You may need to pay a premium copays coinsurance and other out-of-pocket expenses. 5 Zeilen The Part A inpatient hospital deductible covers beneficiaries share of costs for the first 60.

2017 Medicare Parts A B Premiums And Deductibles Announced Fhk Insurancefhk Insurance

2017 Medicare Parts A B Premiums And Deductibles Announced Fhk Insurancefhk Insurance

Medicare Part A cost-sharing amounts for 2021 are listed below.

What is medicare part a deductible. In this instance the charges for the treatment doctor and the sling will count toward your Part B deductible. After the deductible Medicare. In 2021 Medicare Part A comes with a 1408 deductible the amount you must pay in out-of-pocket expenses before coverage kicks in for each benefit period.

Here at Max Out of Pocket we like to keep track of any and all out-of-pocket costs. The Part A deductible for 2020 is 1408 for each benefit period. We explain what you may expect to pay.

5 Zeilen The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to. Unlike Part A your deductible isnt tied to a benefit period or other complicated formulas. Part A is your hospital insurance.

Medicare Part A covers hospital bills nursing services and some home health services and care. Medicare Part A Deductible 1408 for 2020 14 Benjamins a Lincoln and 3 Golden Dollars 2020 Medicare Part A Deductible. Medicare Part A Deductible Medicare was designed with the goal of providing all senior citizens in America with reliable and affordable health care coverage.

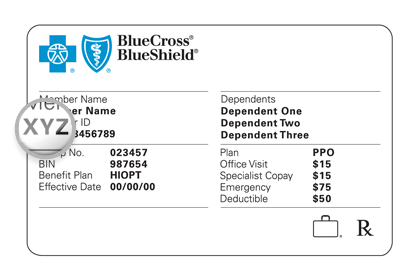

Part A and Part B. This period begins when you are admitted to a hospital or nursing home for up to 60 consecutive days and ends 60 days after youve left. The deductible in 2019 is 1364.

En español The 2020 deductible for Medicare Part A is 1408 for each benefit period. Keep in mind this post is only referring to the traditional Medicare Part A program. The exact services covered vary according to your physical condition federal policy and the claims review process.

Unfortunately its a cost we need to plan for. Some people call it original Medicare. Even those that might occur for us in the future.

You must pay the hospital or nursing home deductible for each benefit period. You can have multiple benefit periods in a single calendar year which means you can pay multiple deductibles. Stays at skilled nursing facilities.

Part A covers inpatient services and most of the care you get during a stay in the hospital. Medicare Part A has costs. Part B would cover the cost of the care if you are treated as an outpatient and Medicare Part A would cover any services receive if you are formally admitted as an inpatient.

