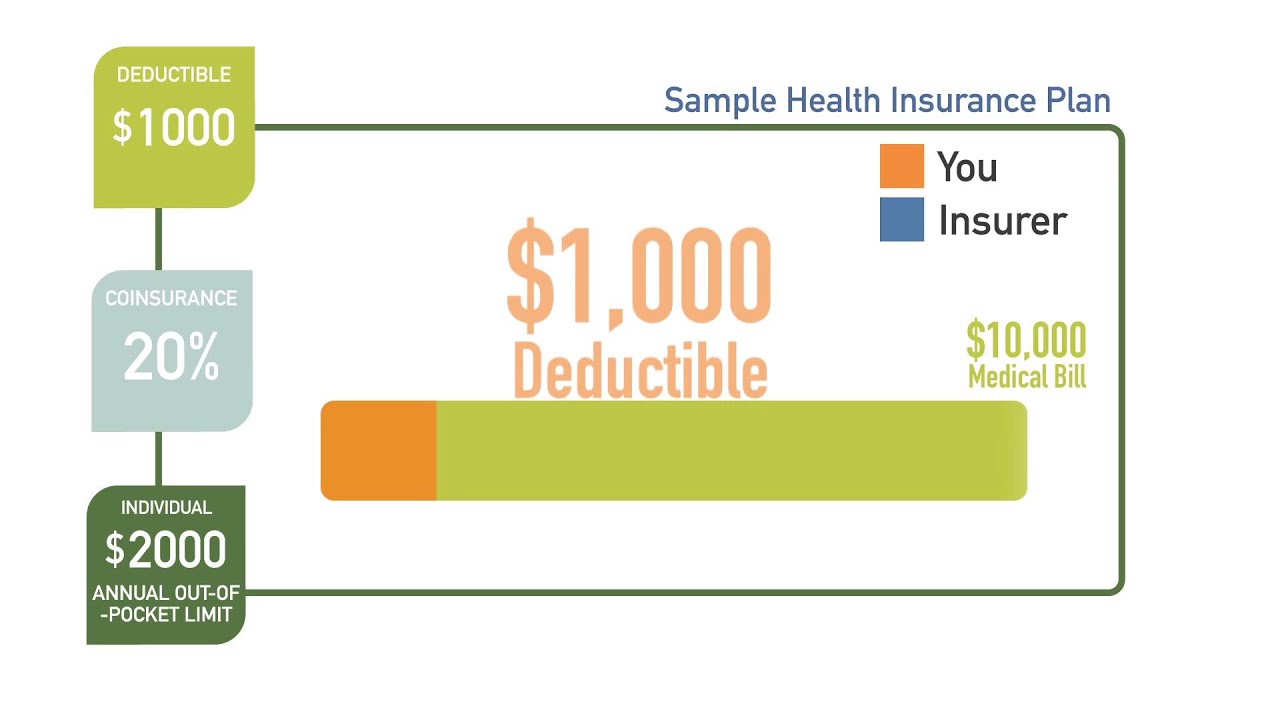

Coinsurance does not begin until afteryou meet your deductible meaning youll pay all of your medical costs except for certain covered services until reaching your deductible. After you pay the 4000 deductible your health plan covers 70 of the costs and you pay the other 30.

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

For services covered by coinsurance after deductible the amount you pay in co-insurance continues to count towards meeting your next Tier deductible.

What does after deductible mean. Coinsurance is often 10 30 or 20 percent. Coinsurance is a portion of the medical cost you pay after your deductible has been met. The percentage of costs of a covered health care service you pay 20 for example after youve paid your deductible.

The insurance company pays the rest. 1 Per IRS guidelines in 2021 an HDHP is a health insurance plan with a deductible of at least 1400 if you have an individual plan or a deductible of at least 2800 if you have a family plan. A deductible is the amount you pay for health care services before your health insurance begins to pay.

A copay after deductible is a flat fee you pay for medical service as part of a cost-sharing relationship in which you and your health insurance provider must pay for your medical expenses. How to Calculate Coinsurance Payments. After that you share the cost with your plan by paying coinsurance.

After meeting a deductible beneficiaries typically pay coinsurance a. What does no charge after deductible mean. I get Copay after deductible -- you must pay for the service fully out of pocket until your deductible is met after which you must only pay the copay amount and the insurance pays for the rest.

Once you hit your deductible your insurance company starts splitting the cost of future care based on a set percentage of the costs. Updated on November 23 2020. Everything You Need to Know.

Pertaining to health insurance what does Copay with deductible mean in contrast to Copay after deductible. For example if your coinsurance is 20 percent you pay 20 percent of the cost of your covered medical bills. If youve paid your deductible.

After youve reached this limit you will not have copayments coinsurance or other out-of-pocket costs. Depending on the service the health care provider and your insurance your portion of the cost of care covered by the plan after youve met your deductible may be a copayment or. After you have met your yearly deductible certain services are covered at 100 and this means that you do not pay one penny towards the treatment.

After you pay your annual deductible your insurance starts paying its portion of the cost of covered care you receive for the rest of the year. When you incur health care costs from a medical procedure you have to pay out of pocket until you spend a certain amount known as your deductible. Coinsurance is an additional cost that some health care plans require policy holders to pay after the deductible is met.

In addition the plans out-of-pocket limit must be no higher than 7000 for an. You pay 20 of 100 or 20. Your insurance company covers the entire bill so long as it is an agreed upon service that is.

You must pay 4000 toward your covered medical costs before your health plan begins to cover costs. The deductible resets every year so each year youll need to repeat the process and pay out of pocket again before your health insurance covers your medical expenses. When youve paid 5000 out of your pocket toward your medical costs your plan covers 100 of your costs until your plan year renews.

When you pay coinsurance you split a certain cost with the insurance company at a ratio determined by the terms of your insurance plan. A deductible is a fixed amount a patient must pay each year before their health insurance benefits begin to cover the costs. The deductible is the amount youll pay out of pocket for medical expenses before your insurance pays anything.

Lets say your health insurance plans allowed amount for an office visit is 100 and your coinsurance is 20. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent. Then you will pay only a percentage of the costs while the insurance company covers the rest.

If your plans deductible is 1500 youll pay 100 percent of eligible health care expenses until the bills total 1500. Deductibles coinsurance and copays are all examples of cost sharing. You may still be responsible for a copayment or coinsurance even after the deductible is met but the insurance company is paying at least some amount of the charge.

After meeting the deductible The next time you have a medical expense you will only be responsible for coinsurance having already met the deductible in full. If you understand how each of them works it will help. This means that once you have paid your deductible for the year your insurance benefits will kick in and the plan pays 100 of covered medical costs for the rest of the year.

The percentage that you pay is your coinsurance. Most Tier 1 services are covered at 90 coinsurance after deductible while Tier 2 services are 75 after deductible and Tier 3 are 60 after deductible.