ETS is a same-day outpatient procedure performed at The Valley Hospitals. Y742 Thoracoscopic approach to thoracic cavity NEC.

Endoscopic Thoracic Sympathectomy Sciencedirect

Endoscopic Thoracic Sympathectomy Sciencedirect

ETS surgery involves opening the chest cavity and slicing the nerve lines that control a persons sweating response.

Endoscopic thoracic sympathectomy near me. The sympathetic nerves that control the sweat glands of the hand and armpits runs inside the rib cage near the top of the chest. The operation involves a camera on a telescope being inserted into the chest. ETS An ETS involves cutting the sympathetic nerves which switches off the sweating.

Endoscopic sympathectomy can be used to treat all three regions. Images of the inside of your body are shown on a television screen. What to expect during an endoscopic sympathectomy.

ETS is a surgical procedure that is performed under a general anaesthetic. What Is the Success Rate of Sympathectomy. The most common form of this procedure is endoscopic thoracic sympathectomy ETS surgery.

Y111 Cauterisation of organ NOC. The operation A small incision is made beneath the armpit. Check out the Hyperhidrosis Forum for hyperhidrosis treatments other than endoscopic thoracic sympathectomy frequently to learn about what nonsurgical treatment or combination of treatments other hyperhidrosis sufferers are benefiting from.

ETS is considered a last resort because it frequently causes serious irreversible compensatory sweating excessive sweating on large areas of the body or all over as well as other dibilitating effects such as extreme hypotension arrhythmia and heat intolerance. Results at the axillary level are less predictable around 70. If you have hyperhidrosis like myself you might be exploring endoscopic thoracic sympathectomy ETS as a solution.

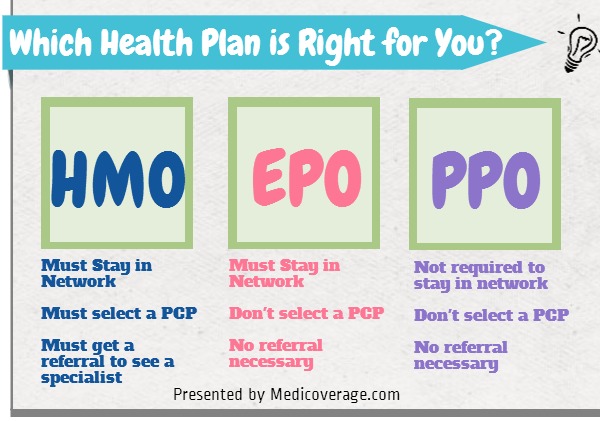

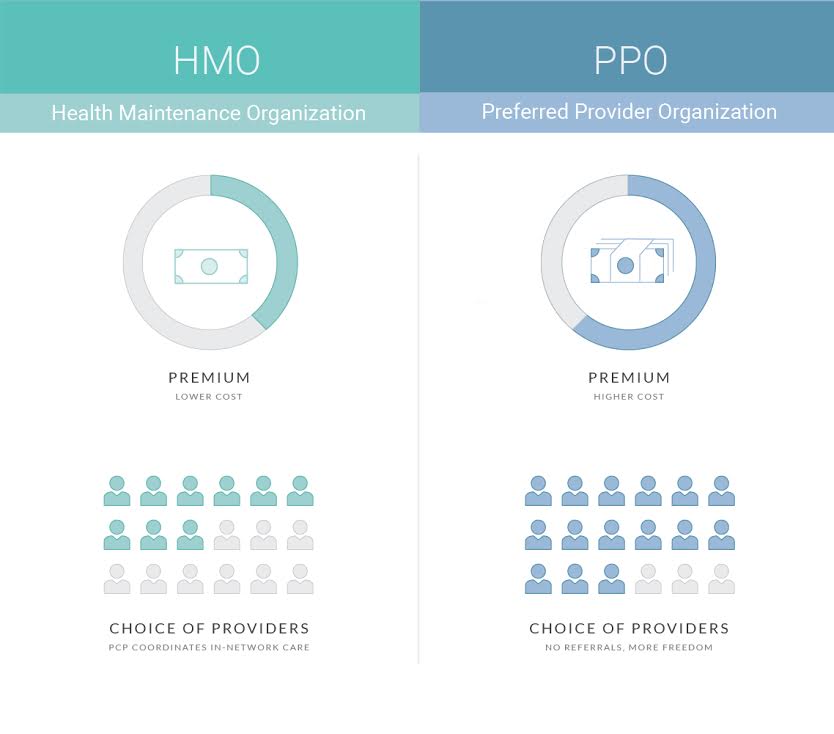

Endoscopic thoracic sympathectomy ETS is a minimally invasive procedure that can treat different types of hyperhidrosis including armpit sweating axillary hyperhidrosis sweaty palms palmar hyperhidrosis and excessive facial sweating and blushing. The sympathetic nerves that control the sweat glands of the hand and armpits runs inside the rib cage near the top of the chest. Endoscopic thoracic sympathectomy ETS is a surgical procedure involving the division of the sympathetic nerves that control some of the bodys involuntary responses to external stimuli.

A792 Destruction of thoracic sympathetic nerve NEC. 3 The procedure 31 The aim of endoscopic thoracic sympathectomy ETS for primary facial blushing. The most invasive of these is endoscopic thoracic sympathectomy ETS.

An endoscope is a long thin flexible tube that has a light and camera at one end. Reflex sympathetic dystrophy RSD. What is an endoscopic thoracic sympathectomy.

What is an Endoscopic Thoracic Sympathectomy. Endoscopic sympathectomy is now usually the preferred technique because it is associated with less pain improved cosmesis and more rapid recovery than open sympathectomy. For reasons poorly understood excessive feet sweating when present will improve about 60 of the times with ETS designed to target the hands.

Endoscopic thoracic sympathectomy using laser. 99 times out of a 100 excessive sweating hyperhidrosis is caused by diet. The development of surgical telescopes and cameras has led to the ability to divide.

This state-of-the-art procedure allows for a quicker and more comfortable recovery for patients when compared to traditional spine surgeries. Two common disorders treated by this procedure are. Take your time and conduct ample research before deciding to get ETS surgery and then potentially having to get this expensive.

This allows the surgeon to identify the sympathetic chain the main trunk from which sympathetic nerves innervate sweat glands and burn very small specific areas of it. What is an endoscopic thoracic sympathectomy. ETS An ETS involves cutting these sympathetic nerves which switches off the sweating.

The Endoscopic Thoracic Sympathectomy surgery is purely superficial and cosmetic. After being diagnosed with cranial hyperhidrosis I underwent this surgery to stop sweating. Endoscopic thoracic sympathectomy using cauterisation.

Endoscopic Thoracic Sympathectomy did seem to reduce my flushing and fear of flushing which allows me to interact more frequently with my colleagues I still experience anxiety in social situations at work. Abnormal chronic pain in one of the limbs. An ETS is a surgical procedure in which a portion of nerves in the thoracic region usually in the chest are severed in order to switch off the bodys excessive sweating.

An endoscopy is a procedure where organs inside your body are looked at using an instrument called an endoscope. I now believe my facial flushing developed those many years ago as a symptom of underlying social anxiety. Endoscopic sympathectomy is now usually the preferred technique.

Open or endoscopic approaches. For the right patients the results of ETS for hand sweating are in the 98-100 range of success. Endoscopes can be put into the body through the mouth and down the throat or.