Click on Review your tax link in PAYE Services. Compare car insurance rates by zip code allstate insurance agents near me best insurance companies in quebec auto insurance zone rating car insurance companies offering covid refunds car insurance companies in ontario car insurance refund ontario auto insurance companies quotes.

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

In the Tax Credits Reliefs page select Health and Medical Insurance Relief.

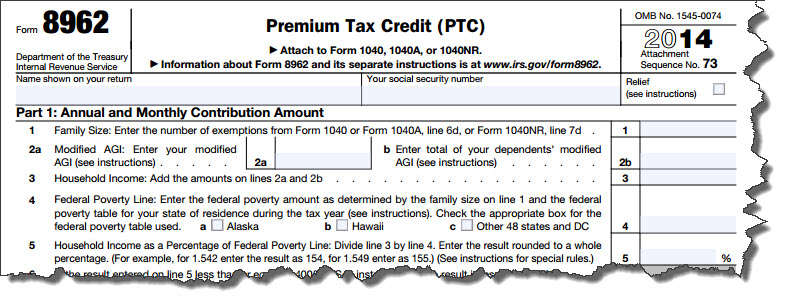

Tax form for health insurance credit. Taxpayers use Form 8962 Premium Tax Credit to figure the amount of their PTC and reconcile it with their APTC. Irs Approved 1099 H Tax Forms File Form 1099 H Health. Must file a tax return and reconcile the advance payments with the amount of the premium tax credit allowed on your return.

Form 8941 is used by eligible small employers to figure the credit for small employer health insurance premiums for tax years after 2009. 2020 health coverage your federal taxes. Heres how to get a 1095 form if you havent received one.

Form 1095-B and Form 1095-C help the IRS know whos entitled to tax credits to help pay health insurance premiums. Form 8962 Premium Tax Credit. Well help you create or correct the form in TurboTax.

If you had Marketplace insurance and used premium tax credits to lower your monthly payment you must file this health insurance tax form with your federal income tax return. Form 3800 is used by business owners to report each of the tax credits that make up the general business creditwhich includes the credit for insurance premiums. With form 1095-A you provide information regarding the recipient s of health insurance coverage in your household and policy details such as start and termination dates as well as monthly premium amounts paid and monthly advance premium tax credits received throughout the year.

Therefore youll enter the credit amount from Form 8941 in Part 3 of your 3800 form with the other business credits you might be taking. For individuals and families who may have already repaid the federal excess Premium Tax Credit the IRS is advising not to file an amended return to recoup the money paid on their federal tax return. This computation lets taxpayers know whether they must increase their tax liability by all or a portion of their excess APTC called an excess.

Health Insurance Tax Credit Form. Received a Form 1095-A Health Insurance Marketplace Statement showing you received the benefit of advance payments of the premium tax credit. The credit implemented under the Affordable Care Act ACA is designed to help eligible families or individuals with low to moderate income pay for health insurance.

The Marketplace will send you Form 1095-A Health Insurance Marketplace Statement showing your premium amounts and your advance credit payments by January 31 of the year following the year of coverage. Premium tax credits are only. For the 2020 Tax Year you should receive your 2020 coverage statement by January 31 2021.

Sign in to myAccount. Claim all of the credit on your tax return. 2018 and prior years.

The reconciliation of the federal Premium Tax Credits occurs on form 8962. Your overall general business credit will include the health premiums and the total is. Form 8962 Premium Tax Credit is required when someone on your tax return had health insurance in 2020 through Healthcaregov or a state marketplace and took the Advance Premium Tax Credit to lower their monthly premium.

Youll use this form to reconcile to find out if you used more or less premium tax credit than you qualify for. The IRS also uses Form 1095-C to determine if a large employer one with 50 or more full-time or full-time. Eligible taxpayers may claim a PTC for health insurance coverage in a qualified health plan purchased through a Health Insurance Marketplace.

Premium tax credits are sometimes known as subsidies discounts or savings. Select the income Tax Return for the year you wish to claim for. A health insurance tax credit also known as the premium tax credit lowers your monthly insurance payment either through advance payments to your insurer or through your tax refund.

You should have received a paper form in the mail from your marketplace. If you got excess advance payments of the premium tax credit APTC for 2020 you dont need to pay it back. Information about Form 8941 Credit for Small Employer Health Insurance Premiums including recent updates related forms and instructions on how to file.

If you have coverage through an employer you typically wont qualify for the advanced premium tax credits that would help you buy a policy on Obamacare exchanges. For California the reconciliation is on FTB form 3849. In the Tax Credits Reliefs page select Health and Medical Insurance Relief complete and submit the form.

2020 tax filing changes due to the American Rescue Plan. You still need to use your Form 1095-A to reconcile your 2020 premium tax credits when you file your 2020 taxes.