So we designed a plan to keep your teeth in the best shape possible. Advertentie Compare 50 Global Health Insurance Plans for Expats living abroad.

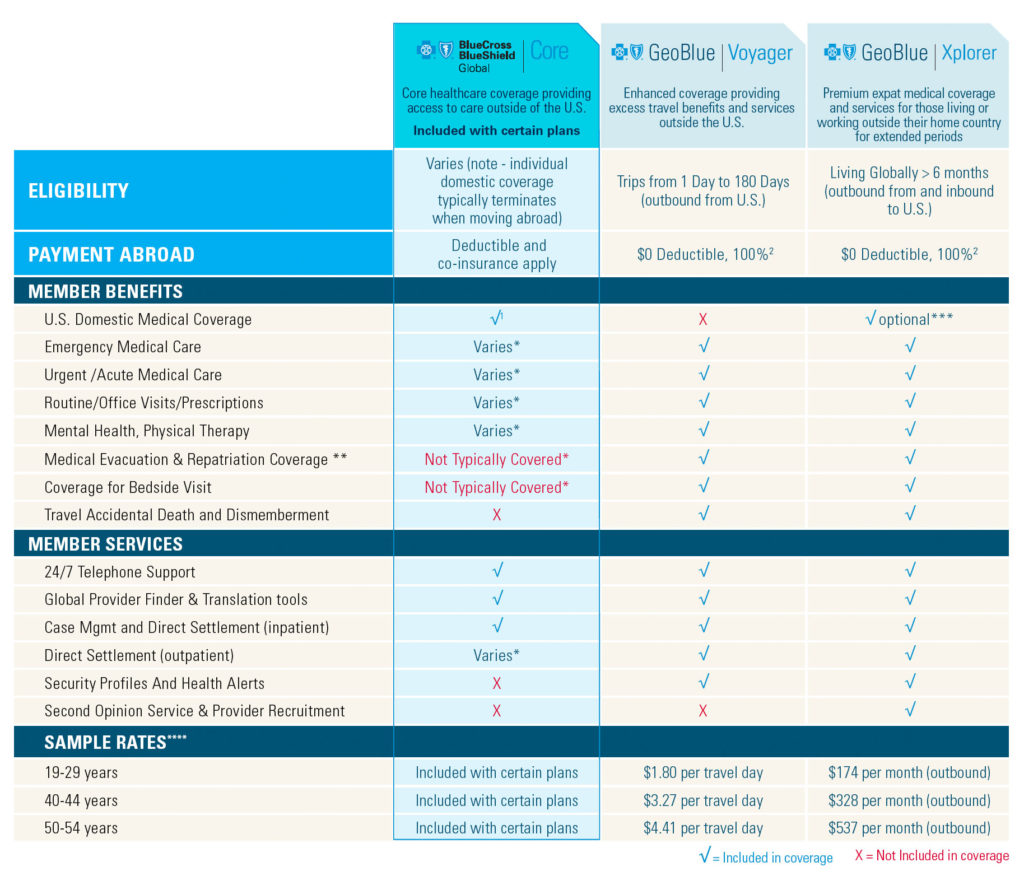

Blue Cross Blue Shield International Solutions Offshore Health Net

Blue Cross Blue Shield International Solutions Offshore Health Net

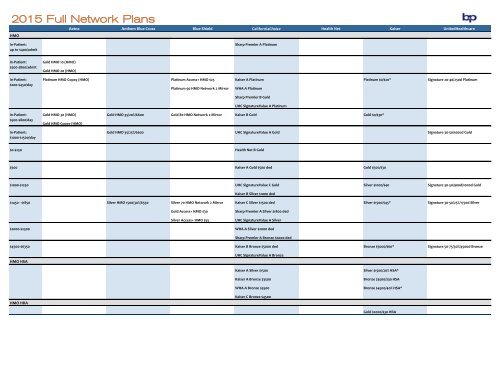

Official Site of Anthem Blue Cross Blue Shield a trusted health insurance plan provider.

Blue cross blue shield insurance benefits. With the new ways to get affordable health insurance it makes sense to get covered. Advertentie Compare 50 Global Health Insurance Plans for Expats living abroad. New York Health Insurance.

