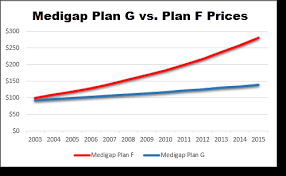

The only cost that Medigap Plan G doesnt cover is the Part B deductible. Plan G offers the same coverage as Plan F except for a single difference.

Medicare Supplement Plans F G Facts And Fiction Medicare Supplement Medicare Supplement Plans Medicare

Medicare Supplement Plans F G Facts And Fiction Medicare Supplement Medicare Supplement Plans Medicare

Plan G and Plan N premiums are lower to reflect that.

Medicare plan f & g. This means that you will have to pay 183 annually before Plan G begins to cover anything. First Plan G has lower premiums than Plan F. Medigap plans F and G are supplemental health insurance plans that work in conjunction with original Medicare.

However once the Part B deductible for Plan G is paid for you essentially have Plan F. For 2021 the Part B deductible is 203 per year. Ad No Account Needed to Order Checkout As Guest For Faster Order Processing.

Discover the key differences between Medicare Supplement Insurance Plan F and the Medigap plan that may soon become the most popular Medigap plan Medigap Plan G. Plan F is the best plan and Plan G is the 2nd. Protect the best years ahead.

Plan F covers one more benefit than Plan G which is the Part B deductible. Shop 2020 Medicare plans. Plan G does not cover the Part B deductible the Part B deductible for 2018 is 183.

Protect the best years ahead. Plans F and G. As mentioned above these are your medical insurance costs which can be some of the more expensive hospital services.

However when it comes to the monthly premium if you think lower is better then Plan G may be better for you. Ad No Account Needed to Order Checkout As Guest For Faster Order Processing. Those who already have Plan F or were new to Medicare prior to January 1 2020 may still have a Plan F policy.

Plan G may be a good option if you are new to Medicare and cant enroll in Plan. When you compare the lower premium benefit of Plan G you can save 500 or more. Ultimately Plan G has the same benefits as the Plan F except for coverage for the Part B deductible 203 for.

Close to 34 percent of all Medicare beneficiaries are enrolled in a Medicare supplement insurance Medigap plan. Plan F and Plan G are the most comprehensive Medicare Supplement Insurance plans available. Even though it has similar coverage Medigap Plan Gs monthly premiums are typically much less expensive than those for Plan F.

In Florida one company charges an annual premium of 2738 for Plan F and 2496 for Plan G a difference of 242. Medicare Supplement Plan F is the most comprehensive plan. Ad Find affordable quality Medicare insurance plans that meet your needs.

Ad Find affordable quality Medicare insurance plans that meet your needs. Diagnostics Equipment Consumables Stethoscopes First Aid Much More. There are two big differences between Medicare Plan F and Plan G.

It does not cover the Medicare Part B deductible. Private insurance companies offer them. Second you will pay a 203 Part B deductible in 2021.

On January 1 2020 changes to Medicare meant that Plan F and Plan C were phased out for people new to Medicare. Watch video to learn more. 7 Plan G will typically have higher premiums than Plan N because it includes more coverage.

16 rows Most people will select Plan F or Plan G. Diagnostics Equipment Consumables Stethoscopes First Aid Much More. In Washington a Plan Fs premium is 2568 and the Plan G1896 a.

When it comes to coverage Plan F will give you the most coverage since its a first-dollar coverage plan and leaves you with zero out of pocket costs. Medicare Supplement Plans F and G are identical with the exception of one thing. Shop 2020 Medicare plans.

What do you consider better. So the answer to the question depends on you. In some cases the difference in premiums between the two plans may be so large that you could save money by choosing Plan G even after the Part B deductible.

Medicare Supplement Plan F Plan G and Plan N Explained Plan N F and G are all under Medicare Supplement Plans or Medigap Plans.