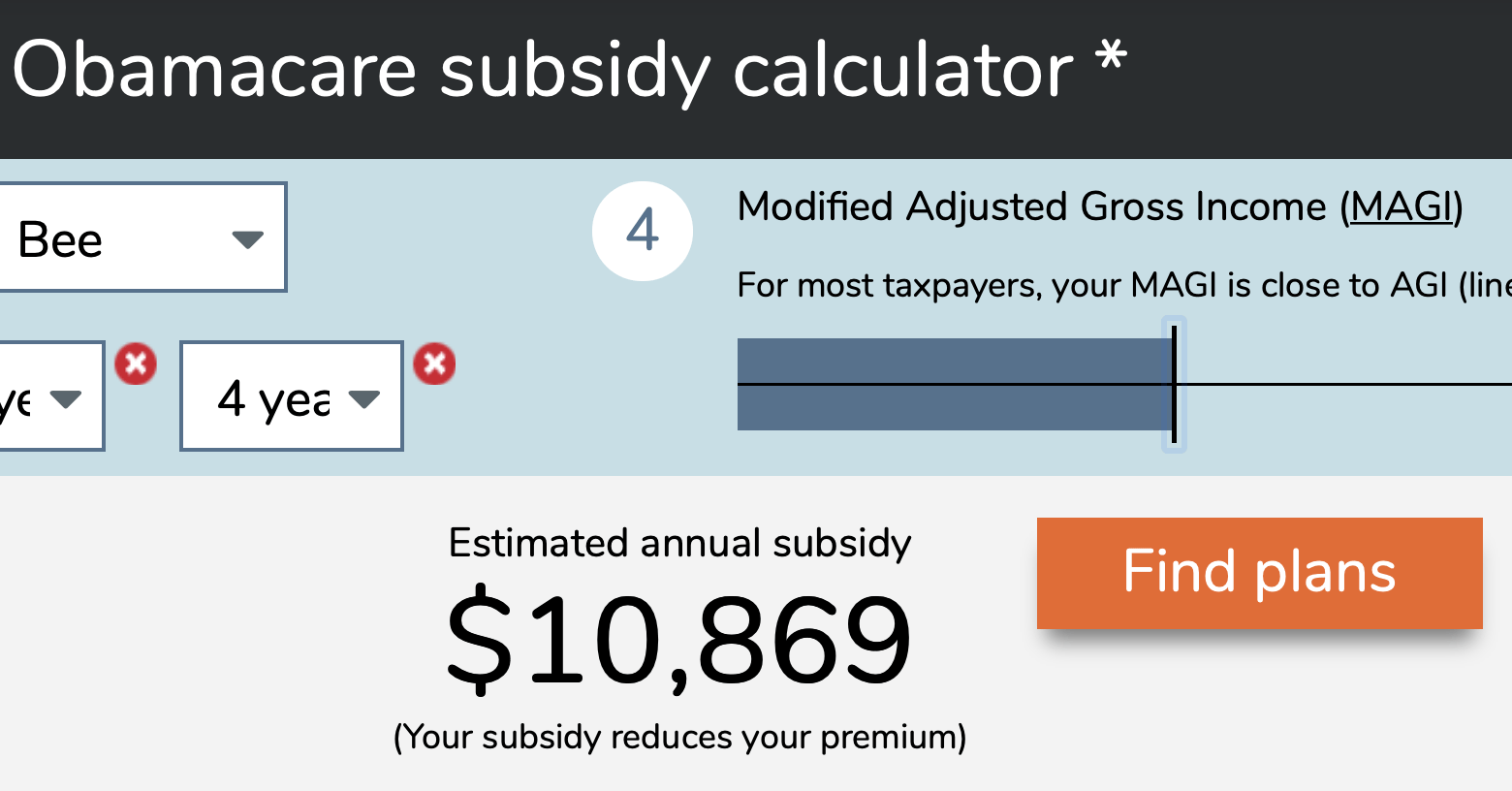

Medicare Part A deductible. The Medicare Part B deductible in 2021 is 203 per year and the Part A deductible is 1484 per benefit period. Medicare Part A Deductible With Part A the benefit period is different.

Medicare Part A and Part B make up the federal program known as Original Medicare. Part A wont cover a private room private nursing personal care items or a television. 0 coinsurance for the first 60 days of each benefit period.

A benefit period starts on the day you are admitted to. 1484 for each benefit period. That leaves you on the hook for only 20.

Those are explained below. Medicare Part A coinsurance. The program also strives to provide senior citizens with quality coverage and while the program eliminates many costs associated with health care for seniors the system still has premiums co-insurances and deductibles that beneficiaries must pay.

Learn more about these costs and what you can expect. That means you may have to pay a certain amount the deductible before Medicare kicks in and you may have to pay some part of services coinsurance. If youre eligible for Medicare Part A and Part B you might be enrolled automatically.

Speak with a licensed insurance agent 1-800-557-6059 TTY 711 247. Learn more about how you qualify for Medicare. Beyond the usually free premiums Medicare Part A has a deductible and coinsurance that depend on how long you need coverage.

Medicare patients get billed for the Medicare Part A deductible when they land in the hospital as an inpatient. Local companies in each state review claims and set standards for what Medicare will pay. A benefit period begins the day youre admitted to a hospital and ends once you havent received in-hospital care for 60 days.

The Medicare Part A Deductible. Even if your hospital stay is approved you Read More. 371 a day for the 61st to 90th days of each benefit period.

Once you pay your 203 which is likely to happen after your first or second doctor visit or procedure of the year Medicare pays 80 of the Medicare-approved amount. If so how much is the deductible.