They have completely different functions. Stanford Health Care Advantage - Platinum HMO H2986-004 is a 2021 Medicare Advantage Plan or Medicare Part-C plan by Stanford Health Care Advantage available to residents in California.

Stanford Health Care Advantage Plan For 2020 Youtube

Stanford Health Care Advantage Plan For 2020 Youtube

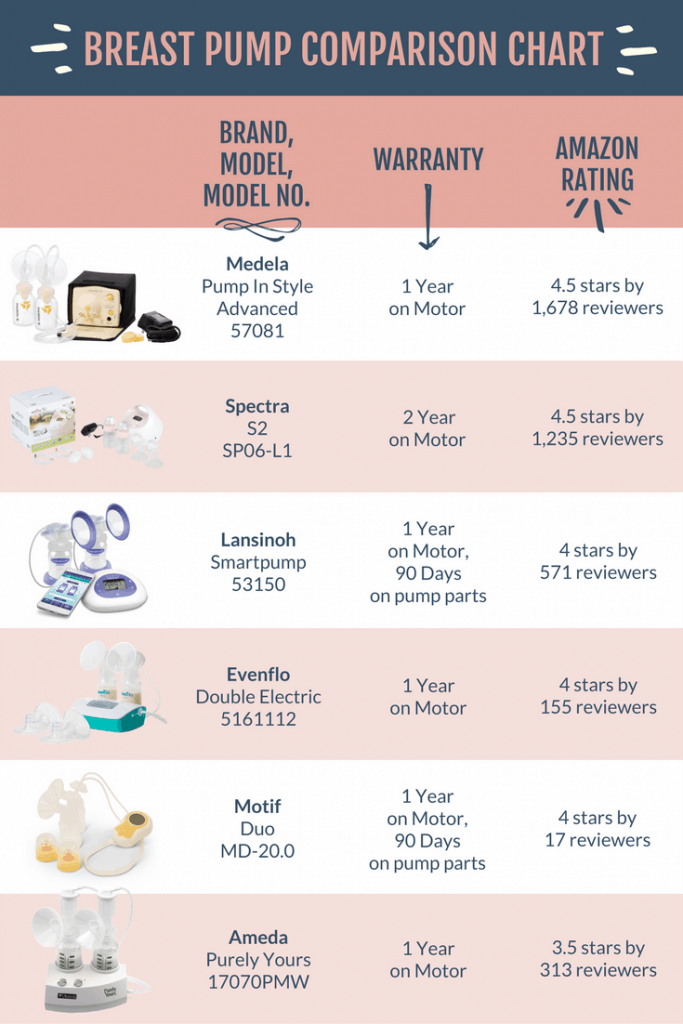

The comparison chart above is meant to show the best of each type of plan available.

Stanford medicare advantage plan. Simply enter the county you live in and click Go to see our Medicare plans that are available to you or call. Stanford Health Care Advantage is an HMO plan with a Medicare contract. To enroll in a Stanford Health Care Advantage plan you must have both Medicare Parts A and B and reside in the plan service area.

Helping you identify and obtain coverage for government programs where available. All Stanford Health Care Advantage plans include Part D drug coverage. This plan includes additional Medicare prescription drug Part-D coverage.

Enrollment in Stanford Health Care Advantage depends on contract renewal. To enroll in a Stanford Health Care Advantage plan you must have both Medicare Parts A and B and reside in the plan service area. Stanford Health Care Advantage is an HMO plan with a Medicare contract.

All Stanford Health Care Advantage plans include Part D drug coverage. Stanford Health Care Advantage - Platinum HMO H2986-001 is a 2020 Medicare Advantage Plan or Medicare Part-C plan by Stanford Health Care Advantage available to residents in California. This plan includes additional Medicare prescription drug Part-D coverage.

Stanford Health Care Advantage is an HMO plan with a Medicare contract. All Stanford Health Care Advantage plans include Part D drug coverage. Stanford Health Care accepts all Medi-Gap plans.

Compare Medicare Advantage Plans. Our Medicare Supplement Insurance Medigap plans can help pay some of the health care costs that Original Medicare doesnt cover like copayments coinsurance and deductibles. This form will change in 2021 so you can use the Universal Form for any changes that are effective for 2020 and must use the form specific to your plan.

Medicare Plans Comparison Chart for Stanford CA. All Stanford Health Care Advantage plans include Part D drug coverage. If you are electing a Medicare Advantage plan or switching from a Medicare Supplement plan to a Medicare Advantage plan you must also complete an enrollment form to alert the plan and Medicare that you are changing the way youve assigned your Medicare benefits.

The following Stanford Health Care Advantage plans offer Medicare Advantage Prescription Drug plan coverage to California residents. Enrollment in Stanford Health Care Advantage depends on contract renewal. Stanford Health Care Advantage is an HMO plan with a Medicare contract.

Enrollment in Stanford Health Care Advantage depends on contract renewal. Stanford Health Care Advantage is an HMO plan with a Medicare contract. Reach a financial counselor at 650-498-2900 option 2 5 from Monday Friday 800 am.

Enrollment in Stanford Health Care Advantage depends on contract renewal. Medicare Advantage Enrollment Form. Stanford Health Care Advantage - Platinum HMO H2986-001 is a 2019 Medicare Advantage or Medicare Part-C plan by Stanford Health Care Advantage available to residents in California.

To enroll in a Stanford Health Care Advantage plan you must have both Medicare Parts A and B and reside in the plan service area. Medi-Connect is a program for people that coordinate Medicare and Medi-Cal benefits through one health plan. For Medi-Connect patients Stanford Health Care is in-network with the Santa Clara Family Health Plan.

Addressing questions or concerns regarding your insurance coverage and financial assistance. Members must use plan providers except in. This plan includes additional Medicare prescription drug Part-D coverage.

You cant compare Medicare Advantage Medicare Supplements and Medicare Part D plans side-by-side. All Stanford Health Care Advantage plans include Part D drug coverage. Today Stanford Health Care is launching University Health Care Advantage UHCA a Medicare Advantage plan for Santa Clara County residents.

888 605-9277 TTYTDD. All Stanford Health Care Advantage plans include Part D drug coverage. Enrollment in Stanford Health Care Advantage depends on contract renewal.

Stanford Health Care Advantage is an HMO plan with a Medicare contract. UHCA will provide Medicare beneficiaries access to more than 200 primary care physicians and 2100 specialists from Stanford Medicine and its affiliated provider network. Enrollment in Stanford Health Care Advantage depends on contract renewal.

To enroll in a Stanford Health Care Advantage plan you must have both Medicare Parts A and B and reside in the plan service area. Financial counselors strive to make the financial concerns. To enroll in a Stanford Health Care Advantage plan you must have both Medicare Parts A and B and reside in the plan service area.