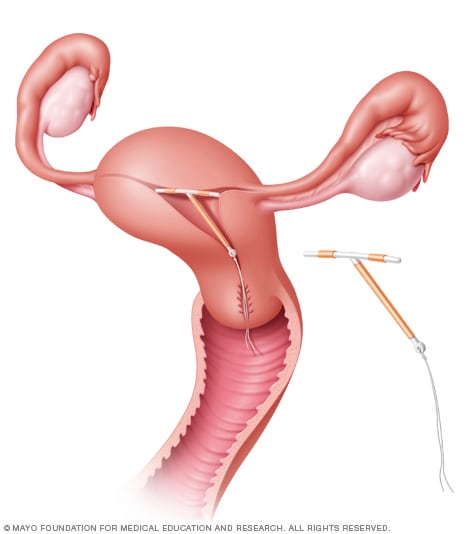

The copper IUD is one of the most effective forms of birth control. If your IUD is due to be replaced and you do not want to get pregnant use condoms or the progestogen-only pill for now.

Intrauterine Devices Why An Iud May Be Right For You Lewisgale Physicians

Intrauterine Devices Why An Iud May Be Right For You Lewisgale Physicians

It is nonhormonal so people who are unable to take hormonal birth control can use this device.

How long can a copper iud stay in. In terms of longevity the copper IUD is the epitome of this set-it-and-forget-it form of birth control offering a full decade of pregnancy protection. As emergency contraception after unprotected sex copper IUD. WHEN DOES THE COPPER IUD START WORKING.

Delucia says the copper IUD lasts a bit longer. An IUD also has a limited lifespan. The copper IUD can stay in place for 5 or 10 years depending on the type you choose.

In fact since copper IUDs are non-hormonal you could theoretically get pregnant the same day. The Copper T can remain in the womb for up to 10 years. Once in place Paragard provides continuous pregnancy prevention for up to 10 years but can be removed by a healthcare provider at any time sooner if you decide you want to get pregnant.

Removal and return to fertilityedit. It can remain in place for up to 10 years and can be removed at any time if you decide you want to become pregnant. An additional advantage of using the copper IUD for emergency contraception is that it can be used as a form of birth control for 1012 years after insertion.

Its safe to use while breastfeeding following childbirth. If youre under 16 years old. Copper T is usually done at the end of the menstrual period.

AFTER THE COPPER IUD IS INSERTED WHEN CAN I HAVE SEX. The copper IUD works right after it is placed in you. Contraceptive implants are matchstick-size rods that are inserted into the arm for up to three years while IUDs are currently approved for.

In 1980 the ICCR worked with the Population Council to continue refinement of the the design of the copper IUD. If you are aged 40 years or more when it is put in your doctor may advise you that it can be kept in place until menopause. How long does the Paragard IUD last.

It provides birth control for 10 years However no matter how long your intrauterine device lasts you can go. It usually prevents pregnancy for about 10 years after insertion. They should be removed from the uterus after this time.

Hormonal-based IUDs have varying. Although rare your IUD can move which increases your risk of pregnancy and other complications. HOW LONG CAN I LEAVE MY IUD IN.

Modern IUDs including copper ones dont have this flaw and dont have the same risks. Due to the increased amount of copper in the device the Copper T 380 remains effective for a minimum of six years. How do I check to see if it remains in place.

No method of birth control is 100 effective. There are nylon threads attached to the end of the Copper. An IUD can stay in place for three five or 10 years before it needs to be replaced depending on the type of IUD.

IUDs are normally used for 5 or 10 years but can be left in for longer. There are many other benefits to using a copper IUD. The copper IUD is over 99 effective.

It can be used for EC up to five days after the act of unprotected sex and does not decrease in effectiveness during the five days. IUD displacement is most common within the first few months after you get it put in. It must be checked six weeks after insertion and once every year.

Copper-based IUDs prevent pregnancy for up to 12 years after insertion. When you have it put in the nurse or doctor will tell you when you will need to have it replaced. How long can the Copper T remain in the womb.

You must wait 24 hours after the IUD is placed before you can use tampons take a bath or have sex.