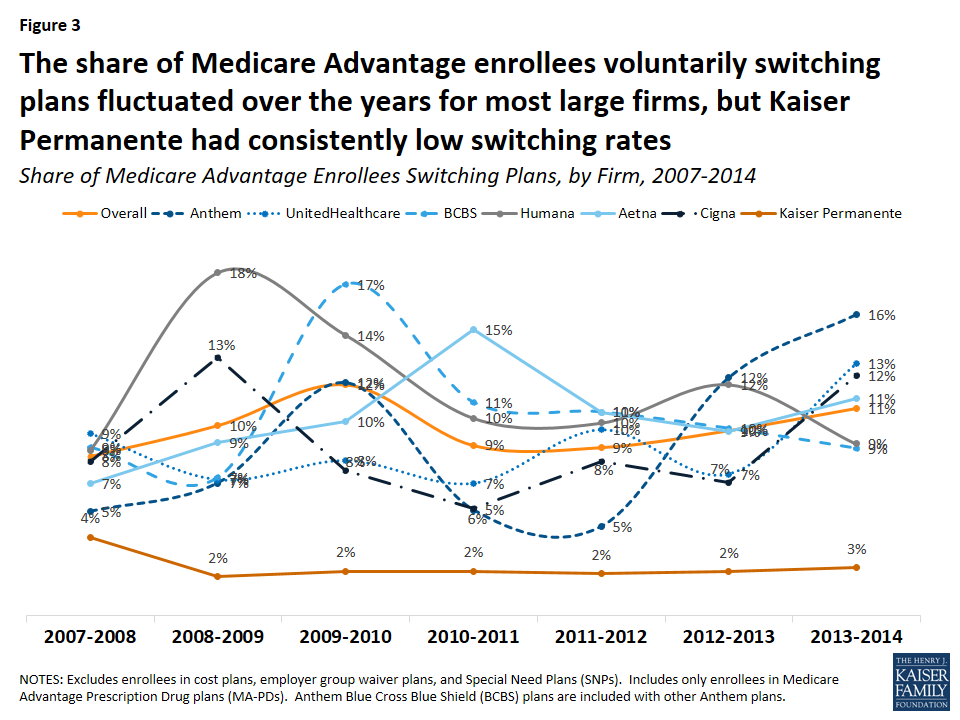

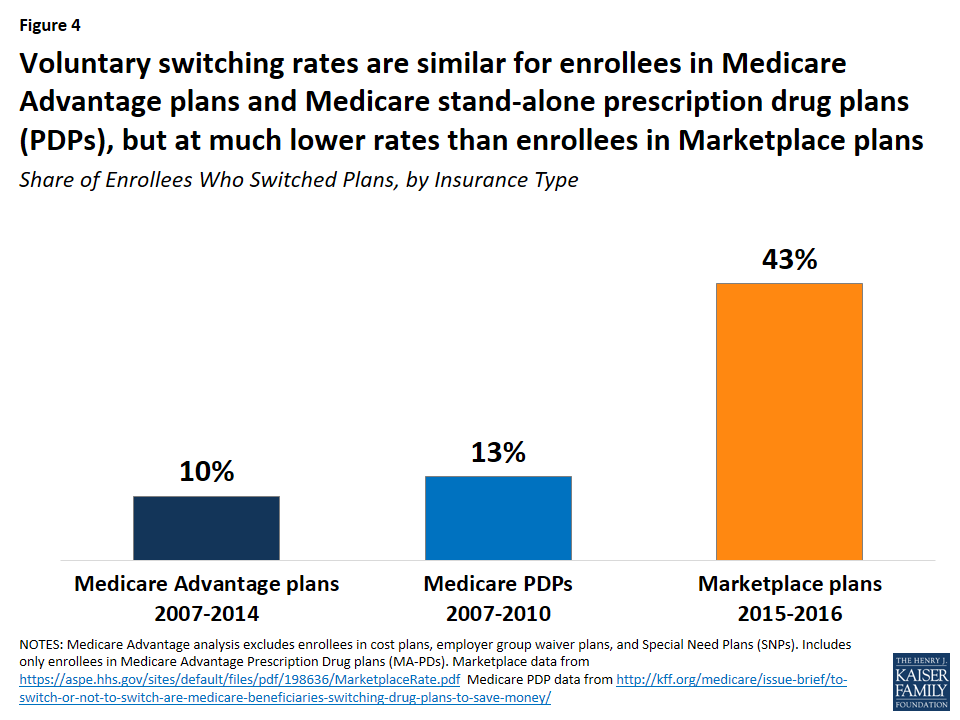

Plan Documents and Forms. Shop plans for Medicare Medical Dental Vision Employers. From creating a supportive working environment to allowing for time away from work to recharge the BCBSA benefits package makes us an active supporter of our employees health wellness and quality of life.

Mental health. Official Site of Empire BlueCross BlueShield affordable Medicare Medical Dental Vision insurance. Colds minor cuts cough wheezing sore throat headache or migraine mild allergies fever skin rash anxiety depression.

Blue Cross and Blue Shield Service Benefit Plan - FEP Blue Standard and FEP Blue Basic Options. The Blue Cross and Blue Shield Service Benefit Plan per our contract with the US. Other key benefits of health insurance are access to a network of doctors and hospitals and other resources to help you stay healthy.

If you have prescription drug coverage through Blue Cross and Blue Shield of Texas learning about your drug benefits can help you and your doctor get the most from your prescription drug coverage. Selecting the Right Plan. Physical health financial security general well-being and professional development.

Visit and compare plans today. Our comprehensive benefits are designed to enhance all aspects of our employees lives. Summary of Benefits for the Blue Cross and Blue Shield Service Benefit Plan Standard Option 2021 163 2021 Blue Cross and Blue Shield Service Benefit Plan 2 Table of Contents Emergency inpatient admission 26 Maternity care 26 If your facility stay needs to be extended 26.

Benefits include 401 k Paid time off health dental vision short term and long term disability-view all Insurance Agent - Fort Myers FL - Mar 4 2019 Helpful. Get a Free Quote. If your coverage already includes our telehealth benefit please use our Well Connection platform.

Anthem Blue Cross Blue Shield. Get a Free Quote. Office of Personnel Management OPM follows the National Association of Insurance Commissioners NAIC rules on which plan pays first when you are covered by two or more group health plans.

With a good health insurance plan you help protect the health and financial future of you and your family for a lifetime. Under our contract CS 1039 with the United States Office of Personnel Management as authorized by the Federal Employees Health Benefits law. Whats New in Health Care.

Enjoy the many benefits of regular exercise with expert advice from our fitness professionals. Dental Insurance Benefits Blue Cross Blue Shield of Massachusetts Dental insurance should make you smile Maintaining a healthy grin can contribute to your overall health. This Plan is underwritten by participating Blue Cross and Blue Shield Plans Local Plans that.