They can reduce out-of-pocket costs to as little as 0 per month. Examples of medications in this category that I see commonly rejected are.

Why Insurance Does Not Cover Regenerative Medicine Or Prp Wadsworth Read Our Joint Care Blog

Why Insurance Does Not Cover Regenerative Medicine Or Prp Wadsworth Read Our Joint Care Blog

Are non-prescription sold over-the-counter.

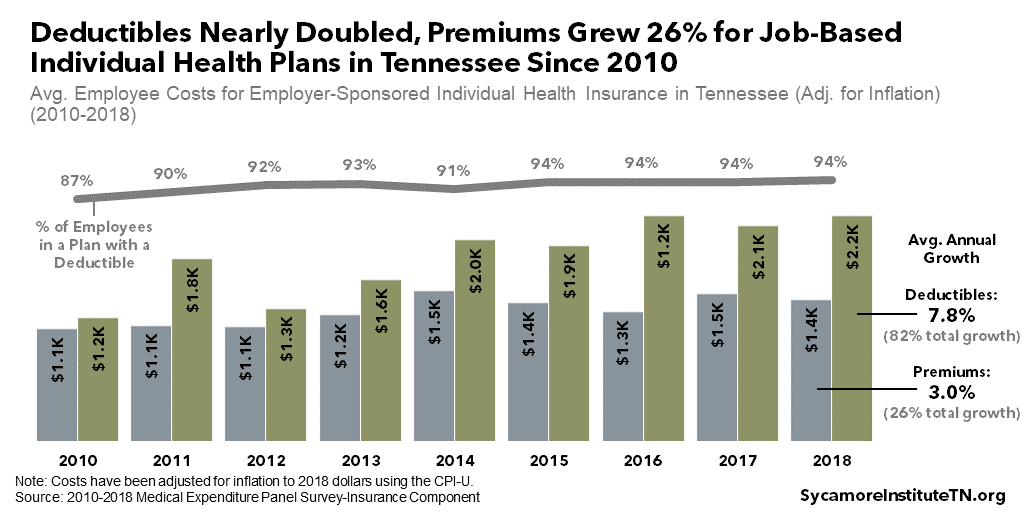

Insurance won t cover medication. For example some medicines are only meant to be taken one time per day but if your doctor prescribes it for twice a day the insurance may not cover it. If you have health insurance and have needed significant medical careor sometimes even minor careyou have likely experienced a situation where the company wont pay. You may pay less out-of-pocket for generic prescription drugs as opposed to brand-name drugs.

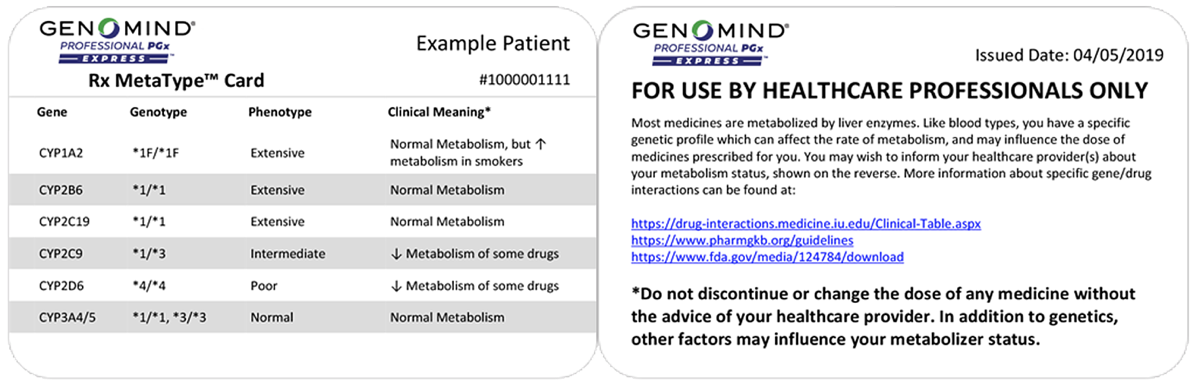

Since January 1 2018 with insurance companies making changes to policies and formularies tier system that determines copayment amounts for medication patients have found the medications they have been on for months to years are now being denied. Before you fill your prescription you might want to ask your doctor if there is a generic medication or other cheaper equivalent that he or she can prescribe to treat your condition. If you and your healthcare provider cant find an affordable option together.

Ask your insurer for an exception. When your doctor orders a medication that is not listed in the formulary the insurance company may overrule your doctors orders. Some take it a step farther and wont cover an entire class of medications if an over-the-counter option exists.

By demonstrating the medical necessity of the proposed procedure treatment or medication your doctor may be able to convince your insurance company they are obligated to pay for the cost of it. A new trend limits the quantity of medication dispensed to cover 30 days in order to prove it is effective first according to a recent survey. Noecker notes that the setup is particularly unfair if a drug isnt covered by insurance at all.

The request must be made in writing. Many insurance companies with the exception of medicaid will not pay for medications that are available over the counter even if a prescription version exists. What to Do When Your Insurance Doesnt Cover Your Medication Talk to your doctor about trying a different medication.

With a PA a doctor can contact the insurance company to see if it possible to get the medication covered. Do you have to just accept their refusal to cover your medical claim. They may deny the full amount of a claim or most of it.

Here are some general guidelines for dealing with insurance. Are not approved by the Food and Drug Administration. These programs help people save on specific medications particularly expensive brand-name ones that are often not covered by insurance.

But unfortunately that doesnt ensure that they can afford the specific drugs their doctors prescribe for them. You get a 50 discount but even after that its 171 for just six doses of the medicine you need I was in la la land with migraine brain and kept trying to make him check with the pharmacist to ensure they had my correct health insurance information. Most pharmaceutical companies have patient assistance programs PAPs that will provide medications free-of-charge to qualified individuals.

A prior authorization PA is an agreement between a doctor and an insurance company that allows for medically necessary medications to be covered. Medicare Part D coverage generally favors generic medications. If a medication is not covered it may still be available through a PA.

Always remember that you have the right to appeal your insurers decision. The insurance companies get significant rebates as much. Appeal the Insurance Companys Decision Your doctor and hisher staff can help you appeal an insurance denial.

TMA has advocated for its members who need specialty drugs by supporting patients rights legislation and offering guidance on how to navigate this dilemma. Or it could be because of the maximum. He called while he was there and said Honey your insurance doesnt cover this.

When patients pay for a drug they pay the full cash price he points out. Your healthcare provider probably wont know which medications. This can be frustrating for both your doctor and you.

Medicare doesnt cover medications that. The eligibility criteria are not always based on income so dont assume that youre ineligible because you have a job. PAPs were created both for people without insurance and for those with insurance who are simply.

There are actually things you can do. Patient assistance programs generally serve the uninsured while manufacturer co-pay programs are for those with insurance. The majority of Americans have health insurance that includes coverage for prescription drugs.