exhausted. The Medicare Supplement Plan D is only one of 10 different supplemental insurance plans.

Part D Medicare drug coverage helps cover cost of prescription drugs may lower your costs and protect against higher costs. Plan D provides beneficiaries with a decent amount of coverage. Medicare Supplement Medigap Plan.

Plan D is found to be between the other plans offering the. Medicare Supplement Plan D. Medicare Supplement Plans Plan D.

An excess charge is an additional amount you will pay if a provider charges more than the Medicare allowed amount. Coverage can begin as early as April 1 2021. Medicare Supplement Plan D.

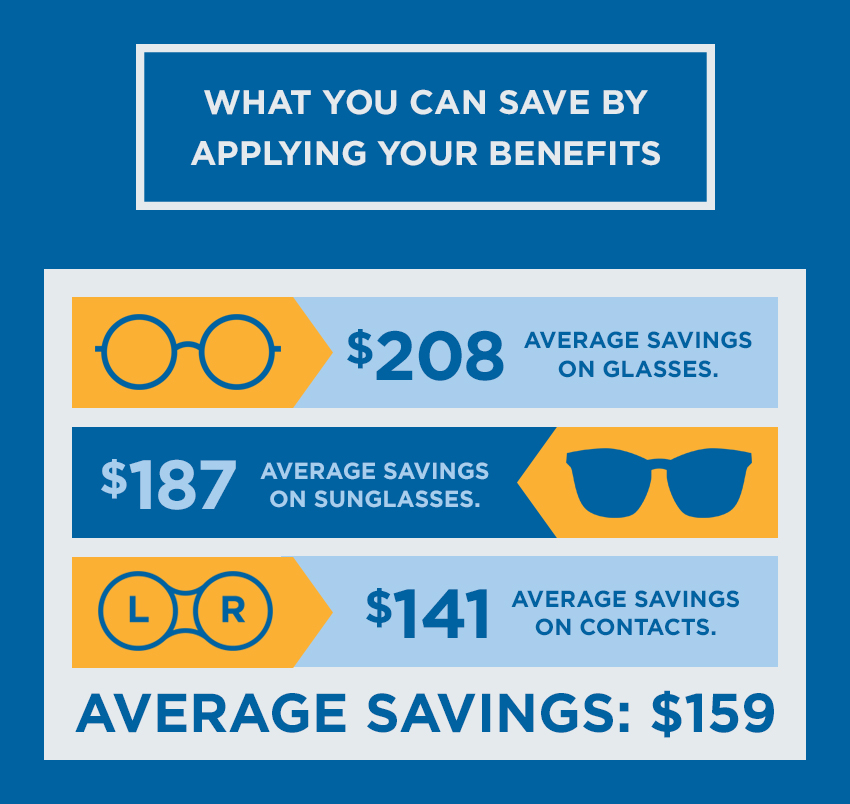

You will pay out-of-pocket for these two minor items if you purchase a Medicare Plan D. For a little more than 15 a month you can add dental vision and hearing coverage to your Medicare Supplement plan. Medicare Part D on the other hand is your prescription drug coverage.

A Medicare Supplement plan otherwise known as Medigap coverage from Indiana Farm Bureau Health Plans will help pay for many costs not covered by Medicare. This additional coverage gives you. Dental exams and cleanings at no additional cost.

It is important to note that Medicare Supplement Plan D is not the same as Medicare Part D which covers prescription drugs. Part A hospice care coinsurance payment or copayment. Medicare Supplement Plan D is one of 10 lettered Medicare Supplement insurance options that you can choose from when purchasing Supplemental health insurance.

This plan offers coverage that is halfway between the minimum coverage in Plan A and the more comprehensive coverage found in Plan G. It does not offer coverage for dental and vision care along with hearing aids and glasses. Learn about Plan D benefits and costs.

Medigap Plan D provides the following benefits. Unlike Medicare Part D Medicare Supplement Plan D is not a prescription drug plan and will not cover prescription drug costs. Compare Medigap Plan D rates.

Can have either Part A or Part B to enroll. A Medigap Plan D policy covers most of the gaps in Medicare for you with the exception of the Part B deductible and also any excess charges. Medicare Supplement Plan D is one of the insurance plans used to help cover certain costs not covered by Original Medicare.

Part B copayment or coinsurance payment. Medigap Plan D Coverage Plan D. Medigap Plan D is a Medicare Supplement policy that helps supplement Original Medicare.

Medicare Supplement Plan D covers most out-of-pocket expenses except the Part B deductible and excess charges. Medicare Supplement Insurance also called Medigap is a type of private insurance that is used together with your Original Medicare coverage Medicare Part A and Part B to help cover certain Medicare out-of-pocket expenses such as copays and deductibles. Medicare Supplement Medigap Plan D is easy to confuse with Medicare Part D but take care not to mix them up.

If youre looking for an option with middle-of-the-road monthly premiums and benefits Medicare Supplement Plan D deserves some consideration.