An out-of-pocket maximum is the annual limit on the amount of money that you would have to pay for health care services not including monthly premiums. She has 300 more to pay before she reaches her out-of-pocket maximum.

Remaining Out Of Pocket Ppt Download

Remaining Out Of Pocket Ppt Download

When what youve paid toward individual maximums adds up to your family out-of-pocket max your plan.

Blue cross blue shield max out of pocket. The OOPM is different for every type of plan. To view the report members can follow these easy steps. To help keep premium costs lower some health care plans have a deductible.

Calendar Year Out-of-Pocket Maximum 6850 per Member 13700 per Family 9850 per Member 19700 per Family Maximum Lifetime Benefits Maximum Blue Shield Payment Services by Preferred Participating and Other Providers 4 Services by Non-Preferred and Non-Participating Providers Lifetime Benefit Maximum No maximum. Select Out-of-Pocket Expenses from. When the next plan year begins your deductible and coinsurance reset.

Nothing after 5500 PPO per contract per year. The out-of-pocket maximum is what you pay during a policy period before your health insurance plan begins paying 100 percent of your covered medical expenses. After you pay the 4000 deductible your plan covers 75 of the costs and you pay the other 25.

She has a 1500 deductible with 20 coinsurance and an out-of-pocket maximum of 3500. After you pay the 4000 deductible your health plan covers 70 of the costs and you pay the other 30. When youve paid 5000 out of your pocket toward your medical costs your plan covers 100 of your costs until your plan year renews.

Maximum out-of-pocket MOOP expenses for specific individual members or the entire family. If your plan covers more than one person you may have a family out-of-pocket max and individual out-of-pocket maximums. Your health Insurance plan may require you to pay for some expenses out of your own pocket.

Out-of-pocket Maximum The out-of-pocket maximum is the amount you have to pay for eligible costs under your health care plan during a certain period of time. Its important to note that all payments that apply to the deductible also apply to the out-of-pocket maximum. The reports available in both PDF and Excel formats can be quickly and easily downloaded or printed.

Jenny pays her doctor and hospital 3200 1500 deductible plus 1700 coinsurance. The information includes both in- and out-of-network claims if applicable. The amount paid goes toward the out-of-pocket maximum.

This means you may not pay for in-network services but for out-of-network. When the deductible coinsurance and copays for one person reach the individual maximum your plan then pays 100 percent of the allowed amount for that person. If you are a current BCBSMT member you can see what your plans OOPM is within Blue Access for Members.

The out-of-pocket maximum also called OOPM is the most you will have to pay out of your own pocket for expenses under your health insurance plan during the year. For example if your out-of-pocket maximum is 10000 you must meet this amount before your insurance covers services at 100. Effective January 1 2020 and upon renewal unless otherwise noted were making.

Wellmark Blue Cross and Blue Shield of Iowa Wellmark Health Plan of Iowa Inc Wellmark Blue Cross and Blue Shield of South Dakota Wellmark Value Health Plan Inc and Wellmark. Most health plans must include an out-of-pocket maximum that limits costs for all Essential Health Benefits including pharmacy. Need an explanation of health care terms we use.

The OOPM is different for every type of plan. Blue Cross Blue Shield of Massachusetts is an Independent Licensee of the Blue Cross and Blue Shield Association. An independent company that provides and hosts an online community platform for blogging and access to social media for Blue Cross and Blue Shield of Texas.

A deductible is the amount of money a member pays out-of-pocket before paying a copay or coinsurance. Protection against catastrophic costs your catastrophic protection out-of-pocket maximum pages 32-33 You pay. If you are a current BCBSIL member you can see what your plans OOPM is within Blue Access for Members.

When youve paid 5000 out of your pocket toward your medical costs your plan covers 100 of your costs until your plan year renews. A plan is good for 1 year. The out-of-pocket maximum also called OOPM is the most you will have to pay out of your own pocket for expenses under your health insurance plan during the year.

Sign in to Member Online Services. Please note there are in-network and out-of-network out-of-pocket maximums. After the maximum is reached all covered health services are paid in full by the health plan for the rest of that plan year.

Summary Of Health Plan Payments Myblue

Summary Of Health Plan Payments Myblue

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

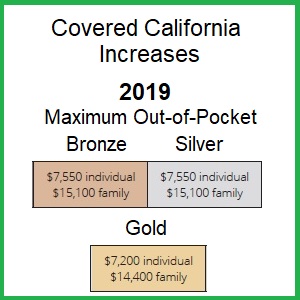

Maximum Out Of Pocket Amount Jumps 7 For 2019 Covered California Plans

Maximum Out Of Pocket Amount Jumps 7 For 2019 Covered California Plans

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Medical Insurance 80 60 Ppo Kent State University

Medical Insurance 80 60 Ppo Kent State University

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.