Keep in mind that you have to have Original Medicare in order to sign up for Plan F which means you have coverage for Medicare Part A and Part B. How to Compare Medicare Supplement Plans.

Compare Medicare Supplement Plans 2018

Pick a recommended plan.

Compare medicare supplement plans. However the Part A one is much more expensive and it usually costs 1340 for each benefit period. Medicare Supplement Plan A offers just the Basic Benefits while Plan B covers Basic Benefits plus a benefit for the Medicare Part A deductible. Use the scroll bar at the bottom of the chart to view all plans and information.

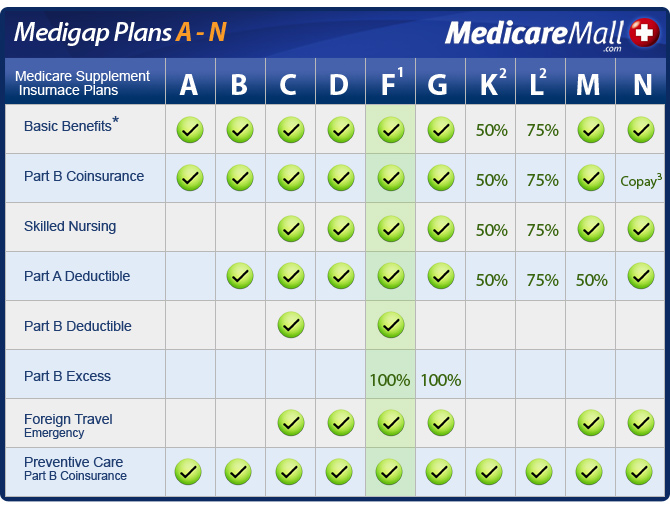

Differences Between Carriers PlansIf you are newly eligible for Medicare. When looking at the Medicare supplement plans comparison chart there are currently 10 standard Medicare Supplement Plans as you can see from the Medicare supplement plans chart below. Medicare Supplement Medigap Plan F Plan G and Plan N Comparison of Coverage The benefit chart compares Medicare Supplement Medigap plans F G and N.

Medigap policies are standardized and in most states are named by letters Plans A-N. It has a simple easy-to-read design to help you learn about and select. The Medicare supplement plan comparison chart below shows a list of plans.

Shop trusted companies here or call. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Comparing Medicare Supplement Plans.

Get Quotes for Plan F G and N from the Top Carriers. A means 100 of benefit is paid with the exception of foreign travel. Compare the benefits each plan helps pay for and choose a plan that covers what you need.

Medicare Supplement plans for 2020 will probably have prices that are higher than what the current Supplement plans are but youre still getting the same coverage you always have with these insurance plans. In case you want to compare different prices for different plans you can use our website for the same. Our website is a free yet trustworthy resource.

It guides you step-by-step through the process of shopping for and comparing plans. 12 Zeilen Plans F and G also offer a high-deductible plan in some states. Medigap Plans K L and M These plans offer partial coverage of certain benefits.

Compare Medicare Supplement Plans Online in Minutes. The costs of plans may differ with each insurance company but the benefits are same across the board. The Medicare Part A deductible could be one of your largest out-of-pocket expenses if you need to spend time in a hospital.

You can plan ahead by checking out current plans. Comparing Medicare Supplement Plans - YouTube. Plans A and B generally have higher out-of-pocket costs for things like Skilled Nursing Facility Coinsurance Medicare.

They are labeled A through N E H I and J are no longer available to new subscribers. Medicare Supplement Plans 2021 Comparison Chart There are 10 standardized Medigap plans available across 47 US. Aetna Mutual of Omaha AARP Cigna Accendo.

When we compare Medicare Supplements between Plan F and G in most states we often find that Plan G is a better value annually. Now for free quotes 888 598-0827. Decide which plan you want.

Compare Medicare Supplement Insurance Plans Medicare Supplement also known as Medigap or MedSupp insurance plans help cover certain out-of-pocket costs that Original Medicare Part A and Part B doesnt cover. You can find Medicare Advantage plans at competitive pricing and affordable rates. Medicare Plan Finder is mobile friendly so you can use it on your smart phone tablet or other mobile device.

See benefits of each plan. And if you find a plan thats affordable and offers good coverage itll save you. That can be quite comforting and what that means is that you can look at what coverage is included in current Supplement plans and know what is going to be there in the 2022 plans.

Speak with one of our highly knowledgeable agents and select the Medicare Supplement plan that fits your needs. Foreign travel is covered 80Comparison of Plan F Plan G and Plan N. That Part B deductible isnt very much- coming in at 183 per year.

If playback doesnt begin shortly try restarting. If you find a plan thats affordable youll save money. Find a Medicare plan You can shop here for drug plans Part D and Medicare Advantage Plans.

Medicare Made Easy Save Time and Money. The exceptions are Massachusetts Minnesota and Wisconsin which each have. The Medicare Plan Finder helps you compare 2021 coverage options and shop for plans.