If you are pregnant Office visits Prenatal. BlueRx Card 100200 then 50 coinsurance.

Blue Cross Blue Shield Amends Error Ridden 2018 Benefits Outline Michigan Radio

The 30 you paid was applied toward your coinsurance.

Blue cross blue shield coinsurance. After the out-of-pocket is met in-network covered services are paid at 100 by Blue Cross Blue Shield of Rhode Island. 1 Cameron Hill Circle Chattanooga TN 37402-0001. If youre a member of a federally recognized tribe you may qualify for additional cost-sharing benefits.

Blue Cross and Blue Shield. We will reduce benefits for the inpatient hospital stay by 500 if no one contacts us for Physiciansurgeon fees 15 coinsurance 35 coinsurance Prior approval is required for certain surgical services If you need mental health behavioral. Youve paid 1500 in health care expenses and met your deductible.

Mail order is subject to retail deductiblecoinsurance. 20 coinsurance after deductible Postnatal. Advertentie Compare 50 Global Health Insurance Plans for Expats living abroad.

The 30 percent you pay is your coinsurance. Now your coinsurance balance is 970. After you pay the deductible you pay 20 percent of your health care costs until you reach your maximum out-of-pocket amount 6000.

Watch this short video to learn more. Any additional costs are paid by the member out of pocket. Inpatient services No charge after deductible 20 coinsurance after deductible Preauthorization is required.

You must pay 4000 toward your covered medical costs before your health plan begins to cover costs. Insurance pays 70 or 70. You can get this discount if your income is below a certain level and you choose an insurance plan from the Silver plan category.

You are once again responsible for the 4000 deductible. For example your plan pays 70 percent. Must use designated specialty pharmacy for all specialty prescriptions.

When youve paid 5000 out of your pocket toward your medical costs your plan covers 100 of your costs until your plan year renews. A provision in a members coverage that limits the amount of coverage by the plan to a certain percentage commonly 80 percent. Deductible does not apply Postnatal.

When the next plan year begins your deductible and coinsurance reset. The percentage you pay for covered services. You really ought to know.

Advertentie Compare 50 Global Health Insurance Plans for Expats living abroad. Learn more about coinsurance and how to calculate your costs below. In this example you pay the first 5000 your deductible before your plan begins to pay.

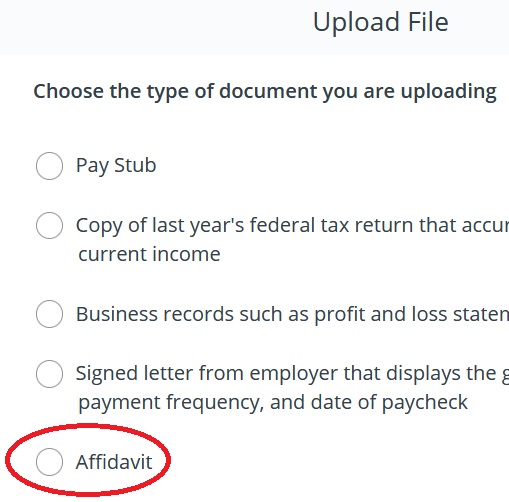

A discount that lowers the amount you have to pay out-of-pocket for deductibles coinsurance and copayments. You must pay the first 5000 of your medical costs. After that your plan covers 80 of the costs and you pay the other 20.

1998-2021 BlueCross BlueShield of Tennessee Inc an Independent Licensee of the Blue Cross Blue Shield Association. Out-of-pocket maximum of 5000. Out-of-pocket maximum The maximum amount you would pay out-of-pocket for covered healthcare services each year including deductible copays and coinsurance.

After you pay the 4000 deductible your health plan covers 70 of the costs and you pay the other 30. A plan is good for 1 year. This amount is a percentage of the total cost of carefor example 20and your Blue Cross plan covers the rest.

Coinsurance is the amount you pay for covered health care after you meet your deductible. No charge after deductible Prenatal. BlueCross BlueShield of Tennessee is a Qualified Health Plan issuer in the Health Insurance Marketplace.

When the amount of coinsurance youve paid reaches 6000 the plan covers 100 until your plan year renews. If your plan has a deductible you pay your coinsurance for covered services once the deductible is met. Deductible does not apply.

Get a Free Quote. Also referred to as cost sharing its part of the total cost of medical or hospital services you receive. When you go to the doctor instead of paying all costs you and your plan share the cost.

Copays deductibles and coinsurance make up your out-of-pocket costs or out-of-pocket maximum. Get a Free Quote. Out-of-pocket maximum of 6000.

Precertification is required for inpatient hospital stays. You start paying coinsurance after youve paid your plans deductible. A plan is good for 1 year.