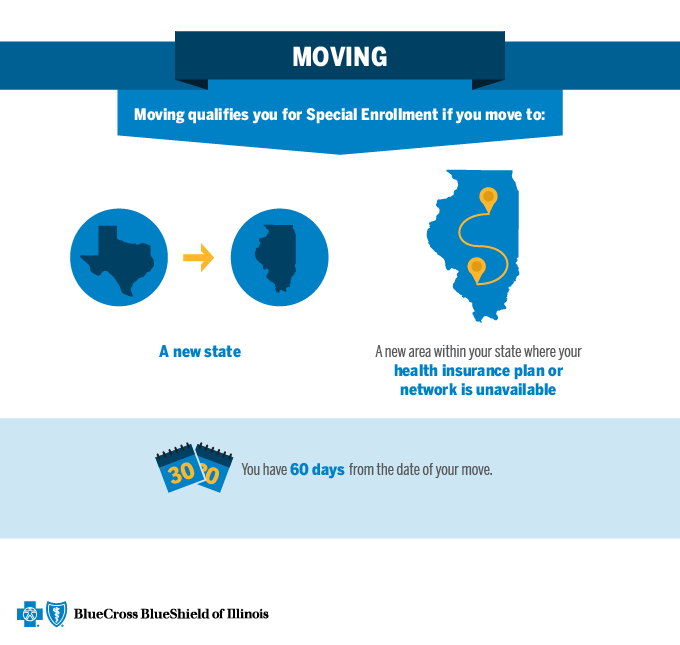

They can also cancel their plan coverage if a qualifying life event. Marriage and divorce if the exchange or insurer counts it as a qualifying event loss of other coverage as long as the coverage youre losing is considered minimum essential coverage a permanent move to an area where different health plans are available as long as you already had coverage prior to the move.

Qualifying Event Moving Blue Cross And Blue Shield Of Illinois

Qualifying Event Moving Blue Cross And Blue Shield Of Illinois

Moving to a different ZIP code or county that changes your health plan area.

Is moving a qualifying event for health insurance. This counts as a qualifying life event to purchase a new policy in the new area. Do I have a qualifying event. Qualifying Life Event QLE A change in your situation like getting married having a baby or losing health coverage that can make you eligible for a Special Enrollment Period allowing you to enroll in health insurance outside the yearly Open Enrollment Period.

The IRS states that a qualifying event must have an impact on your insurance needs or change what health insurance plans that you qualify for. After a qualifying life event you have a period of 60 days to change your plan or enroll in a new plan. The current policy does not apply to the new location.

There are 4 basic types of qualifying life events. The ability to pay for coverage and family changes that qualify you for Medicaid or the Childrens Health Insurance Program CHIP are reasons to allow you to make some alterations in your coverage. The change in location is an important change in status.

Known as Special Enrollment Periods these exceptions help you make necessary updates to your health insurance. When you experience a qualifying life event dont sit like a bump on a log. Other qualifying events like income changes.

Some qualifying life events also act like open enrollment for the whole family. There are exceptions to the annual open enrollment period. These are called qualifying life events and if you experience one or more of them you can buy new coverage or change your existing coverage.

Call your health insurance agent and get the process going immediately. If you dont have a qualifying event youre required to maintain your insurance as is until the following enrollment period. Eligible dependents can take advantage of a qualifying life event to modify or elect new coverage.

Your health insurance provider gives you the chance to make changes to your health insurance plan typically up to 60 days after a qualifying life event. Gaining a dependent or becoming a dependent through birth or adoption. In most situations youll need to make changes to your health plan within a specific time frame of the qualifying life event.

Below is a list of the qualifying life events. A qualifying life event is a big change in your lifelike having a baby getting married or losing your jobthat suddenly changes your health insurance needs. For example if one moves to a new location that is outside of the service area of the current health plan the rules permit a new signup.

A qualifying event for health coverage can be moving to another state for a job or for going to school. Health insurance after qualifying event. If you experience a qualifying life event sign up right away.

Other Qualifying Life Events - There are various other types of changes that can be a qualifying event to allow for health insurance changes. After a qualifying life event you have 60 days to make changes to their health insurance policy. How a qualifying life event works.

Missing this deadline could mean having to wait until the next open enrollment which could be as long as a year. See the full list of life events. Moving to a new location can make it impossible to access those doctors.

Qualifying events require new insurance because some important part of the individuals status changes. Certain household moves like moving to a new ZIP code or county. For example if an employee that is not enrolled in benefits has a baby the employee can enroll themselves their spouse and all eligible dependents as well.

Changes that make you no longer eligible for Medicaid or the Childrens Health Insurance Program CHIP leaving incarceration etc. In either case the qualifying life event would trigger a special enrollment period that would make you eligible to select a new individual insurance policy through the state marketplace.