Why ending the senior penalty is important Due to the Affordable Care Act most adults in California can qualify for full Medi-Cal with incomes up to 138 of the poverty level 1436month for an individual. Department of Health Care Services.

Covered California 2020 Open Enrollment Official Website Assemblymember Richard Bloom Representing The 50th California Assembly District

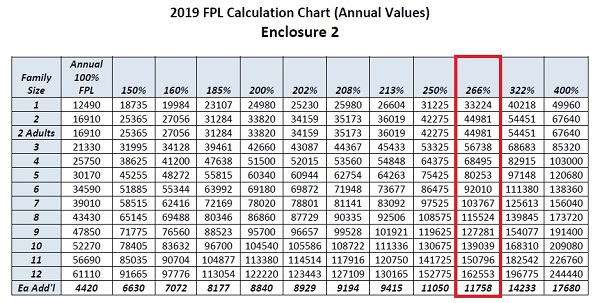

This means that a family of four with an annual income of around 150000 per year may be eligible for subsidies.

California medical income limits 2020. 2021 HCD State Income Limits. Revised Covered California 2020 Income Table with Medi-Cal eligibility updates. April 30 2020 PDF.

If it is higher than 1481 for individuals you may qualify for Medi-Cals Working Disabled Program or ABD-MN Medi-Cal instead. Federal tax credit California state subsidy Enhanced Silver plans and AIAN plans. 12 Zeilen Monthly Income Annual Income.

The subsidies are for individual Californians who earn between 50000 and 75000 and families of four earning 103000 to 155000. The new policy limits annual increases in income limits to 5 percent or twice the change in the national median family income whichever is greater. Also new in the coming year low-income undocumented young.

1 80 percent of MFI or 2 80 percent of state non-metropolitan median family income. State of California Health and Human Services Agency. Federal tax credit Silver 94 87 73 plans and AIAN plans.

In order to qualify children must be under 19 years old. To see if you qualify based on income look at the chart below. In general most low-income limits represent the higher level of.

California also will offer new subsidies in 2020 aimed at making health coverage more affordable for middle-income individuals and families. The threshold for Medi-Cal 138 FPL jumped from 17237 on the September chart up to 17609 on the new revised income table. HCD updated its 2021 State Income Limits effective April 26 2021 when requesting the Office of Administrative Law OAL to publish 2021 Income Limits in the California Code of Regulations Title 25 Section 6932.

When only one spouse of a married couple applies for regular Medi-Cal the income limit is a combination of an income limit for the applicant spouse plus a maintenance needs allowance for the non-applicant spouse. If ineligible for Medi-Cal consumers may qualify for a Covered California health plan with financial help including. If ineligible for Medi-Cal consumers may qualify for a Covered California health plan with financial help including.

If it is less than 1481 for individuals or 2004 for a couple then you qualify for free full scope Medi-Cal based on AD FPL rules. In order to qualify for Medi-Cal adults must have a household income of less than 138 of the FPL. Medi-Cal and Covered California have various programs with overlapping income limits.

Most consumers up to 138 FPL will be eligible for Medi-Cal. This means you must pay at least 700 in covered medical expenses andor health care premiums in a given month before Medi-Cal covers. Or Medi-Cal Beneficiary Medi-Cal income levels have.

Ualif for no - cost or low t M edi Cal ov rage under the new 2021 income limits. This brings the couples income limit to 2081 month 1481 month for the applicant spouse and 600 month as a maintenance needs. The new income limit was supposed to go into effect as of August 1 2020 but has been delayed to December 1 2020.

Income numbers are based on your annual or yearly earnings. April 26 2021 PDF 2020 HCD State Income Limits. 2020 State Income Limits Briefing Materials California Code of Regulations Title 25 Section 6932.

For areas where income limits are decreasing HUD limits the decrease to no more than 5 percent per year. The new higher income amount concurs with the issued Medi-Cal income table for 2020. However due to adjustments that.

For the FY 2020 income limits the cap is almost 8 percent. The subsidies are for individual Californians who earn. Most consumers up to 138 FPL will be eligible for Medi-Cal.

However Children qualify for Medi-Cal when their family has a household income of 266 or less. For example if you have an individual monthly income of 1300 Medi-Cal subtracts 600 for a SOC of 700. In 2020 those who make between 400 to 600 of the FPL are eligible for subsidies.

Medi-Cal and Covered California have various programs with overlapping income limits.