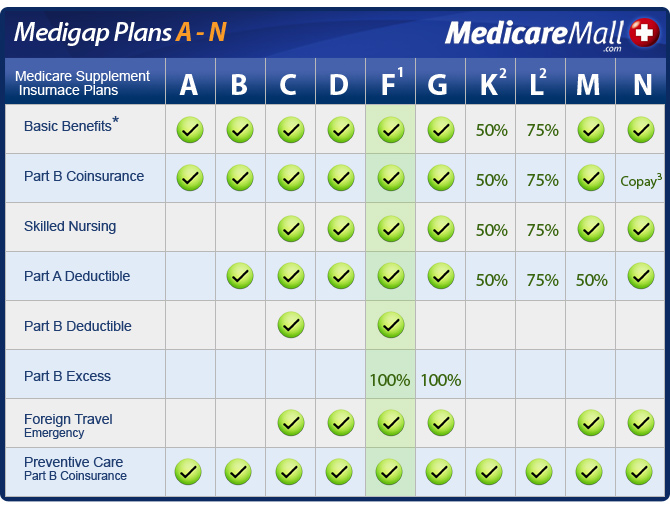

Once enrolled into your Medicare Supplement insurance plan your coverage is guaranteed for the life of the plan with only two exceptionsrestrictions. If a Plan F option includes premiums that cost more in a year than the price of a Plan G policy plus the Medicare B deductible 203 in 2021 then a beneficiary would save money by.

Anthem Blue Cross Medicare Supplement Senior Healthcare Direct

Anthem Blue Cross Medicare Supplement Senior Healthcare Direct

The exact cost of an Anthem Medicare supplement plan can depend on which plan you choose and your location.

Anthem plan g cost. Based on ages 65 to 75 years old gender smoking status and cost summaries from Medicares Find a Plan search engine Part G costs ranged 189 to 432 on the east coast New York 104 to 479 in the midwest Michigan 88 to 417 in the south Texas and 115 to 308 on the west coast California. In 2021 the Medicare Part B annual deductible is 203. This deductible increases a bit every year but in 2020 it is 2340.

Both plans offer you comprehensive coverage and are among the most robust of all supplements offered by Anthem Blue Cross. Plan G coverage details are the same no matter who you get the policy from although costs and availability will vary by carrier. Anthem Medigap Plan G.

Beyond the Blue Cross. Medicare Supplement plans are offered by Anthem Health Plans of New Hampshire Inc. Plan G Anthem Medicare Supplement.

Plan G annual deductible. Your Plan F kicks in to pay the Part A and Medicare Part B copays and coinsurance for the remainder of the year. Anthems Plan G in recent years became more popular because.

In New York our 65-year-old would pay about 260 per month for Plan G from Anthem. Plan G would be higher than the Part B deductible itself. Home Health Care is skilled nursing care and certain other health care services you get in your home for the treatment of an illness or injury.

In fact other than not covering the Medicare Part B deductible amount Medigap Plans G and F provide the same comprehensive coverage options. The ongoing co-pay elimination from BCBS Supplement Plan G also helps boost the overall rating of this plan from many of its subscribers. Anthem processes the claims then sends the first 2200 in bills each year to you.

Plan F 100 coverage. With the Medicare Supplement Plan G from Anthem you can also obtain a long list of benefits. Nonpayment of premiums and material misrepresentation.

Anthem Blue Cross and Blue Shield is adding Plan G and Select Plan G to its Medicare Supplement portfolio in Ohio. Plan G costs were reviewed across four regions of the United States in 2020. Therefore predicting rate increases can be.

Plan G 203 deductible then 100 coverage. Anthem Insurance Companies Inc. Plan G covers up to 13750 per day for days 21-100.

Plan G covers the 20 remainder not paid by Medicare Part B. Excess Charges are additional costs in addition to the Medicare-approved charge. Independent licensees of the Blue Cross and Blue Shield Association.

These rates are also different for each state. With a supplement like BCBS Supplement Plan G you can say goodbye to limits and sleep peacefully in the knowing that long term hospital costs which can easily become insurmountable are nearly extinguished by the benefits of this plan. Plan G high-deductible premium range.

Anthem Blue Cross and Blue Shield is the trade name of Anthem Insurance Companies Inc. In Virginia our service area is all of Virginia except for the City of Fairfax the Town of Vienna and the area east of State Route 123. Anthem Insurance Companies Inc.

Because Plan G covers Part B Excess Charges all of your out-of-pocket costs are covered. 107 2768 per month. Some Medicare beneficiaries choose to purchase a Medicare supplement plan.

Heres a quick look at what costs Plan G covers. However they will track what you are spending. ANTHEM is a registered trademark of Anthem.

Plans in California wont cost the same as plans in Virginia. Anthem track what you spend in a calendar year then once the deductible is paid. Medicare Part A hospital coinsurance and all costs up to 365 days after Original Medicare benefits are exhausted.

In New York our 65-year-old would pay about 260 per month for Plan G from Anthem. We recommend shopping around to find a price that works best for you. Medicare Supplement MediBlue Plus HMO Part D Rx.

Plan G premium range. Anthem will process the claim and send the first 2340year in bills to you. So Medicare will pay its share of your claims and send the remainder to Anthem.

Then all Plan N policies will have a separate rate increase amount. All three provide 100 coverage for Inpatient Hospital services. Contacts Anthem Blue Cross and Blue Shield in.

Rate increases are state and policy specific. It also means that Plan G usually costs a bit less than Plan F. With this plan you get coverage for.

So all Supplement Plan G policies with Anthem in one specific state will have the same increase. The small difference is that Plan G makes the beneficiary pay the Medicare Part B deductible out-of-pocket. The only difference for Anthem Plan G is that there is a 183 deductible for Part B deductible Premiums for the Plan G is saving you money that youd be spending on a Plan F Premium Plan G offers coverage for co-payments coinsurance and deductibles Virtually no out of pocket expenses.

In most areas of the country Plan G prices start at around 90-110month. The short answer for how much does Plan G cost is it depends on where you live how old you are and what gender you are. However some states that are lower than that and some that are much much higher.

Plans A G N and the Anthem Extras Packages are offered by AICI. And Anthem Health Plans of Virginia Inc. AICI and Community Insurance Company CIC.

Even though Plan G doesnt cover the Part B deductible some Plan F options could have high enough premiums that the cost difference between Plan F vs. Plan N 203 deductible then 20 copay for outpatient visits.