In the case of basic life insurance the employer pays all the costs. If your employer offers a group plan consider signing up for advantages that may include.

Life Insurance Learn About Life Insurance Safe Harbor Insurance And Finance Prime

Life Insurance Learn About Life Insurance Safe Harbor Insurance And Finance Prime

And that money gets paid out over a certain period of time.

Work life insurance. However this type of. While basic employer-provided life insurance is usually low-cost or free and you may be able to buy additional coverage at low rates your policys face value still. His wife Jody could ask the insurance company to pay her 75000 a year for 10 years.

YOUR ONE-STOP SHOP FOR ALL YOUR INSURANCE NEEDS. Life insurance can be an integral part of a proper financial plan. Guaranteed issue meaning you can get a certain amount of coverage without answering health questions or taking a medical exam.

The paperwork is often part of your hiring documents. Thats why some employees choose to purchase a voluntary life insurance supplement to get higher coverage and greater protection throughout their lifetime. GET AN INSTANT LIFE INSURANCE QUOTE.

You work for is not lost. With an installment plan the life insurance company pays you a certain amount of money on a regular schedule usually monthly quarterly or yearly. But that will be totally inadequate if you have a young family and actually need something closer to 500000 or more.

The company offers life reinsurance health reinsurance accident reinsurance liability motor insurance property-casualty insurance marine reinsurance aviation reinsurance and fire reinsurance. Getting life insurance through work can be an easy way to protect your family. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features 2021 Google LLC.

Here are three main advantages of getting group life insurance through your employer. What Is Life Insurance and How Does It Work. Basic coverage through work is usually free for the employee making it.

Universal life insurance which may also be referred to as adjustable life is a type of permanent life insurance thats intended to provide benefits until the day you die. Once weve been told by a bank or building society that someone has died well hold on. We work to make.

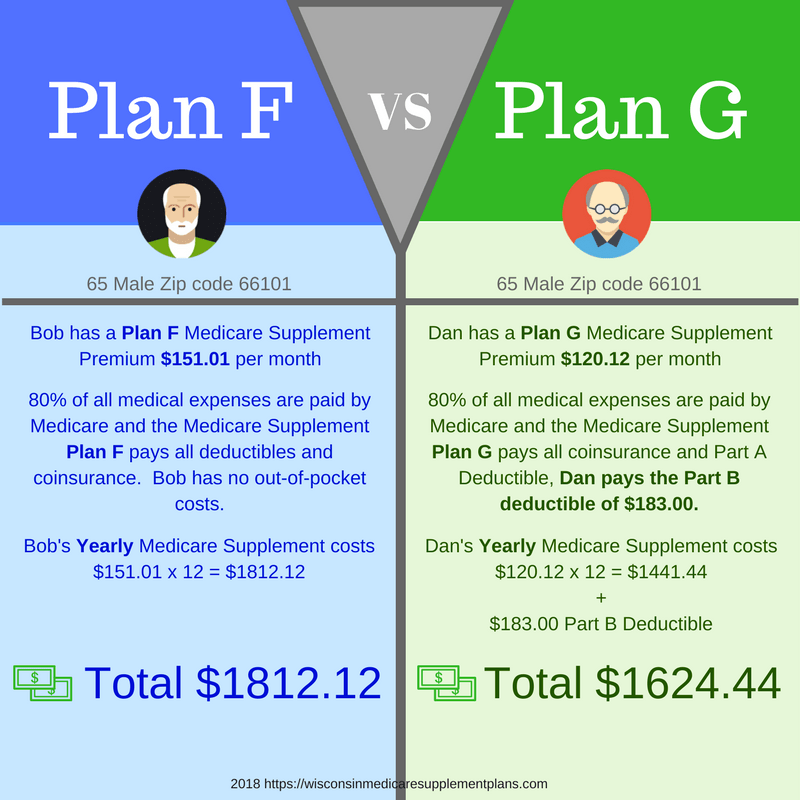

However basic life insurance programs usually cap coverage at 25000 or 50000. For example lets say Paul had a 750000 life insurance policy. Whole life insurance is a type of permanent life insurance also known as cash value life insurance that provides coverage for your entire life while the policys cash value earns interest at a rate determined by your insurer.

Through group insurance plans the employers tend to take care of the financial security of their. However there is a limit to how long an insurer can hold on to a policy once they know the policyholder has died. Because there is no timeframe for a life insurance claim if a pay-out is due it can be claimed.

That works as hard as you do. Some insurers use accelerated underwriting to skip the medical exam and process applications in a day or a week. Some insurers offer fast life insurance including instant approval to people who qualify who are generally younger.

For example most employer life insurance policies fall far short of the amount of coverage that you actually need. Heres everything you need to know before buying life insurance. Life insurance is a contract between yourself and an insurance company to pay your beneficiaries a set amount should you die if the policy is in effect.

The Ergo Insurance Group is one of its major subsidiaries offering comprehensive insurance plans. Many employers provide at no cost a base amount of coverage as well as an opportunity for the employee to purchase. Group term life insurance is a common part of employee benefit packages.

Your employer will have a type of life insurance chart that may offer you a 50000 or 100000 policy at no cost. And some insurers use a traditional process with a medical. Getting coverage through work can be relatively easy.

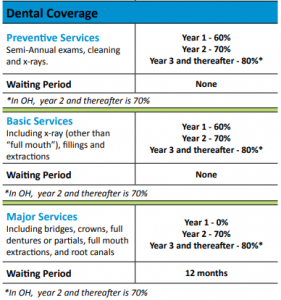

Alongside these life insurance plans provide various other benefits including death benefits tax benefits terminal illness benefits to name a few. These life insurance plans are meant for organizations or groups to provide life cover to the employees or group members respectively. Finally an insurance company.